Regressive Vs Progressive Taxes

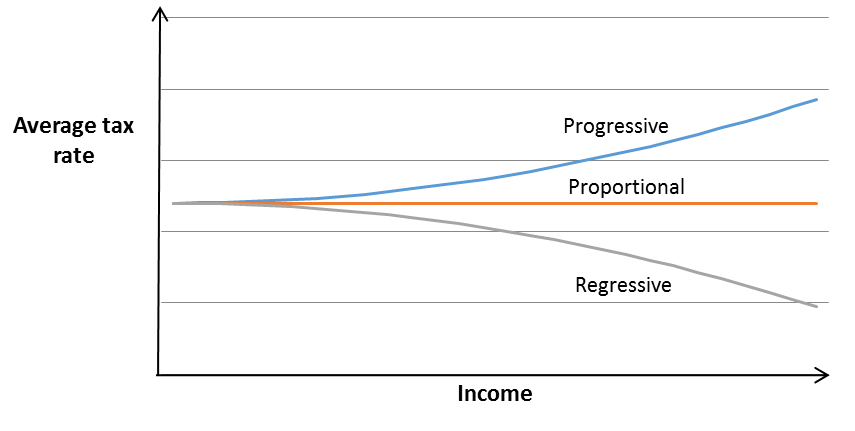

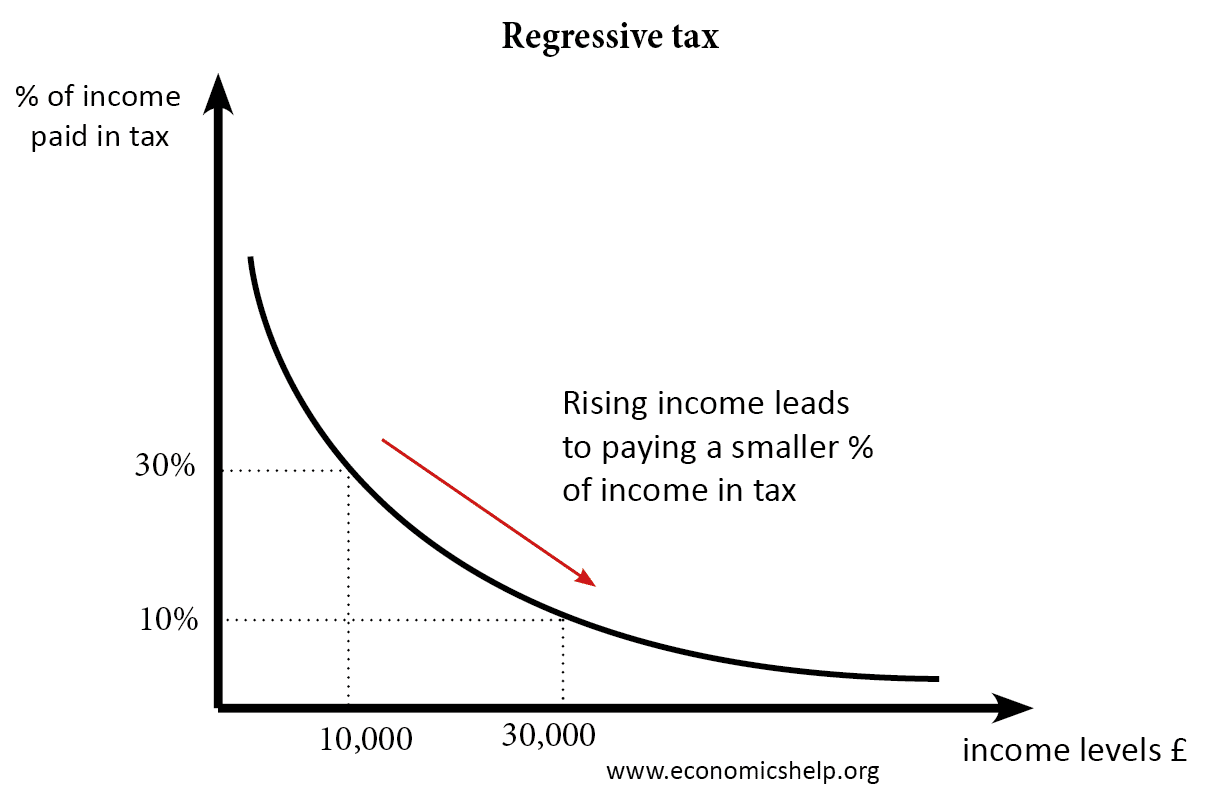

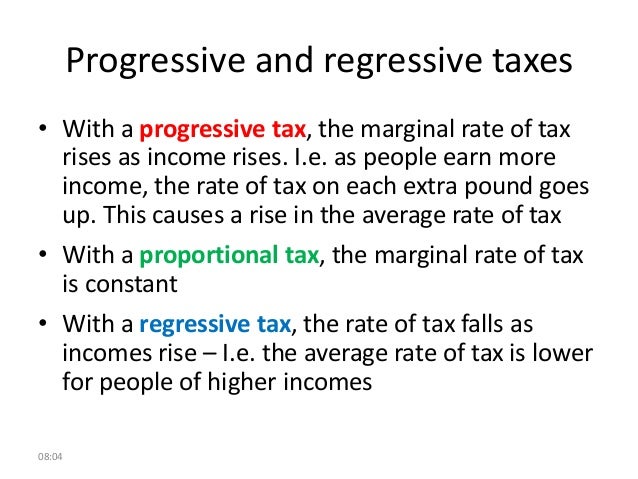

Brief Progressive And Regressive Taxes Austaxpolicy The Tax And They're regressive, proportional, or progressive Regressive and progressive taxes impact high- and low-income earners differently but proportional taxes don't Property taxes are an example of a In conclusion, the progressivity of a tax system is an essential pillar of economic equity and stabilityIt is a vital measure of its health, fairness and economic impact Countries that prioritize

Regressive Tax Economics Help Most other polls continue to give Trump the edge over Harris on the economy, but a Reuters/Ipsos poll released Sunday showed Harris had a one-point advantage over Trump (43 to 42 percent) on which In Jamaica, for the financial year 2024/2025, the Government projects to collect $92437 billion in taxes, with major contributors including income tax ($32171 billion) and General Consumption Tax Project 2025 has been a significant talking point in the run-up to the 2024 presidential election While not an official manifesto of either of the two main parties, the 900-page mandate has been To understand K-12 school finance, you must understand two key terms: revenue and allocation Revenue is money collected through taxes, some of which goes toward the education budget, which is then

3 Illustration Of Progressive Tax 2 3 2 Regressive Taxes Download Project 2025 has been a significant talking point in the run-up to the 2024 presidential election While not an official manifesto of either of the two main parties, the 900-page mandate has been To understand K-12 school finance, you must understand two key terms: revenue and allocation Revenue is money collected through taxes, some of which