Money Management For Teens

Money Management For Teens Tweens Teaching Practical Life Skills Learn how to teach your teens to manage their money wisely with these five tips from bank of america. find out how teens spend, save, budget, use credit and plan for the future. Things teens waste money on. although musical tastes and fashion trends have changed over the years, teens’ spending habits haven’t. just like we did, they still waste their money on whatever sounds good in the moment—like a 10 pack of tacos or that new ariana grande album. these days, gen z teens are spending about $2,600 each year. 1.

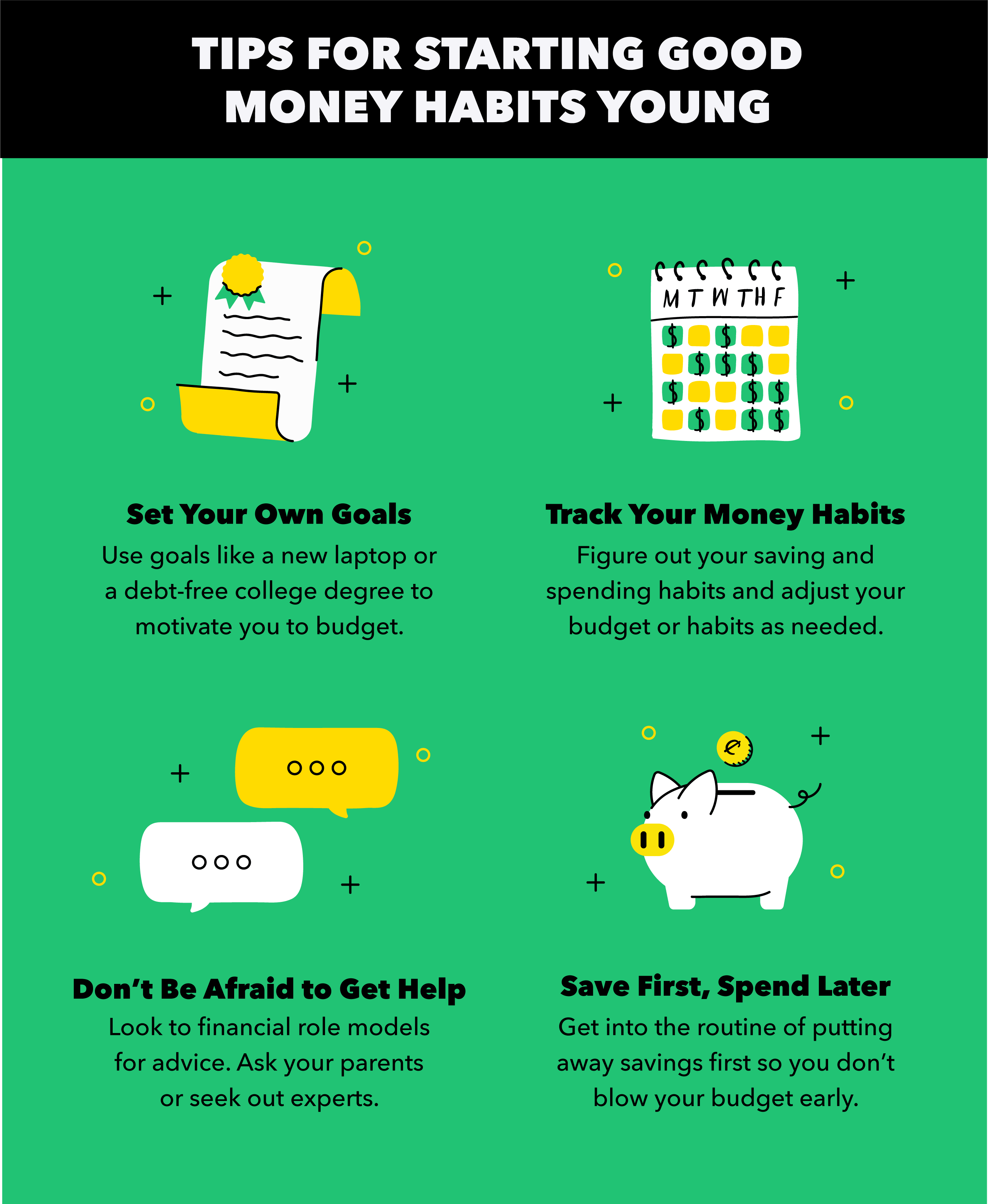

The Money Management Workbook For Teens Moneysmart Lewis Marianne Learn how to manage your personal finances as a teen with these 11 lessons on needs vs wants, savings, investing, skills, income, and debt. find out how to set goals, live below your means, and avoid financial stress. Learn how to manage your money as a teenager with this comprehensive guide for both parents and teens. find out how to earn, save, spend, and invest your money, and how to set up a banking system and money rules with your parents. Understanding where your money goes is part of proper money management. most teens spend the bulk of their money on food, clothing, accessories and cosmetics. the average credit score for people in their 20s is 660, below the country’s average. a solid foundation of financial knowledge allows you to build and maintain a good credit standing. This is the first step in being able to manage your money. budget, budget, and more budget – budgeting can get you thinking a little more intently about how you spend, lose, or give money away. for one, spending money is inevitable, but to an extent. giving it away is a great way to pay it forward and make donations to those in need.

Budgeting For Teens 14 Tips For Growing Your Money Young Understanding where your money goes is part of proper money management. most teens spend the bulk of their money on food, clothing, accessories and cosmetics. the average credit score for people in their 20s is 660, below the country’s average. a solid foundation of financial knowledge allows you to build and maintain a good credit standing. This is the first step in being able to manage your money. budget, budget, and more budget – budgeting can get you thinking a little more intently about how you spend, lose, or give money away. for one, spending money is inevitable, but to an extent. giving it away is a great way to pay it forward and make donations to those in need. There are better places to put your money. here are a few ways you can spend your money wisely as a teen: avoid eating out often. buy things that you need. set a budget for things you want. invest in yourself (skin care, massages, etc.) don’t bet gamble with friends. spending money is inevitable… we all do it. Learn how to help your children develop healthy financial habits and skills as they grow into young adults. find out how to teach them about earning, banking, managing debt, transferring costs and investing for the future.

Comments are closed.