No Experience Is Required For The Test How To Become A Licensed Loan Officer

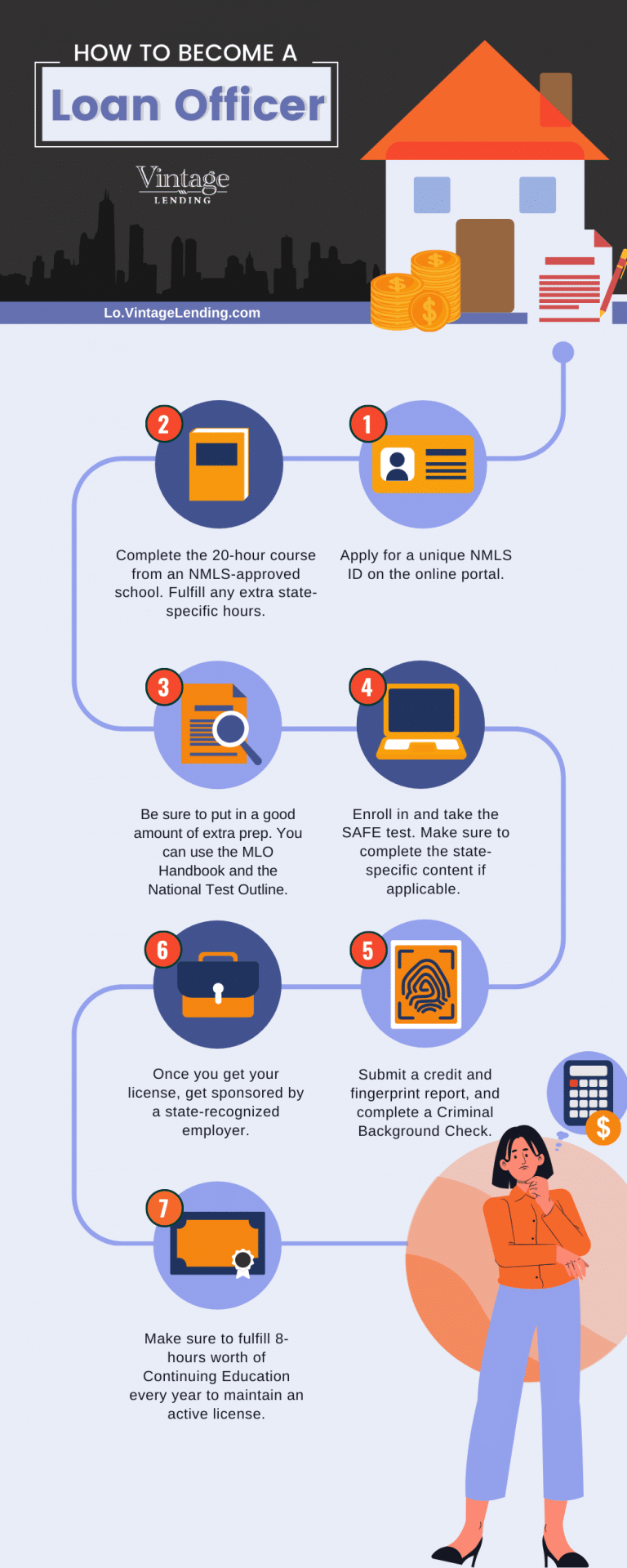

How To Become A Loan Officer Step By Step License Guide Mortgage loan originators typically make 0.5% to 1% of the buyer’s loan amount. for example, a $300,000 mortgage loan will yield $1,500 to $3,000 in commission. this is the origination fee. before the housing crash of 2008, the origination fees were as high as 4% to 5% of the loan amount. your annual income depends on the area you work. Step 5: prepare for the national safe test. step 6: pass the national safe exam to become a licensed loan officer. step 7: complete a background check and get fingerprinted. step 8: complete and submit your individual (mu4) form to nmls. step 9: get sponsored by a mortgage company, the final step to become a licensed mlo!.

No Experience Is Required For The Test How To Become A Licensed Here are the steps you can follow to be an mlo: 1. meet the basic requirements. to become a mortgage loan officer, you need to be at least 18 years old and have a high school diploma or ged. while in school, try to take math and finance based classes to start gaining some knowledge and skills needed to be an mlo. 2. A degree is not required to become a loan officer but is helpful. if you are looking into working for a smaller financial institution or mortgage lender, you often need to be at least 18 years old and have a high school diploma. you should check the educational requirements of the job posting prior to applying to see if you qualify. Becoming a loan officer involves a series of steps, including education, gaining relevant experience, and obtaining the necessary licenses. here's a guide on how to become a loan officer: educational requirements: obtain a high school diploma or equivalent. while a college degree is not always mandatory, having a background in finance, business. Before you can become a licensed mlo, there are some basic requirements that hopefuls across all states need. you need to be at least 18 years old and hold a high school diploma or ged. and while a college degree can be beneficial in your quest to become a mortgage loan officer, it is not required. next, you must register with the nationwide.

How To Become A Loan Officer Everything You Should Know Spoolah Becoming a loan officer involves a series of steps, including education, gaining relevant experience, and obtaining the necessary licenses. here's a guide on how to become a loan officer: educational requirements: obtain a high school diploma or equivalent. while a college degree is not always mandatory, having a background in finance, business. Before you can become a licensed mlo, there are some basic requirements that hopefuls across all states need. you need to be at least 18 years old and hold a high school diploma or ged. and while a college degree can be beneficial in your quest to become a mortgage loan officer, it is not required. next, you must register with the nationwide. Entry level loan officer: as a new loan officer, you typically start in an entry level position, gaining foundational knowledge of loan products and processes, while working under the guidance of senior loan officers. junior loan officer: after gaining experience, you start working independently on loan evaluations and documentation. 1. consider earning a degree. there is no strict educational requirement for becoming a loan officer, although many employers will look for job candidates that have at least a bachelor’s degree. according to zippia, 61 percent of loan officers hold a bachelor's degree, while 17 percent hold an associate degree [3].

Comments are closed.