Ratio Analysis Meaning Limitations Formula Examples

Ratio Analysis Meaning Limitations Formula Examples Limitations. types. application. examples. examples of ratio analysis include the current ratio, gross profit margin ratio, and inventory turnover ratio. growth rates: definition, formula. Ratio analysis is a popular technique of financial analysis. it is used to visualize and extract information from financial statements. it focuses on ratios that reflect profitability, efficiency, financing leverage, and other vital information about a business. the ratios can be used for both horizontal analysis and vertical analysis.

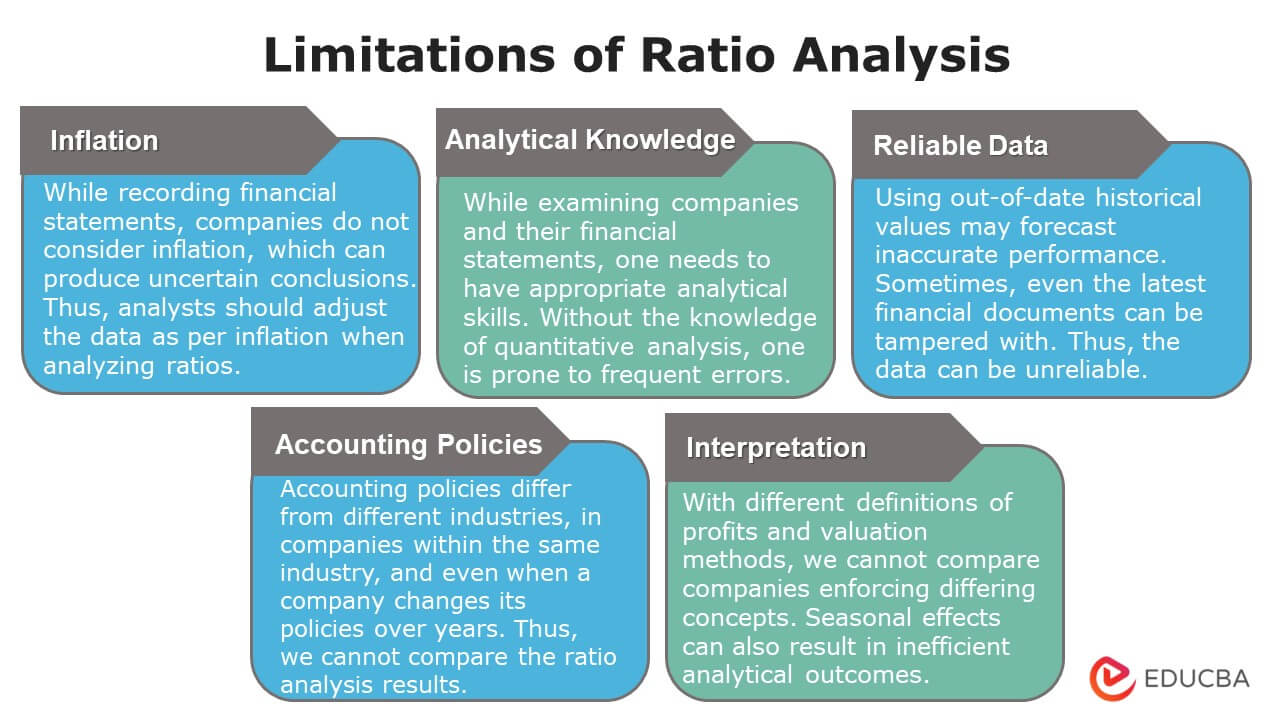

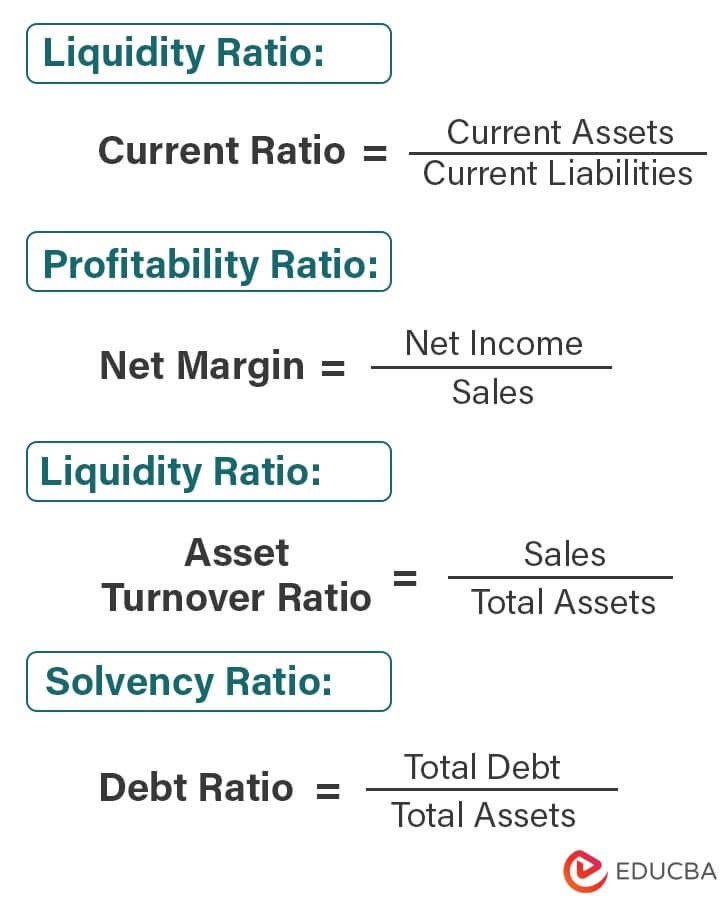

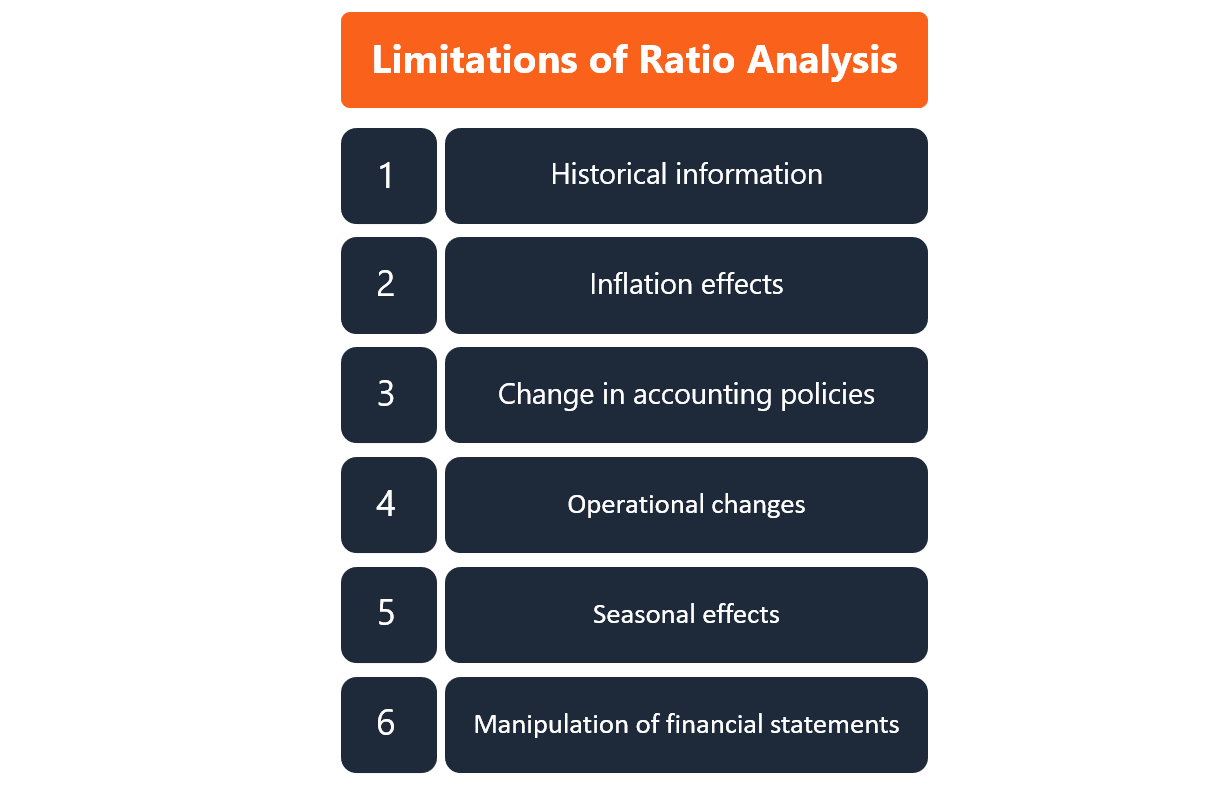

Ratio Analysis Meaning Limitations Formula Examples Ratio analysis is a way for businesses or investors to check if a company is doing well and making enough money to pay its debts by looking at its financial statements. analysts also compare the ratios with similar firms in the industry or analyze the company’s trend over a period. this comparison plays a vital role in the business planning. Table of contents. top 10 limitations of ratio analysis. #1 doesn't consider the size of the business. #2 doesn't take into account contingent liability. #3 doesn't incorporate uniform accounting policies. # 4 susceptible to creative accounting. #5 cannot use to compare