Register For E Filing Taxpayer User Manual Income Tax Department

Register For E Filing Taxpayer User Manual Income Tax Department This pre login service is available to all taxpayers (except companies) who want to register on and access the e filing portal. the registration service enables the taxpayer to access and track all tax related activities. 2. prerequisites for availing this service valid and active pan; valid mobile number; valid email id; 3. step by step guide. 3.6 login for other than taxpayers (ca, tan user, eri, external agency, itdrein user) step 1: go to the e filing portal homepage and click login. step 2: enter your user id in the enter your user id textbox and click continue. note: the user ids for different users are mentioned in the table below: sl. no.

Register For E Filing Taxpayer User Manual Income Tax Department Official guide from the income tax department on how to register as a taxpayer on the e filing portal. Get your refund status. sign in to your account. get your tax record. make a payment. file your taxes for free. find forms & instructions. get answers to your tax questions. apply for an employer id number (ein) check your amended return status. Check the status of your aadhaar linking with pan on the e filing portal of the income tax department, government of india. Step 6: activate e filing account. on submission of the above details, the taxpayer will get a message, “registration successful”. also, an email will be sent to the taxpayer along with an activation link and an sms with otp. to activate the income tax e filing account, click on the activation link sent through email and enter the otp.

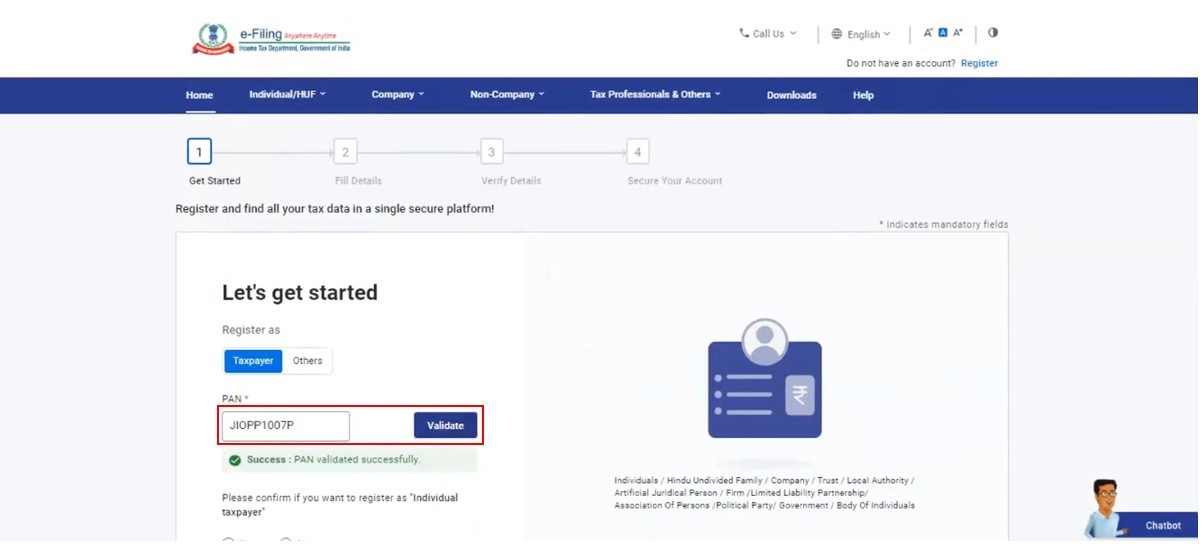

Register For E Filing Taxpayer User Manual Income Tax Department Check the status of your aadhaar linking with pan on the e filing portal of the income tax department, government of india. Step 6: activate e filing account. on submission of the above details, the taxpayer will get a message, “registration successful”. also, an email will be sent to the taxpayer along with an activation link and an sms with otp. to activate the income tax e filing account, click on the activation link sent through email and enter the otp. Pan of principal contact should be registered on the e filing portal; digital signature certificate (dsc) of principal contact registered for the specified pan; 3. step by step guide. step 1: go to the e filing portal homepage, click register. step 2: select register as taxpayer and enter the pan of the company. click validate. New features that the e filing portal offers. the new e portal has come up with some features to ensure hassle free itr filing. these features include : role based user friendly dashboard; secure and multiple options to login; chatbot to answer all queries; multiple methods to pay taxes on the portal; enhanced help section with user manuals and.

Register For E Filing Taxpayer User Manual Income Tax Department Pan of principal contact should be registered on the e filing portal; digital signature certificate (dsc) of principal contact registered for the specified pan; 3. step by step guide. step 1: go to the e filing portal homepage, click register. step 2: select register as taxpayer and enter the pan of the company. click validate. New features that the e filing portal offers. the new e portal has come up with some features to ensure hassle free itr filing. these features include : role based user friendly dashboard; secure and multiple options to login; chatbot to answer all queries; multiple methods to pay taxes on the portal; enhanced help section with user manuals and.

Comments are closed.