Ma Revocable Living Trusts Pros And Cons Of Using This Approach For

Ma Revocable Living Trusts Pros And Cons Of Using This Approach For Revocable living trusts: pros and cons for estate planning pro #1: avoiding probate. alright, on to the positives. arguably the biggest benefit of using a living trust as part of your estate plan is avoiding the probate process. for those blissfully unaware, probate is the court supervised process for distributing some left behind after death. The different types of living trusts. living trusts can be structured in one of two ways: revocable or irrevocable. a revocable trust allows the grantor to maintain control over the assets in the.

:max_bytes(150000):strip_icc()/RevocableLivingTrustProsandCons-bff2ccfdd9b54e61800f30cc050c26fc.png)

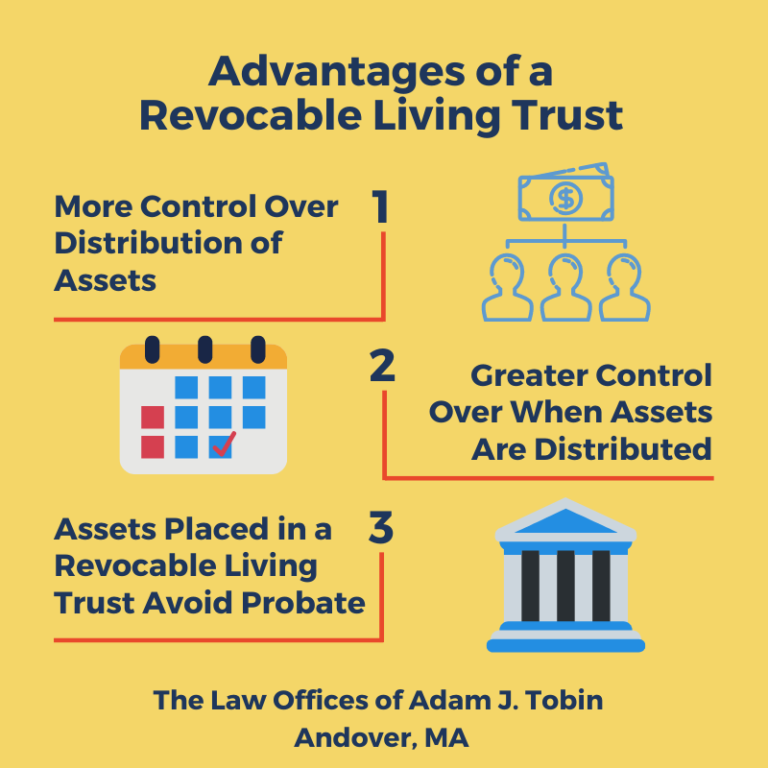

Advantages And Disadvantages Of Revocable Living Trusts The downside of revocable living trusts are that assets in the trust are treated as personal assets. it therefore offers no special protection from creditors if you are sued. upon death, all assets are subject to any state and federal estate taxes. depending on your finances, these two items can result in significant risk or loss. A revocable living trust can help you protect privacy, avoid probate and protects you in case of incapacitation. but you will also have some limitations. that’s because revocable living trusts can be expensive, and they don’t have direct tax benefits. here are the pros and cons of a revocable living trust and how you can carefully weigh. Editor's note: this article was originally published on sept. 10, 2019 and is updated with a clarification from the author: my column incorrectly implies that revocable trusts, commonly known as living trusts, protect assets from creditors in many states. generally speaking, a trust must be irrevocable to provide such protection. A living trust or revocable living trust can help your estate and heirs avoid the hassle and costs of probate. a living trust cannot designate guardianship for minor children, so wills and living.

Three Advantages Of A Revocable Living Trust Law Offices Of Adam Editor's note: this article was originally published on sept. 10, 2019 and is updated with a clarification from the author: my column incorrectly implies that revocable trusts, commonly known as living trusts, protect assets from creditors in many states. generally speaking, a trust must be irrevocable to provide such protection. A living trust or revocable living trust can help your estate and heirs avoid the hassle and costs of probate. a living trust cannot designate guardianship for minor children, so wills and living. Revocable living trusts are legal entities created to hold and manage assets on behalf of the person who establishes the trust, known as the grantor. as the name suggests, these trusts are both revocable and created during the grantor's lifetime. the grantor has the ability to modify the trust's terms, change beneficiaries, or even terminate. Key takeaways: a revocable living trust is a popular estate planning tool that you can manage during your lifetime and use to leave property when you die. using a revocable living trust can avoid probate, which can be a complex and time consuming process, and estate taxes. revocable living trusts are easy to set up and can be created without.

Revocable Living Trusts Definition How It Works Pros Cons Revocable living trusts are legal entities created to hold and manage assets on behalf of the person who establishes the trust, known as the grantor. as the name suggests, these trusts are both revocable and created during the grantor's lifetime. the grantor has the ability to modify the trust's terms, change beneficiaries, or even terminate. Key takeaways: a revocable living trust is a popular estate planning tool that you can manage during your lifetime and use to leave property when you die. using a revocable living trust can avoid probate, which can be a complex and time consuming process, and estate taxes. revocable living trusts are easy to set up and can be created without.

Pros And Cons Of Establishing A Revocable Living Trust вђ Business

Comments are closed.