Money Market Account Vs High Yield Savings Account W

Money Market Vs Savings Account Which One Should You Pick Both high yield savings and money market accounts enjoy fdic insurance up to $250,000 per person, per bank, and per account type, making them among the safest choices for where to put your money. The main difference is that a high yield savings account is a bank account and a money market fund is an investment account. this is an important distinction because it affects aspects of the.

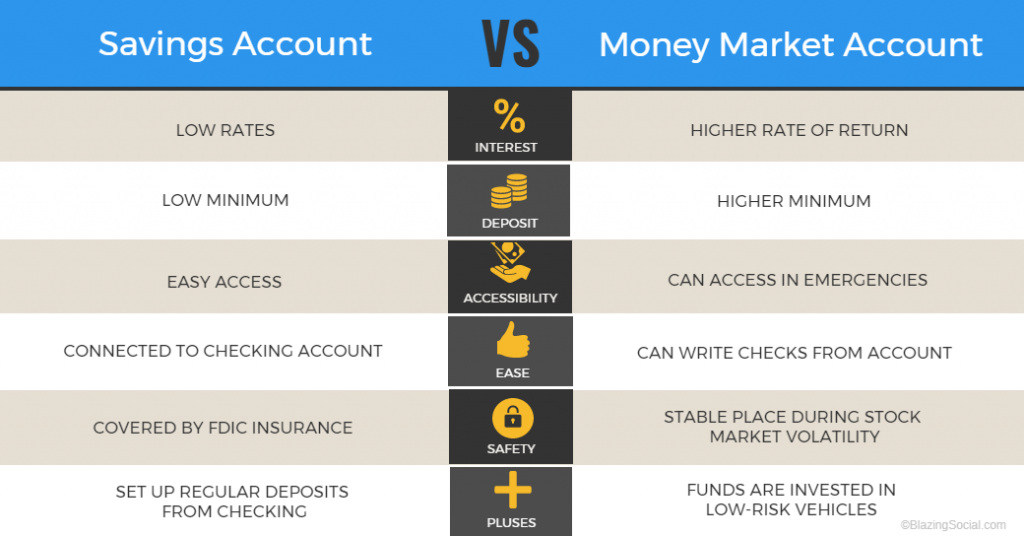

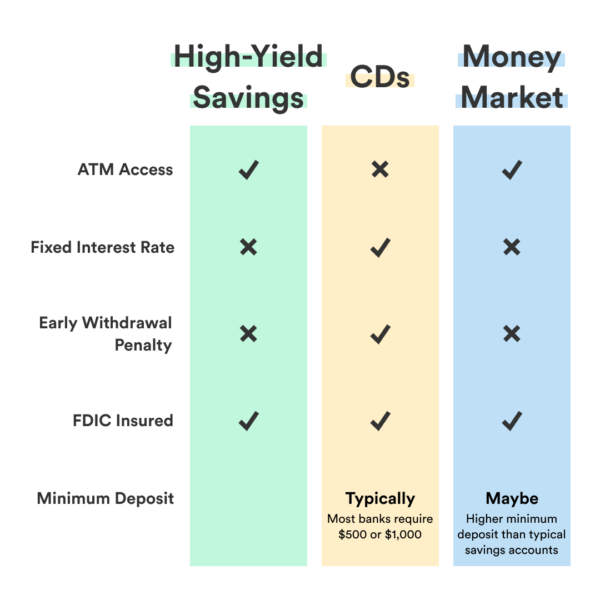

What Is A Money Market Account How Does It Compare To High Yield The national average savings account pays a 0.58 percent apy as of november 2023, according to a recent bankrate survey, while the best high yield savings accounts come with interest rates above 4. Money market accounts and savings accounts can help you build up your savings. while mmas may offer easier access, high yield savings accounts could be a strong choice because of their high apys. Money market accounts tend to come with checkbooks, whereas high yield savings accounts typically don’t. but both accounts may still have monthly withdrawal limits. 2. there may also be differences in requirements to open and maintain an account, such as minimum balances and deposits, and fees. typically, savings accounts are easier and less. Unlike savings accounts, money market accounts provide a debit card and checks. the best money market accounts tend to have higher interest rates than regular savings accounts because the bank.

What Is A High Yield Savings Account And How Do You Get One Chime Money market accounts tend to come with checkbooks, whereas high yield savings accounts typically don’t. but both accounts may still have monthly withdrawal limits. 2. there may also be differences in requirements to open and maintain an account, such as minimum balances and deposits, and fees. typically, savings accounts are easier and less. Unlike savings accounts, money market accounts provide a debit card and checks. the best money market accounts tend to have higher interest rates than regular savings accounts because the bank. A high yield account specifically offers an apy (annual percentage yield) that is more competitive than that of a standard savings account, and thanks to the federal reserve's recent interest rate. A money market account gives you more access to your money in the form of direct checking and atm withdrawals, but it will generally provide a lower interest rate. a high yield savings account pays a much higher interest rate, but you have transfer limits and few, if any, accounts let you directly spend money. money market accounts also tend to.

High Yield Savings Vs Money Market What To Know 2023 A high yield account specifically offers an apy (annual percentage yield) that is more competitive than that of a standard savings account, and thanks to the federal reserve's recent interest rate. A money market account gives you more access to your money in the form of direct checking and atm withdrawals, but it will generally provide a lower interest rate. a high yield savings account pays a much higher interest rate, but you have transfer limits and few, if any, accounts let you directly spend money. money market accounts also tend to.

What Is A High Yield Savings Account And Do I Need One Ramsey

Comments are closed.