Make Paycheck Budget Worksheet

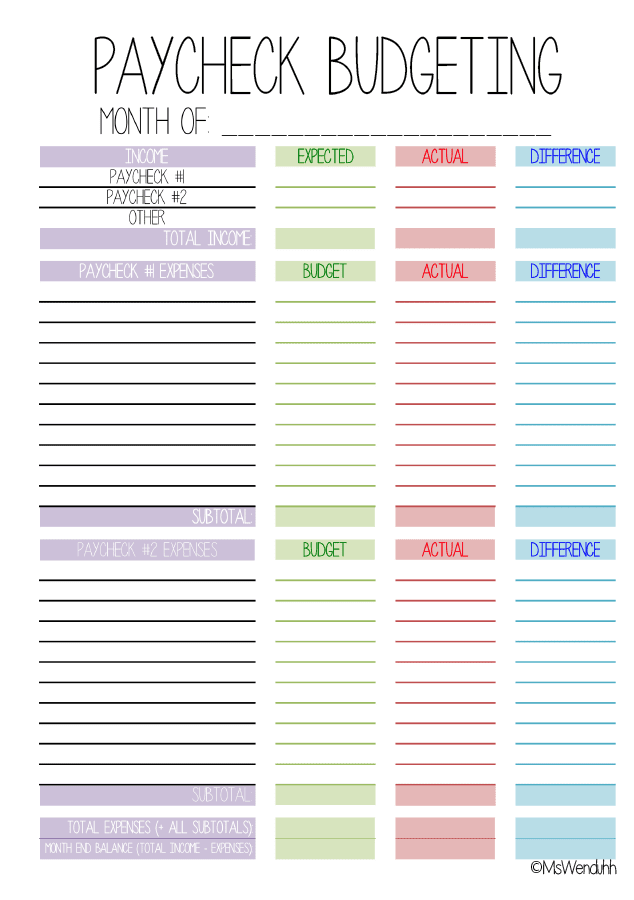

Paycheck Budgeting Printable Wendaful Planning 3. money bliss’s paycheck budget template. here’s a colorful paycheck budget template from money bliss. fyi: you need to subscribe to her entire free resource library to get access to it. 4. one page weekly paycheck budgeting printable. here’s a simple, one page paycheck budget for people who get paid weekly. Here is a list of our partners and here's how we make money. a budget planner is a tool, such as a worksheet or template, that you can use to design your budget. a successful budget planner helps.

Budget By Paycheck Printables Free budget binder printables from money minded mom. 8. free printable budget planner from blooming homestead. 9. free zero based budget template from moritz fine designs. 10. simple monthly budget template from the savvy couple. 11. family budget worksheet from a mom's take. How the 50 30 20 budget calculator works. our 50 30 20 calculator divides your take home incomeinto suggested spending in three categories: 50% of net pay for needs, 30% for wants and 20% for. How to budget by paycheck: step by step example. step 1: figure your how much money you make per paycheck. step 2: write down all your monthly bills and their due dates. examples of recurring monthly bills: step 3: set a budget for your variable expenses. examples of variable expenses: how to use cash envelope system. 5. make a new budget (before the month begins). your budget won’t change too much from month to month—but no two months are exactly the same. so, create a new budget every single month. don’t forget month specific expenses (like holidays or seasonal purchases). and do this before the month starts so you can get ahead of what’s coming.

Budget By Paycheck Printables How to budget by paycheck: step by step example. step 1: figure your how much money you make per paycheck. step 2: write down all your monthly bills and their due dates. examples of recurring monthly bills: step 3: set a budget for your variable expenses. examples of variable expenses: how to use cash envelope system. 5. make a new budget (before the month begins). your budget won’t change too much from month to month—but no two months are exactly the same. so, create a new budget every single month. don’t forget month specific expenses (like holidays or seasonal purchases). and do this before the month starts so you can get ahead of what’s coming. Add all of your paychecks to the appropriate date on the calendar, along with the specific paycheck amount. next, add your regular monthly bills to their due date on the calendar. regular monthly bills include your fixed expenses, such as rent or mortgage, insurance, debt payments, car payments, student loans, etc. 3. An important part of money management is keeping track of your salary, whether it is regular or irregular income. paycheck budget template will help you keep track of your income, calculate the amount of spending, allocate money to pay utility bills and debts, plan savings, etc. control every payday, manage money competently, set priorities correctly, become financially independent, and.

Comments are closed.