Loan To Value Ratio Real Estate Math 10 Of 18

How To Calculate Your Loan To Value Ratio Ltv Finder Uk Learn to calculate maximum loan amounts and required down payments using the loan to value ratio.gold coast schools is florida's leader in real estate educat. In today's real estate exam prep video i will show you how to calculate a loan to value ratio (ltv) a real estate math problem you may have on your real esta.

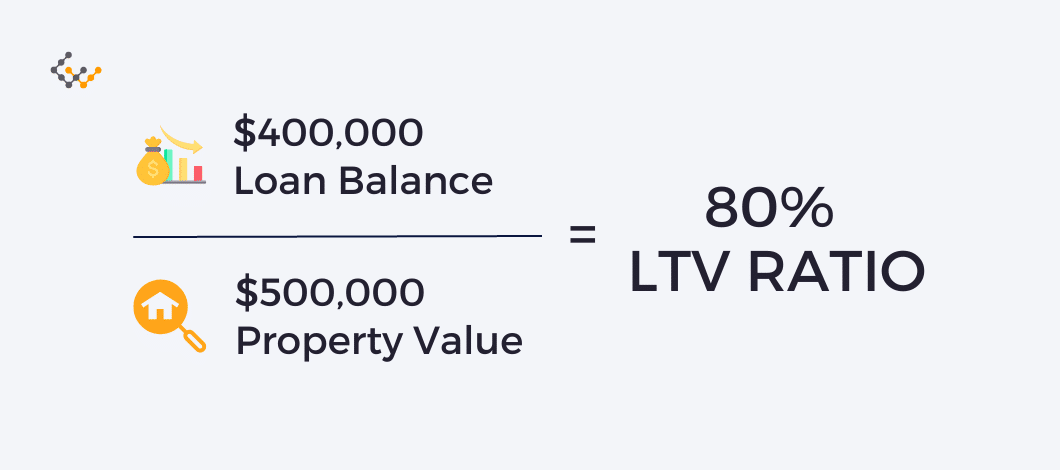

Loan To Value Ltv Ratio Overview Formula Commloan Welcome to maggie’s real estate academy! in this comprehensive video, real estate instructor maggie relloso shares her expertise on the loan to value (ltv) r. The loan to value calculator uses the following formulas: ltv = loan amount property value. where, ltv is the loan to value ratio, la is the original loan amount, pv is the property value (the lesser of sale price or appraised value). cltv = all loan amounts property value = ( la1 la2 lan ) property value. Loan to value (ltv) definition: in real estate, the “loan to value” (ltv) ratio indicates the percentage of debt used to acquire a property or refinance an existing loan; this percentage is always based on the property’s estimated market value at the time. in financial models, such as property valuation and the real estate pro forma, the. Divide that total amount of $270,000 by the property value of $350,000, and your combined loan to value (cltv) ratio is 77%. appraised home value: $350,000. total amount owed: $270,000. ltv formula: $270,000 $350,000 = 0.77 or 77% ltv. an ltv of 57% is great, and while a cltv of 77% is still good, it may have different risk implications for.

Comments are closed.