Secured Vs Unsecured Lines Of Credit What S The Difference

:max_bytes(150000):strip_icc()/whats-difference-between-secured-line-credit-and-unsecured-line-credit-v1-b78ddb9683b24ef2bc31743c5b3b13d2.png)

Secured Vs Unsecured Lines Of Credit What S The Difference A secured line of credit is guaranteed by collateral, such as a home. an unsecured line of credit is not guaranteed by any asset; one example is a credit card. unsecured credit always comes with. Many unsecured credit cards offer better rewards and benefits than secured cards. they may also charge lower aprs. likewise, you don’t need to put down any collateral upfront. if you can qualify.

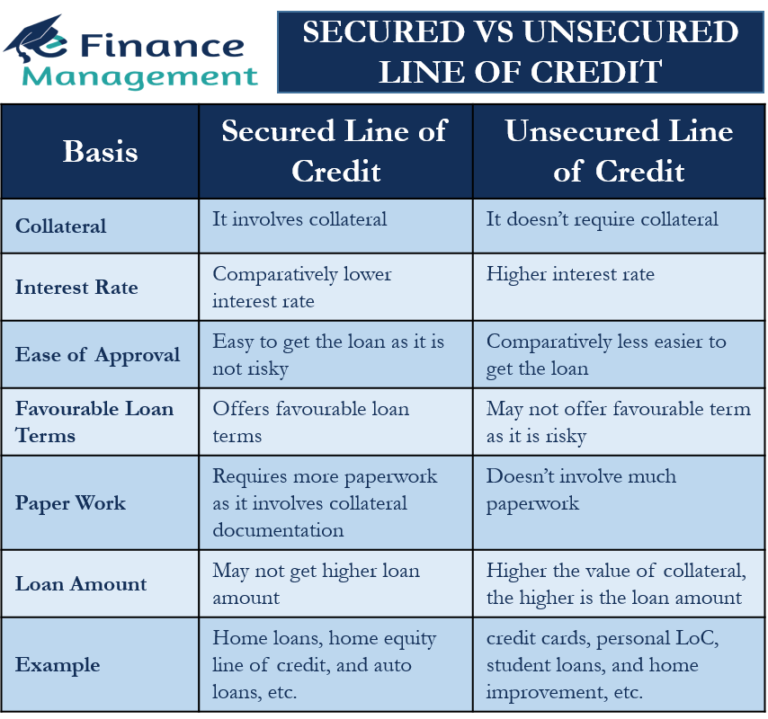

Secured Vs Unsecured Line Of Credit Meaning Differences Efm Higher interest rates: unsecured lines of credit often come with higher interest rates compared to secured options due to the increased risk for lenders. limited borrowing limits: without collateral, the borrowing limits for unsecured lines of credit may often be lower, which could restrict access to higher balances. Secured credit cards vs. unsecured credit cards. whether you need a secured card comes down to how good your credit is. for unsecured cards, which don't require a deposit and therefore pose more. Unsecured credit cards tend to come with better perks and rewards, lower fees and lower interest rates. secured credit cards are usually for people with poor credit or no credit history, whereas. Key differences between secured and unsecured lines of credit. understanding the core differences between secured and unsecured lines of credit is essential to make an informed decision. secured lines of credit require collateral, such as your house or another substantial asset, to back the borrowed amount. on the other hand, unsecured lines.

Secured Vs Unsecured Line Of Credit Key Differences Explained In Unsecured credit cards tend to come with better perks and rewards, lower fees and lower interest rates. secured credit cards are usually for people with poor credit or no credit history, whereas. Key differences between secured and unsecured lines of credit. understanding the core differences between secured and unsecured lines of credit is essential to make an informed decision. secured lines of credit require collateral, such as your house or another substantial asset, to back the borrowed amount. on the other hand, unsecured lines. Unsecured lines of credit work the same way that secured ones do in that they offer easy access to ongoing funds. the main difference is that unsecured loans don't require collateral. instead, the amount of your credit line is largely based on your income, employment status, and current debts. It’s worth noting that many secured credit lines come without the spending temptations commonly associated with unsecured credit cards, like rewards programs that might encourage higher spending. this could help you stay focused on your financial goals and budget without unnecessary distractions.

Secured Vs Unsecured Credit Cards Chime Unsecured lines of credit work the same way that secured ones do in that they offer easy access to ongoing funds. the main difference is that unsecured loans don't require collateral. instead, the amount of your credit line is largely based on your income, employment status, and current debts. It’s worth noting that many secured credit lines come without the spending temptations commonly associated with unsecured credit cards, like rewards programs that might encourage higher spending. this could help you stay focused on your financial goals and budget without unnecessary distractions.

Secured Vs Unsecured Line Of Credit Us Business Funding

Comments are closed.