Market Segmentation Theory

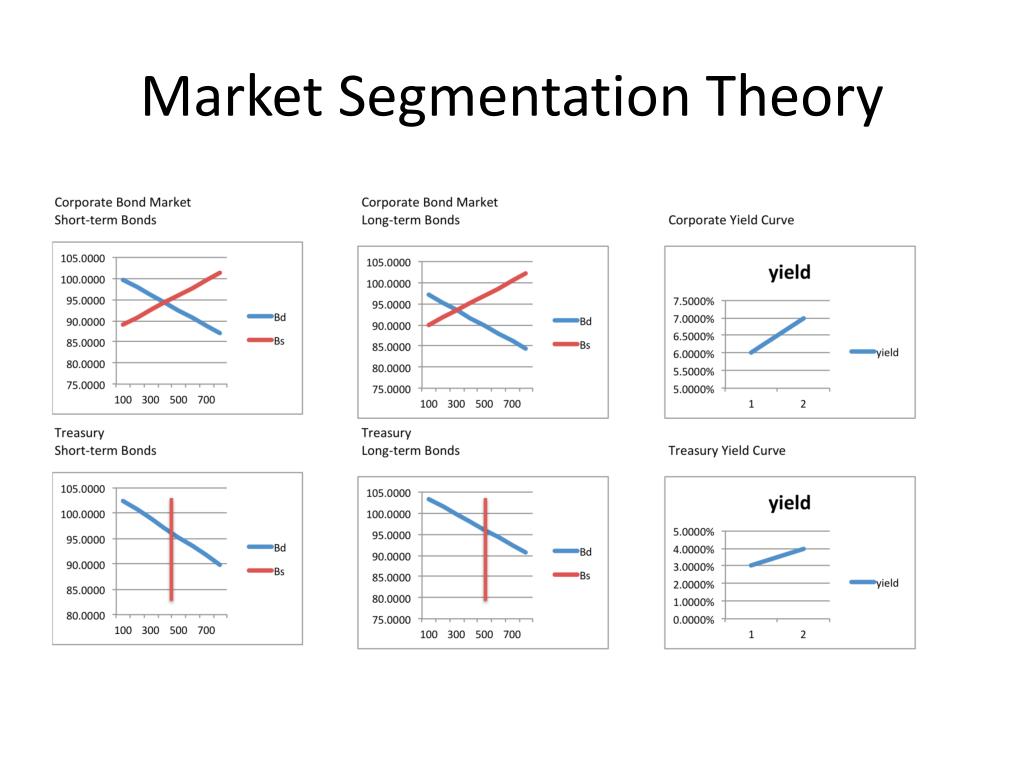

Market Segmentation Theory Market segmentation theory states that long and short term interest rates are not related and should be viewed separately. learn how this theory affects the yield curve, bond markets, and investors' preferences. Learn what market segmentation is, how it works, and why it is important for businesses. explore the different types of market segmentation, such as demographic, geographic, behavioral, and psychographic, with examples and benefits.

Ppt Market Segmentation Theory Powerpoint Presentation Free Download Learn how market segmentation theory explains the independence of short term and long term interest rates. find out why this theory matters for interest rate analysis and yield curve interpretation. Market segmentation theory explains how investors have different preferences for maturity lengths and how the yield curve affects their investment choices. learn the key concepts, examples, and implications of this theory for finance and marketing. Learn how the market segmentation theory explains the interest rates for bonds with different maturity lengths and how the yield curve reflects the economy. find out the types of yield curves and their implications for investors and economists. Market segmentation theory challenges the traditional notion that long and short term interest rates are interlinked. it contends that each maturity category—short, intermediate, and long term bonds—should be treated as a distinct market, governed by unique forces of supply and demand.

7 Major Types Of Market Segmentation To Tailor Your Business Learn how the market segmentation theory explains the interest rates for bonds with different maturity lengths and how the yield curve reflects the economy. find out the types of yield curves and their implications for investors and economists. Market segmentation theory challenges the traditional notion that long and short term interest rates are interlinked. it contends that each maturity category—short, intermediate, and long term bonds—should be treated as a distinct market, governed by unique forces of supply and demand. Learn about the process of dividing a market into meaningful sub groups of customers with similar needs and wants. explore the evolution of market segmentation from ancient times to the present, and the different ways to segment a market based on various criteria. Practical issues arise when handling advanced theoretical frameworks and implementing segments, challenging the foundations of market segmentation theory (clarke & freytag, 2008; hlavacek & reddy, 1986; dibb & wensley, 2002). foedermayr and diamantopoulos (2008) note the need for practical guidance for marketers implementing segmentation.

Comments are closed.