Real Estate Wire Fraud Tips To Prevent How To Protect Your

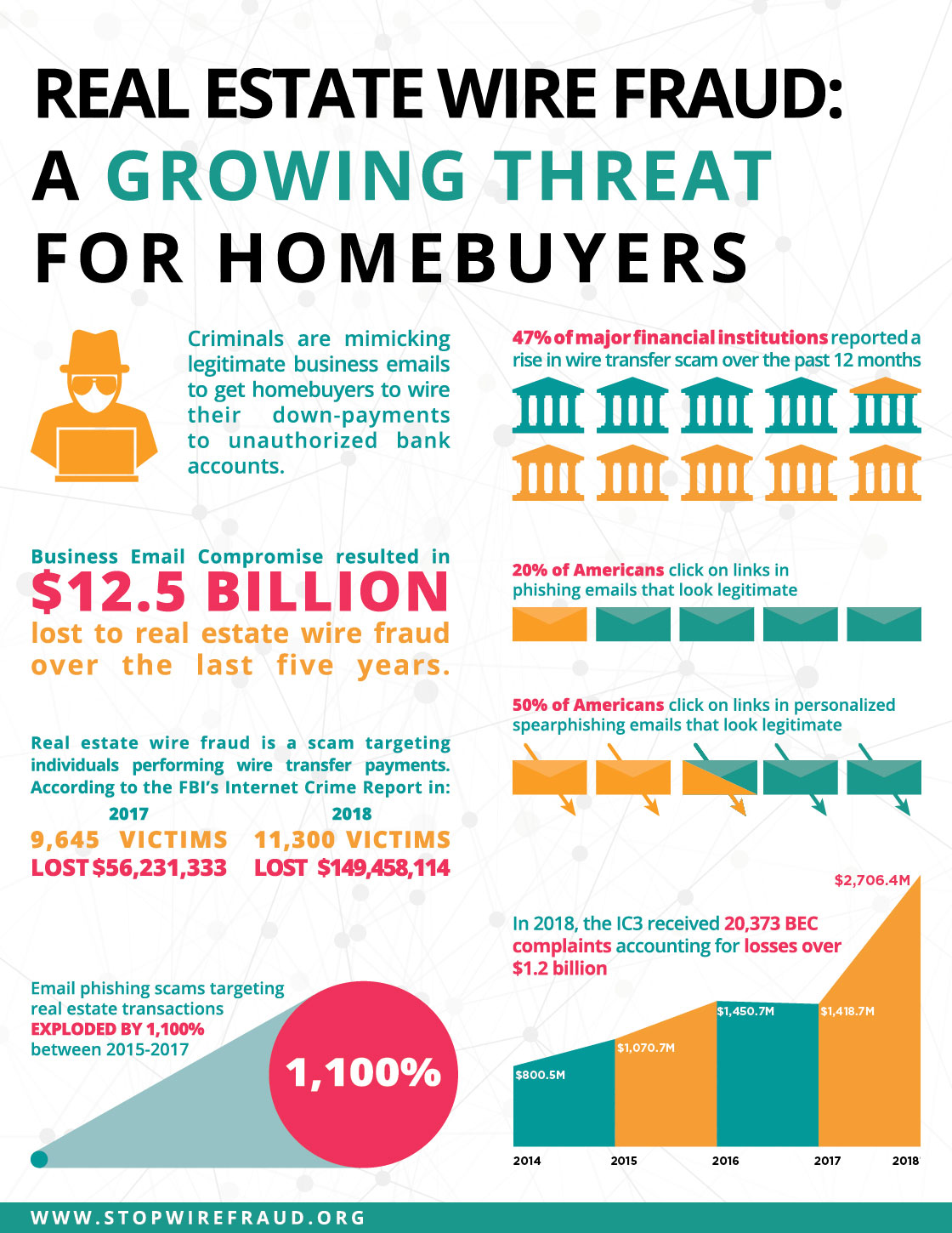

How To Prevent Wire Fraud At Your Title Company Certifid One of the fastest growing cybercrimes in the u.s. is wire fraud in real estate. about 11,677 people were victims of wire fraud in the real estate and rental sector in 2019 with losses of more than $221 million (a 48% increase over 2018), according to fbi data. How to avoid mortgage wire fraud. as the cliche goes, knowledge is power. “the best way to avoid scams like this is to discuss the closing process with your real estate agent and title company.

How Wire Fraud Happens вђ Coalition To Stop Real Estate Wire It’s easy to be fooled by cybercriminals if you let your guard down, but with knowledge and preparation, you can avoid becoming a victim. tips for preventing wire fraud. secure your devices and accounts. securing your computer, phone and mobile devices, and practicing good email and password hygiene can make you less vulnerable to any cybercrime. You may wish to use a wire transfer to pay a large invoice, send money to a family member, or to complete a real estate transaction. however, because wire transfer payments are typically irreversible, they are commonly used in fraud schemes. these five tips can help you protect your accounts. tip 1: remember that wire transfers are like sending. Mortgage wire fraud relies on a complicated hacking technique called phishing. in a phishing scam, a hacker uses fake emails, phone numbers or websites to impersonate someone you trust. a scammer who runs a mortgage wire fraud might use an email address or phone number that looks like the one your real estate agent or lender uses. Unfortunately, wire fraud is often only discovered at the closing appointment. all parties involved in a real estate transaction must know these signs of wire fraud. 1. unexpected changes in payment instructions. be cautious if you receive an email or phone call instructing you to change the payment process. 2.

Real Estate Wire Fraud Tips To Prevent How To Protect Your Mortgage wire fraud relies on a complicated hacking technique called phishing. in a phishing scam, a hacker uses fake emails, phone numbers or websites to impersonate someone you trust. a scammer who runs a mortgage wire fraud might use an email address or phone number that looks like the one your real estate agent or lender uses. Unfortunately, wire fraud is often only discovered at the closing appointment. all parties involved in a real estate transaction must know these signs of wire fraud. 1. unexpected changes in payment instructions. be cautious if you receive an email or phone call instructing you to change the payment process. 2. In an effort to avoid falling victim to such scams, we recommend communicating with your real estate agent, title company, and lender via secure channels, and ask them to confirm any wire transfer instructions verbally before sending funds. endpoint will not change its wire instructions. If you believe you are a victim of real estate wire fraud, it’s important to act quickly. here are steps to follow as soon as possible after the money transfer has occurred. contact all banks involved in the transaction. even if you feel embarrassed about the situation, it’s important to talk to your bank and give them all relevant.

Comments are closed.