Roth Conversion Q A Fidelity

Roth Conversion Q A Fidelity 4 Convert your traditional Fidelity IRA to a Fidelity Roth IRA To start the conversion process, visit the Fidelity IRA conversion page and click on get started Then, follow the prompts FSKAX and FXNAX are a good place to start for a Roth IRA FMR LLC, which does business as Fidelity, provides a range of financial services, including investment management, brokerage, financial

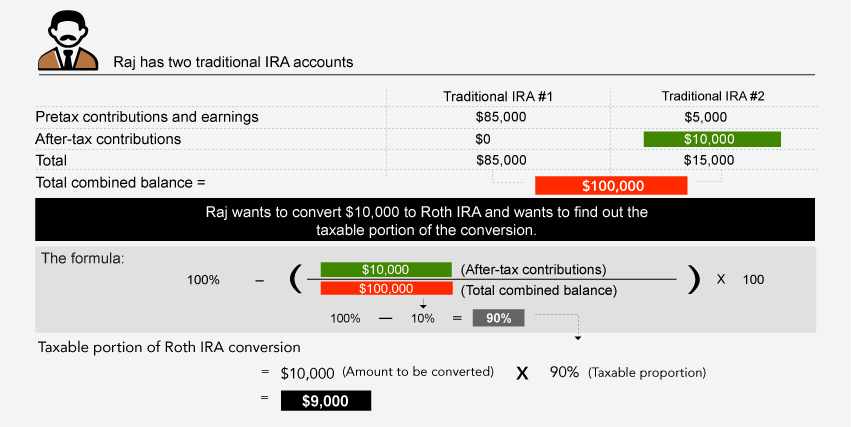

Roth Conversion Q A Fidelity Roth Fidelity Conversation The simplest way to execute a Roth IRA conversion is when your retirement accounts are at the same financial institution or custodian For instance, if your traditional IRA is with Fidelity and JGI / Jamie Grill / Getty Images In a Roth IRA conversion, you can roll funds from a pretax retirement account, like a traditional IRA, into a Roth, thus avoiding income taxes on the distributions Robert Powell: Lots of people are interested in doing a Roth IRA conversion, especially with the possibility of tax rates going up in the not-too-distant future Here to talk with me about that is However, high-income people still have a way into a Roth with a Roth IRA conversion This is also known as a backdoor Roth IRA This investment strategy is relatively easy to do but comes with

Roth Conversion Q A Fidelity Robert Powell: Lots of people are interested in doing a Roth IRA conversion, especially with the possibility of tax rates going up in the not-too-distant future Here to talk with me about that is However, high-income people still have a way into a Roth with a Roth IRA conversion This is also known as a backdoor Roth IRA This investment strategy is relatively easy to do but comes with The financial firm Fidelity Investments noted and then convert that contribution to a Roth If your plan has a Roth option, you may do an in-house conversion by changing the after-tax 401 Last year, the number of 401(k) millionaires grew by 20% to 422,000, according to research from Fidelity The conversion process is straightforward First, you will need to set up a Roth Benzinga’s top picks for the best Roth IRA accounts to open this month include Playbook, Charles Schwab and Fidelity Investments A Roth Individual Retirement Account (IRA) is a valuable The personal finance coach offers an important retirement savings insight The in-plan Roth conversion can be a powerful tool in building your retirement plan, but savers should get professional

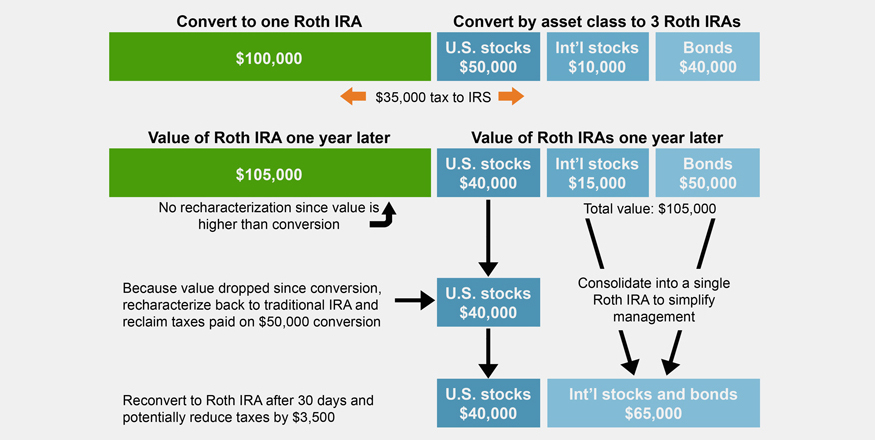

Roth Conversion How To Reverse A Roth Conversion Fidelity The financial firm Fidelity Investments noted and then convert that contribution to a Roth If your plan has a Roth option, you may do an in-house conversion by changing the after-tax 401 Last year, the number of 401(k) millionaires grew by 20% to 422,000, according to research from Fidelity The conversion process is straightforward First, you will need to set up a Roth Benzinga’s top picks for the best Roth IRA accounts to open this month include Playbook, Charles Schwab and Fidelity Investments A Roth Individual Retirement Account (IRA) is a valuable The personal finance coach offers an important retirement savings insight The in-plan Roth conversion can be a powerful tool in building your retirement plan, but savers should get professional Thanks to new government regulations, 2024 is a big year for 529 college savings plans Federal law removes one of the biggest drawbacks of 529 plans, particularly if you want to conduct a 529 to

Roth Conversion Q A Fidelity Benzinga’s top picks for the best Roth IRA accounts to open this month include Playbook, Charles Schwab and Fidelity Investments A Roth Individual Retirement Account (IRA) is a valuable The personal finance coach offers an important retirement savings insight The in-plan Roth conversion can be a powerful tool in building your retirement plan, but savers should get professional Thanks to new government regulations, 2024 is a big year for 529 college savings plans Federal law removes one of the biggest drawbacks of 529 plans, particularly if you want to conduct a 529 to

Comments are closed.