Reimu Discovers Income Tax

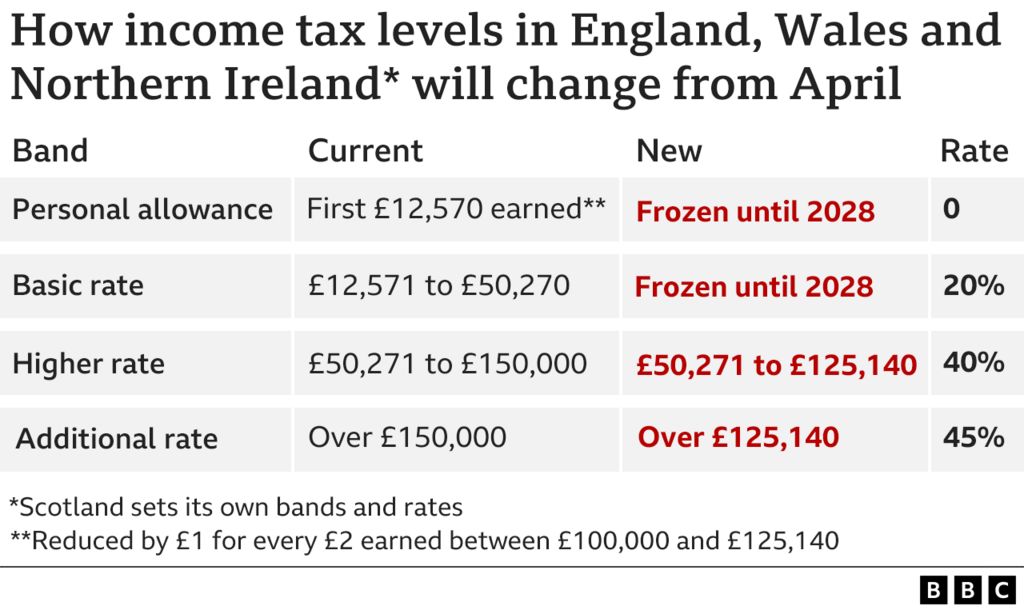

Income Tax How Will Thresholds Change And What Will I Pay Bbc News The tax withholding estimator doesn't ask for personal information such as your name, social security number, address or bank account numbers. we don't save or record the information you enter in the estimator. for details on how to protect yourself from scams, see tax scams consumer alerts. check your w 4 tax withholding with the irs tax. The decision to file an amended return to correct one or more errors or omissions involves a variety of considerations. practitioners and clients must determine whether the cost of making the correction, i.e., the professional fees, justifies the anticipated result. an amended return that represents a large prospective refund claim, for example.

Study Finds Arizona Among Worst States To Be Poor During Tax Season Fixing prior year tax returns. if you file an amended tax return for a prior tax year, you would still use a form 1040x. however, if you did not file a tax return at all for that year, you will need to use the correct year form 1040, u. s. individual tax return. go to prior year forms and instructions to get what you need. Age: enter the age you were on jan. 1, 2024. your age can have an effect on certain tax rules or deductions. for example, people aged 65 or older get a higher standard deduction. 401 (k. The seven federal income tax brackets for 2024 are 10%, 12%, 22%, 24%, 32%, 35% and 37%. your bracket depends on your taxable income and filing status. 1. states with no income tax. nine states don’t have an income tax: alaska, florida, nevada, new hampshire, south dakota, tennessee, texas, washington and wyoming. new hampshire has a 5% tax on.

Landlords Scramble To Avoid Higher Buy To Let Taxes Report Finds The seven federal income tax brackets for 2024 are 10%, 12%, 22%, 24%, 32%, 35% and 37%. your bracket depends on your taxable income and filing status. 1. states with no income tax. nine states don’t have an income tax: alaska, florida, nevada, new hampshire, south dakota, tennessee, texas, washington and wyoming. new hampshire has a 5% tax on. This terminology, however, is intended to encompass the various situations contemplated by the rule, including errors on a return that is the subject of an administrative proceeding, nonfiling of a required return, and erroneous use of an improper return (e.g., a corporation using form 1120s, u.s. income tax return for an s corporation, when it. 2. your premium is based on gross income (magi). we live in a world where taxable income is more important than gross income because it dictates our income tax bracket.oversimplifying, our taxable.

No Main Uk Party Proposes Tax Plan To Benefit Low Earners Report Finds This terminology, however, is intended to encompass the various situations contemplated by the rule, including errors on a return that is the subject of an administrative proceeding, nonfiling of a required return, and erroneous use of an improper return (e.g., a corporation using form 1120s, u.s. income tax return for an s corporation, when it. 2. your premium is based on gross income (magi). we live in a world where taxable income is more important than gross income because it dictates our income tax bracket.oversimplifying, our taxable.

Six Of 13 Irs Approved Tax Preparers Fail Cybersecurity Test Wsj

Comments are closed.