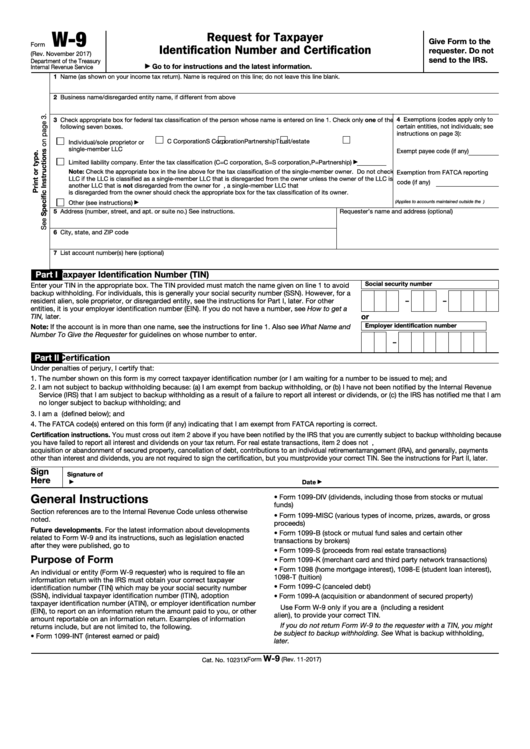

Printable Form W 9 2017

Printable Form W 9 2017 Form w 9 (rev. 11 2017) by signing the filled out form, you: certify that the tin you are giving is correct (or you are waiting for a number to be issued), certify that you are not subject to backup withholding, or. claim exemption from backup withholding if you are a u.s. exempt payee. All form w 9 revisions. about publication 515, withholding of tax on nonresident aliens and foreign entities. about publication 519, u.s. tax guide for aliens. publication 1281, backup withholding for missing and incorrect name tin(s) pdf. publication 5027, identity theft information for taxpayers pdf. video: how to complete form w 9. other.

