Mortgage Brokers Vs Banks Which Is Better Financial Independence Hub

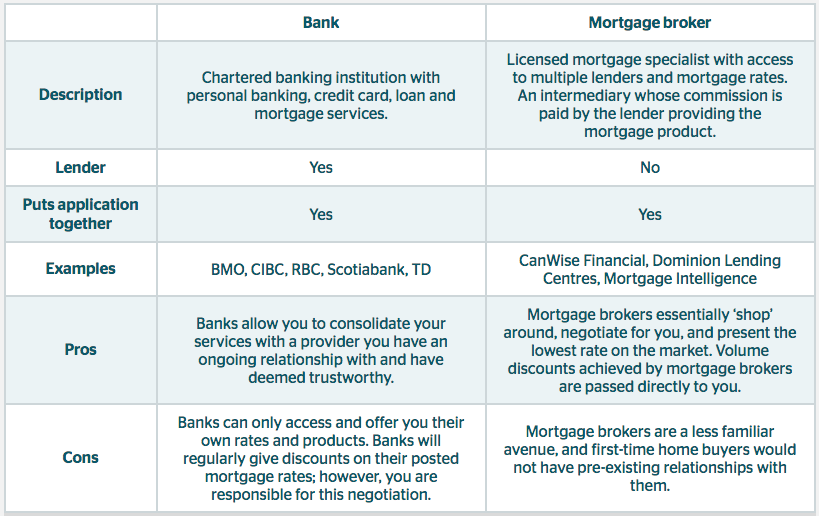

Mortgage Brokers Vs Banks Which Is Better Financial Independence Hub By alyssa furtado, ratehub.ca special to the financial independence hub shopping for a mortgage can be a challenging task. much like when you buy a car, it can be hard to get clear information. mortgage rate comparison websites like ratehub.ca can help you learn about your options in general terms. but when it actually comes time […]. For loans with lower rates, the borrower pays the broker’s commission, usually about one percent of the loan amount. brokerages are often smaller than banks. and if you work with a broker, it.

Mortgage Brokers Vs Banks Which Is Better Financial Independence Hub Using a mortgage broker vs. a bank. a mortgage broker can offer a wider array of options and streamline the mortgage process, but working directly with a bank gives you more control and costs less. Pros of banks. all in one convenience – having your bank accounts, savings and mortgage all with the same bank, which can make managing your finances much easier. discount potential – banks. The difference between brokers and banks comes down to who actually finances the purchase when you borrow money to buy a house. banks and direct lenders are companies that loan money for a home purchase. mortgage brokers are service providers that help borrowers find and apply for loans — but they don’t actually loan you the money. The best mortgage rates in canada. mortgage interest rates in canada are driven by the bank of canada’s policy interest rate. in march 2022, the boc’s policy interest rate was 0.25%. it.

Comments are closed.