Ratio Analysis Types Type Of Ratio Analysis With Formula

Ratio Analysis Types Type Of Ratio Analysis With Formula Current ratio in 2022 = $570,000 $700,000 = 0.81 current ratio in 2023 = $700,000 530,000 = 1.32 1. high current ratio starlane ltd. had a ratio of 1.32 in 2023, which is higher than 1.2, indicating that the company is highly capable of repaying its short term debt obligations. Financial ratio analysis is often broken into six different types: profitability, solvency, liquidity, turnover, coverage, and market prospects ratios. other non financial metrics may be scattered.

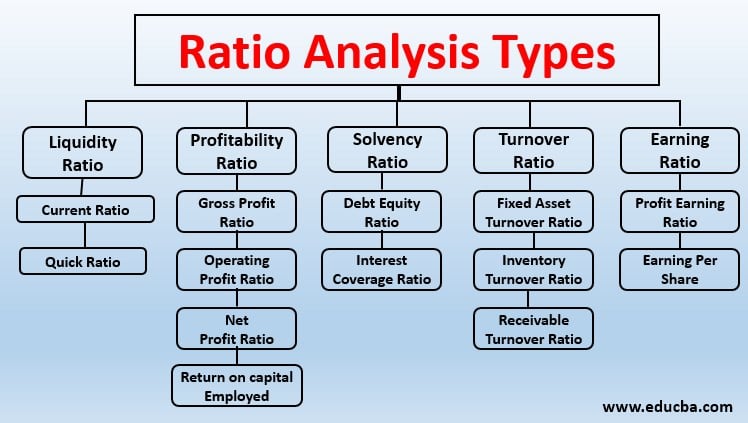

Ratio Analysis Types Top 5 Types Of Ratios With Formulas If the company has a higher cash ratio, it is more likely to be able to pay its short term liabilities. formula. cash ratio formula = cash & cash equivalents current liabilities. example. let us take a simple cash ratio calculation example, cash and cash equivalents = $500. current liabilities = $1000. These ratios can give you valuable insights into the company's performance. profitability ratios, solvency ratios, liquidity ratios, turnover ratios, and earning ratios are five types of ratio analysis. financial analysis in companies can benefit from various types of ratio analysis. top management can use it as a crucial tool for strategic. Ratio analysis refers to the analysis of various pieces of financial information in the financial statements of a business. they are mainly used by external analysts to determine various aspects of a business, such as its profitability, liquidity, and solvency. analysts rely on current and past financial statements to obtain data to evaluate. Key learning points. ratio analysis is a process of investigating a company’s operating performance looking at different metrics. there are seven most common types of investor ratios that are used by equity analysts and investors. the management ratios can be subdivided into operating, financial, and cash flow ratios.

Comments are closed.