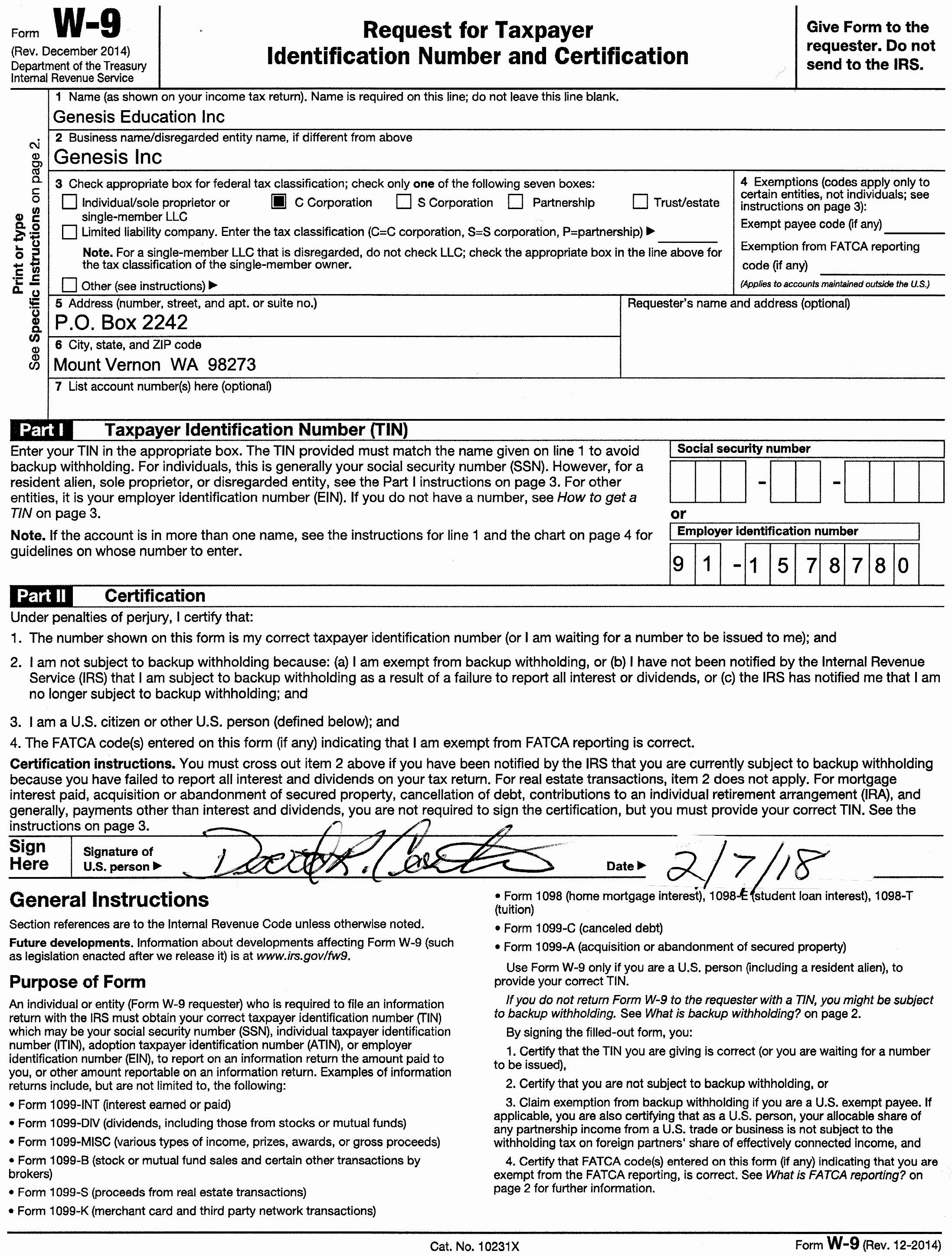

2017 W 9 Printable Form • form 1099 c (canceled debt) • form 1099 a (acquisition or abandonment of secured property) use form w 9 only if you are a u.s. person (including a resident alien), to provide your correct tin. if you do not return form w 9 to the requester with a tin, you might be subject to backup withholding. see what is backup withholding, later. Here’s the w 9 form meaning, in a nutshell: the form, officially called form w 9, request for taxpayer identification number and certification, is typically used when a person or entity is required to report certain types of income. the form helps businesses obtain important information from payees to prepare information returns for the irs. The irs w 9 form certifies that the tin (taxpayer identification number) given is correct (or that the person is waiting for an amount to be issued), that the person is not subject to backup withholding, or that the person is exempt from backup withholding because they are an exempt payee. this tax document may be found online on the irs. Irs form w9 (2024) an irs form w 9, or "request for taxpayer identification number and certification," is a document used to obtain the legal name and tax identification number (tin) of an individual or business entity. it is commonly required when making a payment and withholding taxes are not being deducted. create document.

18 Printable Form W 9 Templates Fillable Samples In Pdf Word To The irs w 9 form certifies that the tin (taxpayer identification number) given is correct (or that the person is waiting for an amount to be issued), that the person is not subject to backup withholding, or that the person is exempt from backup withholding because they are an exempt payee. this tax document may be found online on the irs. Irs form w9 (2024) an irs form w 9, or "request for taxpayer identification number and certification," is a document used to obtain the legal name and tax identification number (tin) of an individual or business entity. it is commonly required when making a payment and withholding taxes are not being deducted. create document. Form w 9. form w 9 (officially, the " request for taxpayer identification number and certification ") [1] is used in the united states income tax system by a third party who must file an information return with the internal revenue service (irs). [2] it requests the name, address, and taxpayer identification information of a taxpayer (in the. Chapter 3 or 4 purposes), do not use form w 9. instead, use the appropriate form w 8 or form 8233 (see pub. 515). if you are a qualified foreign pension fund under regulations section 1.897(l) 1(d), or a partnership that is wholly owned by qualified foreign pension funds, that is treated as a non foreign person for purposes of section 1445.

Comments are closed.