Open Enrollment How To Maximize Your Benefits Couple Money

Open Enrollment How To Maximize Your Benefits Couple Money Maximizing your benefits is well worth your time. spreadsheets are your friends. tax planning shouldn’t be a once a year consideration. if you want to discuss this more, please come chat with us on facebook in the thriving families group. we’re supportive. we’d love to see you there! maximizing your benefits during open enrollment. To be able to use an hsa, you need to be enrolled in what’s called a high deductible health plan, or hdhp. contributions then grow on a tax free basis, and any money you don’t use can be.

Open Enrollment How To Maximize Your Benefits Couple Money Consider using open enrollment as a time to review all of your benefits to make sure they are still the best fit for you. in particular, people entering or leaving your life is typically a good. Step 4. talk to your hr person. step 5. compare and contrast. and then decide. find the mix of benefits that work best for you and your partner. step 1. start with last year’s health expenses. it’s budgeting 101: take what you spent last year, and assume you’ll spend the same amount this year. If your employer offers a health plan with a deductible of at least $1,400 for individual coverage or $2,800 for family coverage in 2021 and you enroll, there’s a good chance you also can take advantage of a health savings account. this account allows you to set aside money for out of pocket health care costs. Use open enrollment as an opportunity to talk about all your benefits offerings. enrollment is a vital time for employees to enroll in their health plan and other benefits—but it's also a great.

Open Enrollment How To Maximize Your Benefits Couple Money If your employer offers a health plan with a deductible of at least $1,400 for individual coverage or $2,800 for family coverage in 2021 and you enroll, there’s a good chance you also can take advantage of a health savings account. this account allows you to set aside money for out of pocket health care costs. Use open enrollment as an opportunity to talk about all your benefits offerings. enrollment is a vital time for employees to enroll in their health plan and other benefits—but it's also a great. Here are three tips to make the most of your benefits. take advantage of the best tax deal around. if your company offers a health savings account, put in as much as possible for the triple tax. Employee 401 (k) contributions for 2022 will rise by $1,000 to $20,500 with an additional $6,500 "catch up" contribution allowed for those age 50 or older. during open enrollment, highlight the.

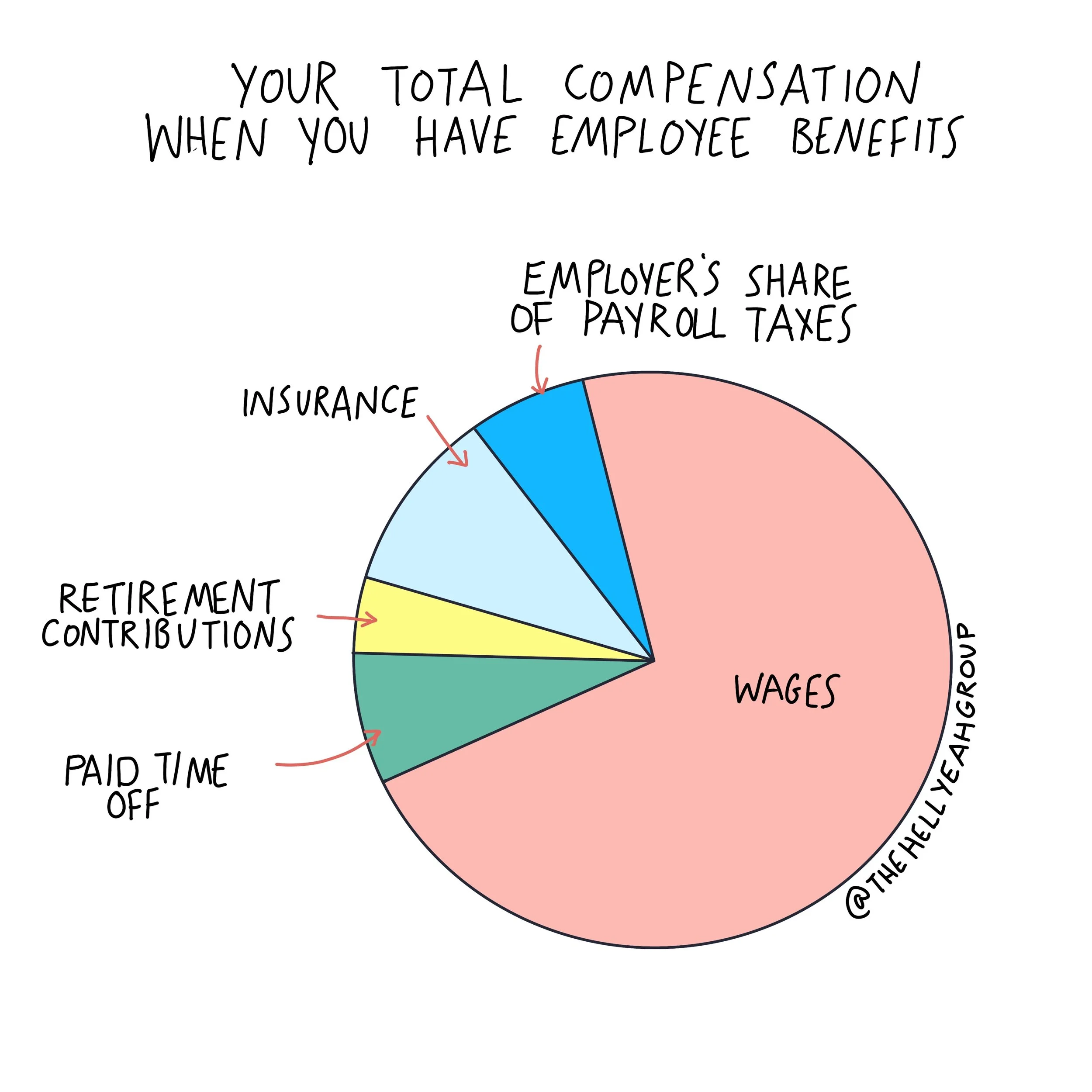

How To Maximize Your Benefits During Open Enrollment вђ The Hell Yeah Here are three tips to make the most of your benefits. take advantage of the best tax deal around. if your company offers a health savings account, put in as much as possible for the triple tax. Employee 401 (k) contributions for 2022 will rise by $1,000 to $20,500 with an additional $6,500 "catch up" contribution allowed for those age 50 or older. during open enrollment, highlight the.

How To Maximize Your Work Benefits During Open Enrollment Simplify

Comments are closed.