Report Us Residents Average 17 In Cell Phone Fees Taxes Mobilevillage

Report Us Residents Average 17 In Cell Phone Fees ођ How much higher are your cell phone fees and taxes than your state sales taxes on most other goods and services? on average, more than two times higher, according to the report. and since 2003, overall cellular taxes grew from 15.27 percent to 17.05 percent — about three times faster growth than general sales taxes on other goods and services. Tag: cellular taxes report: us residents average 17% in cell phone fees, taxes think you’re paying too much in fees and taxes on your monthly bill for wireless service?.

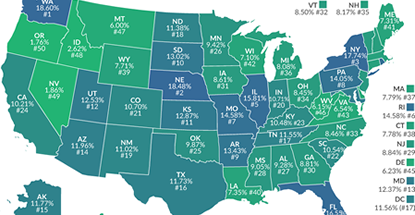

Report Us Residents Average 17 In Cell Phone Fees ођ On taxable voice services. illinois residents continue to have the highest wireless taxes in the country at 33.8 percent, followed by residents in arkansas at 32.2 percent and washington at 32.1 percent. idaho residents pay the lowest wireless taxes at 13.7 percent. A typical american household with four cell phones on a “family share” plan, paying $100 per month for taxable wireless service, would pay nearly $300 per year in taxes, fees, and government surcharges—up from $270 in 2020. this year, wireless subscribers will pay approximately $11.3 billion in taxes, fees, and government surcharges to. Since 2012, the average charge from wireless providers decreased by 24 percent, from $47.00 per line per month to $35.74 per line. however, during this same time, wireless taxes, fees, and government surcharges increased from 17.2 percent to 25.4 percent of the average taxable portion of wireless bills. And local taxes 1.7 times higher than the sales taxes imposed on goods, with the average state and local wireless tax rate over 13 percent and the average combined sales tax rate at about 7.8 percent. in 15 states, wireless taxes are more than twice as high as sales taxes. three states that do not.

Report Us Residents Average 17 In Cell Phone Fees ођ Since 2012, the average charge from wireless providers decreased by 24 percent, from $47.00 per line per month to $35.74 per line. however, during this same time, wireless taxes, fees, and government surcharges increased from 17.2 percent to 25.4 percent of the average taxable portion of wireless bills. And local taxes 1.7 times higher than the sales taxes imposed on goods, with the average state and local wireless tax rate over 13 percent and the average combined sales tax rate at about 7.8 percent. in 15 states, wireless taxes are more than twice as high as sales taxes. three states that do not. 8. gross receipts surcharge. these fees which stem from the taxes that some states, counties and cities impose on the carriers’ total revenue can range dramatically. the tax foundation found that states like pennsylvania and rhode island charge a 5% state gross receipts tax, while new mexico charges a 5.13% state tax and an additional 2. According to the consumer tax and spending think tank tax foundation, average cell phone service fees and taxes have reached 18.6%. this means that wireless customers are paying an average of $225 per year above and beyond the actual price of their mobile service. this number also represents a 4.5% increase in these extra fees over the past decade.

Comments are closed.