Millennials In Debt Here Are Some Tips To Fix Credit Debt Fast

Millennials In Debt Here Are Some Tips To Fix Credit Debt Fast The fed has also elevated interest rates in an attempt to combat inflation. this means anyone unable to pay off their credit card (like a young gen z adult) will carry a balance that’s hit with. 22% of millennials used their stimulus check to pay off credit card debt—here's how that could improve your credit score 22% of millennials used their stimulus check to pay off credit card debt.

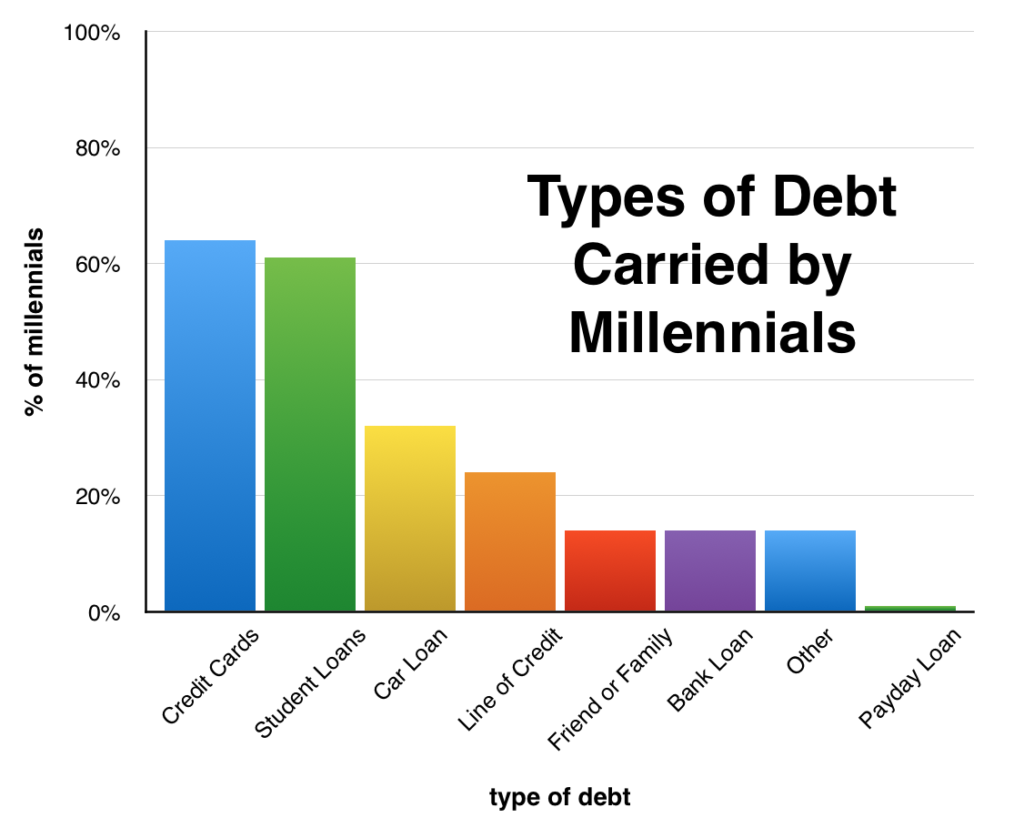

Millennials In Debt Here Are Some Tips To Fix Credit Debt Fast At the end of 2018, the average millennial debt (for 18–29 year olds) reached a record high of over one trillion dollars—one trillion dollars! that’s the highest it’s been since 2007. 4 here’s the breakdown of millennial debt, from greatest to least: student loans (taking up the majority) home mortgages; credit cards; auto loans 5. While millennials are handling credit card balances in a smarter way by keeping their balances lower, they’re less likely to use a helpful tool to reduce credit card interest: balance transfers. Prioritize your debts and power them down. one strategy for paying off debt is to list your credit card and loan accounts by their interest rates, with the highest rate at the top. for example, let's say you have $1,000 to commit to debt payoff, and these are your accounts: account. balance. The bottom line: pay off debt first to get ahead. “i’m telling you in 14 months, y’all could be free forever,” said ramsey. “think about it laurie — i mean you got the rest of your life to make $250,000 a year, and you won’t have a payment in the world. i mean, think about it, you could save $100,000 a year for three years and pay.

5 Surprising Sources Of Debt Personal Finance Us News Prioritize your debts and power them down. one strategy for paying off debt is to list your credit card and loan accounts by their interest rates, with the highest rate at the top. for example, let's say you have $1,000 to commit to debt payoff, and these are your accounts: account. balance. The bottom line: pay off debt first to get ahead. “i’m telling you in 14 months, y’all could be free forever,” said ramsey. “think about it laurie — i mean you got the rest of your life to make $250,000 a year, and you won’t have a payment in the world. i mean, think about it, you could save $100,000 a year for three years and pay. This rising debt load may help explain why many millennials in their 30s are now missing their credit card and auto loan payments at startling rates, according to the new york fed. The average millennial has $27,251 in non mortgage consumer debt—here’s how they compare to other generations. millennials are the generation with the fastest growing debt. here’s a look at.

4 Ways That Millennials Can Pay Off Debt Faster Taikafilat This rising debt load may help explain why many millennials in their 30s are now missing their credit card and auto loan payments at startling rates, according to the new york fed. The average millennial has $27,251 in non mortgage consumer debt—here’s how they compare to other generations. millennials are the generation with the fastest growing debt. here’s a look at.

5 Steps To Settling Your Debts Millennials Find It Tough To Pay Off

Comments are closed.