Secure Act 2 0 Two Big Tax Credits For Small Businesses Rob Cpa

Secure Act 2 0 Two Big Tax Credits For Small о In this video, i will discuss secure act 2.0 as it relates to small businesses and its benefits to them.the first change, effective 1 1 23, the secure act 2 . The secure 2.0 act was designed to make it easier and more affordable for small businesses to offer employer sponsored retirement plans. learn about tax credits that can help offset the costs of a new plan. new provisions from the secure 2.0 act are now underway, aiming to increase retirement readiness for all.

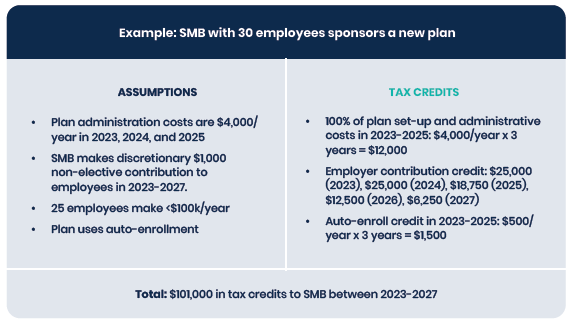

This Secure Act 2 0 Provision Expands Fee For Service Planning The most significant benefits will target plan startup costs. beginning in 2023, the three year small business startup credit is currently 50% of administrative costs, up to an annual cap of $5,000. secure act 2.0 increases the credit to 100% for employers with up to 50 employees. plus, there is an additional credit (except in the case of. Section 302 of the secure act 2.0 reduces the penalty to 25%. in addition, if the failure to take the rmd from an ira is corrected in a timely manner (as defined in the act), the excise tax is reduced to only 10%. section 302 is effective for taxable years beginning after december 29, 2022. January 1, 2024. photo by klaus vedfelt getty images. the secure 2.0 act 1 is an extensive piece of retirement plan legislation passed on dec. 29, 2022. its stated goals are to expand and increase retirement savings and to simplify and clarify retirement plan rules. its passage affects virtually all forms of retirement plans and increases. Increases the small business start up credit: secure 2.0 increases the startup credit to cover 100% (up from 50%) of administrative costs up to $5,000 for the first three years of plans.

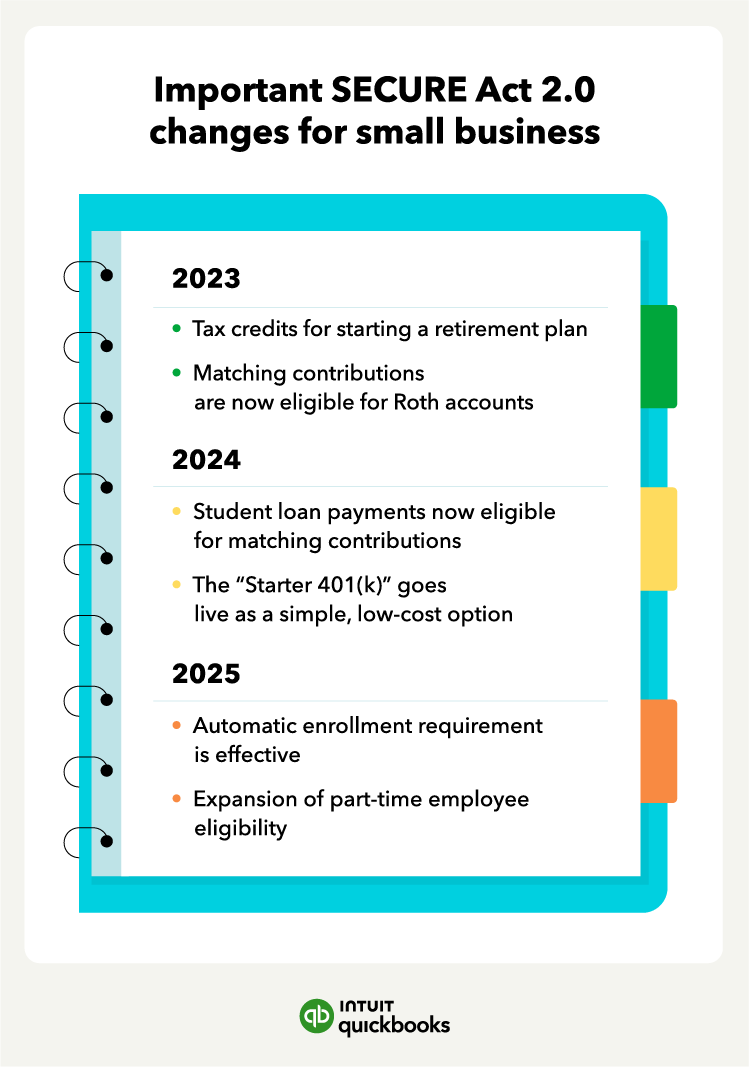

Secure Act 2 0 Your Small Business Payday Employer Solutions January 1, 2024. photo by klaus vedfelt getty images. the secure 2.0 act 1 is an extensive piece of retirement plan legislation passed on dec. 29, 2022. its stated goals are to expand and increase retirement savings and to simplify and clarify retirement plan rules. its passage affects virtually all forms of retirement plans and increases. Increases the small business start up credit: secure 2.0 increases the startup credit to cover 100% (up from 50%) of administrative costs up to $5,000 for the first three years of plans. Secure 2.0 also exempts small businesses from certain mandates. most notably, employers with 10 or fewer employees do not have to have the automatic enrollment and escalation features required for all new plans created in 2025 or later. parks notes, however, that the secure act of 2019 provides a tax credit of $500 for the first three years. Following are several key changes for small businesses included in secure act 2.0. could claim a tax credit for three years for 50% of the cost of starting up a qualified retirement plan, up.

Secure Act 2 0 Tax Credits 401 K Plan Festures вђ Plan2retire Secure 2.0 also exempts small businesses from certain mandates. most notably, employers with 10 or fewer employees do not have to have the automatic enrollment and escalation features required for all new plans created in 2025 or later. parks notes, however, that the secure act of 2019 provides a tax credit of $500 for the first three years. Following are several key changes for small businesses included in secure act 2.0. could claim a tax credit for three years for 50% of the cost of starting up a qualified retirement plan, up.

Secure Act 2 0 Small Business Owner Guide Quickbooks

Comments are closed.