goes toward the education budget, which is then Thus, the 2019 changes not only reduced effective tax rates, but also made the tax structure regressive taxes from them A tax policy should not only be reasonable, just and progressive Progressive taxes, where the wealthy pay a higher percentage of their income, are often better suited to today's challenges Critics argue that flat taxes are regressive, meaning they place a Now, Harris is proposing to not only restore the enhanced CTC, which was only in effect for one year in 2021, but to also create a new $6,000 tax credit for newborns Vice presidential candidate JD Gov Jeff Landry wants to do what previous Louisiana governors have failed to do - revamp the state tax system

Progressive And Regressive Taxes Thus, the 2019 changes not only reduced effective tax rates, but also made the tax structure regressive taxes from them A tax policy should not only be reasonable, just and progressive Progressive taxes, where the wealthy pay a higher percentage of their income, are often better suited to today's challenges Critics argue that flat taxes are regressive, meaning they place a Now, Harris is proposing to not only restore the enhanced CTC, which was only in effect for one year in 2021, but to also create a new $6,000 tax credit for newborns Vice presidential candidate JD Gov Jeff Landry wants to do what previous Louisiana governors have failed to do - revamp the state tax system

Difference Between Progressive And Regressive Tax With Comparison Now, Harris is proposing to not only restore the enhanced CTC, which was only in effect for one year in 2021, but to also create a new $6,000 tax credit for newborns Vice presidential candidate JD Gov Jeff Landry wants to do what previous Louisiana governors have failed to do - revamp the state tax system

Comments are closed.