different industries. #6 only based on historicals. Financial ratio analysis is a tool used by investors, creditors, and company managers to evaluate various aspects of a company’s financial health and performance. financial ratios are calculated by comparing key financial metrics derived from the income statement, balance sheet, and cash flow statement. common types of ratios analyzed include. If the company has a higher cash ratio, it is more likely to be able to pay its short term liabilities. formula. cash ratio formula = cash & cash equivalents current liabilities. example. let us take a simple cash ratio calculation example, cash and cash equivalents = $500. current liabilities = $1000.

Ratio Analysis Meaning Limitations Formula Examples Financial ratio analysis is a tool used by investors, creditors, and company managers to evaluate various aspects of a company’s financial health and performance. financial ratios are calculated by comparing key financial metrics derived from the income statement, balance sheet, and cash flow statement. common types of ratios analyzed include. If the company has a higher cash ratio, it is more likely to be able to pay its short term liabilities. formula. cash ratio formula = cash & cash equivalents current liabilities. example. let us take a simple cash ratio calculation example, cash and cash equivalents = $500. current liabilities = $1000. Accounting ratios. ratio analysis is the comparison of line items in the financial statements of a business. ratio analysis is used to identify various problems with a firm, such as its liquidity, efficiency of operations, and profitability. it is also used to identify the positives or strengths of a firm. 1. comparisons. one of the uses of ratio analysis is to compare a company’s financial performance to similar firms in the industry to understand the company’s position in the market. obtaining financial ratios, such as price earnings, from known competitors and comparing them to the company’s ratios can help management identify market.

Ratio Analysis Formula Calculator Example With Excel Template Accounting ratios. ratio analysis is the comparison of line items in the financial statements of a business. ratio analysis is used to identify various problems with a firm, such as its liquidity, efficiency of operations, and profitability. it is also used to identify the positives or strengths of a firm. 1. comparisons. one of the uses of ratio analysis is to compare a company’s financial performance to similar firms in the industry to understand the company’s position in the market. obtaining financial ratios, such as price earnings, from known competitors and comparing them to the company’s ratios can help management identify market.

Limitations Of Ratio Analysis Ratios Are Popular Learn About The

Comments are closed.