Social Security Tax Withholding What Do You Pay

Social Security Tax Withholding Form W 4v 2021 Printable 2022 W4 Form Calculating social security taxes . let's say you earn $165,240 per year or $13,770 per month. the maximum in wages that can be taxed for social security is $168,600 in 2024 or $14,050 per month. Social benefits repayment – you may have to repay all or a part of your old age security (oas) pension (line 11300) or net federal supplements (line 14600) when you file your income tax and benefit return if your income exceeds a yearly threshold. if that is the case, a recovery tax will be deducted by service canada from your oas benefits.

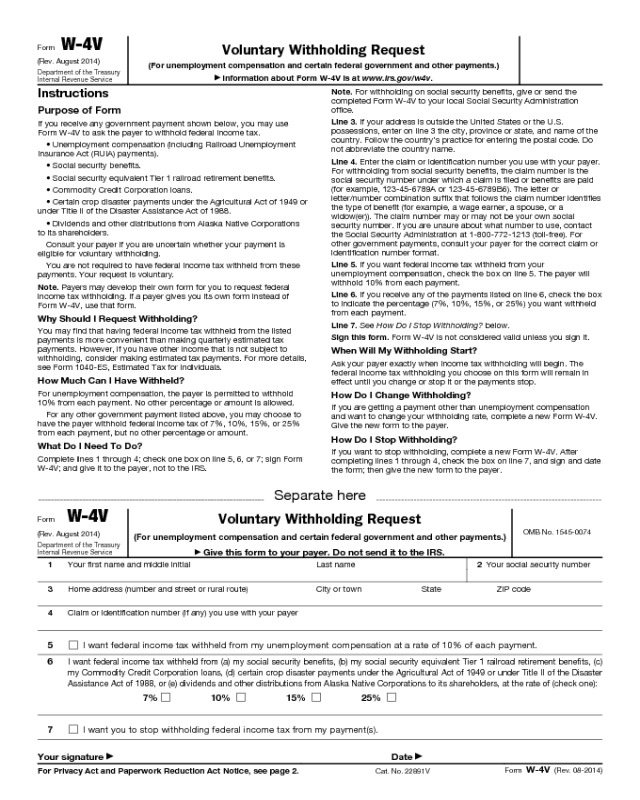

Social Security Income Tax Withholding Forms Withholdingform You will pay federal income taxes on your benefits if your combined income (50% of your benefit amount plus any other earned income) exceeds $25,000 year filing individually or $32,000 year filing jointly. you can pay the irs directly or withhold taxes from your payment. you may choose to withhold 7%, 10%, 12%, or 22% of your monthly payment. Here are seven things social security recipients, present and future, should know about taxation of benefits. 1. income matters — age doesn’t. contrary to another common misperception, you don’t stop paying taxes on your social security when you reach a certain age. income, and income alone, dictates whether you owe federal taxes on your. If you need more information about tax withholding, read irs publication 554, tax guide for seniors, and publication 915, social security and equivalent railroad retirement benefits. if you have questions about your tax liability or want to request a form w 4v, you can also call the irs at 1 800 829 3676. (if you are deaf or hard of hearing. Social security tax rates . social security functions much like a flat tax. everyone pays the same rate, regardless of how much they earn, until they hit the ceiling. as of 2021, a single rate of 12.4% is applied to all wages and self employment income earned by a worker up to a maximum dollar limit of $142,800.

Social Security Tax Limit 2024 Withholding Chart Devina Anatola If you need more information about tax withholding, read irs publication 554, tax guide for seniors, and publication 915, social security and equivalent railroad retirement benefits. if you have questions about your tax liability or want to request a form w 4v, you can also call the irs at 1 800 829 3676. (if you are deaf or hard of hearing. Social security tax rates . social security functions much like a flat tax. everyone pays the same rate, regardless of how much they earn, until they hit the ceiling. as of 2021, a single rate of 12.4% is applied to all wages and self employment income earned by a worker up to a maximum dollar limit of $142,800. You will pay tax on your social security benefits based on internal revenue service (irs) rules if you: file a federal tax return as an "individual" and your combined income* is. between $25,000 and $34,000, you may have to pay income tax on up to 50% of your benefits. more than $34,000, up to 85% of your benefits may be taxable. If your combined income is under $25,000 (single) or $32,000 (joint filing), there is no tax on your social security benefits. for combined income between $25,000 and $34,000 (single) or $32,000.

56 Of Social Security Households Pay Tax On Their Benefits вђ Will You You will pay tax on your social security benefits based on internal revenue service (irs) rules if you: file a federal tax return as an "individual" and your combined income* is. between $25,000 and $34,000, you may have to pay income tax on up to 50% of your benefits. more than $34,000, up to 85% of your benefits may be taxable. If your combined income is under $25,000 (single) or $32,000 (joint filing), there is no tax on your social security benefits. for combined income between $25,000 and $34,000 (single) or $32,000.

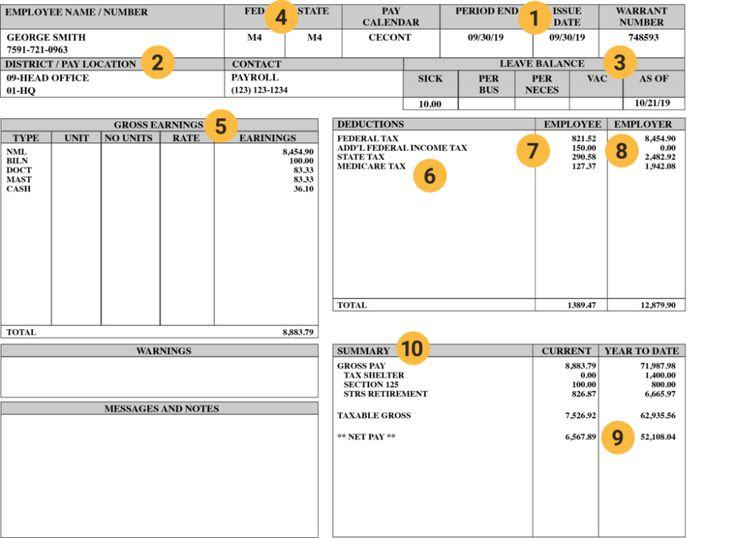

How To Calculate Social Security Wages From Pay Stub

Comments are closed.