Social Security Wage Base 2024

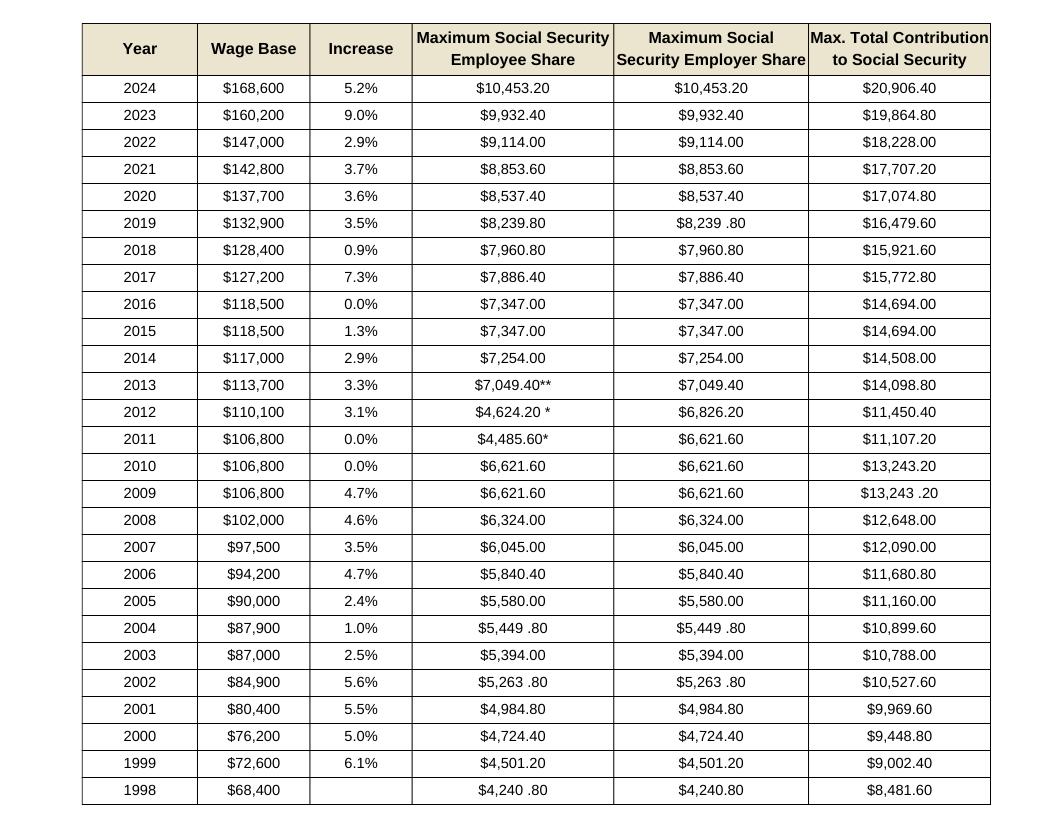

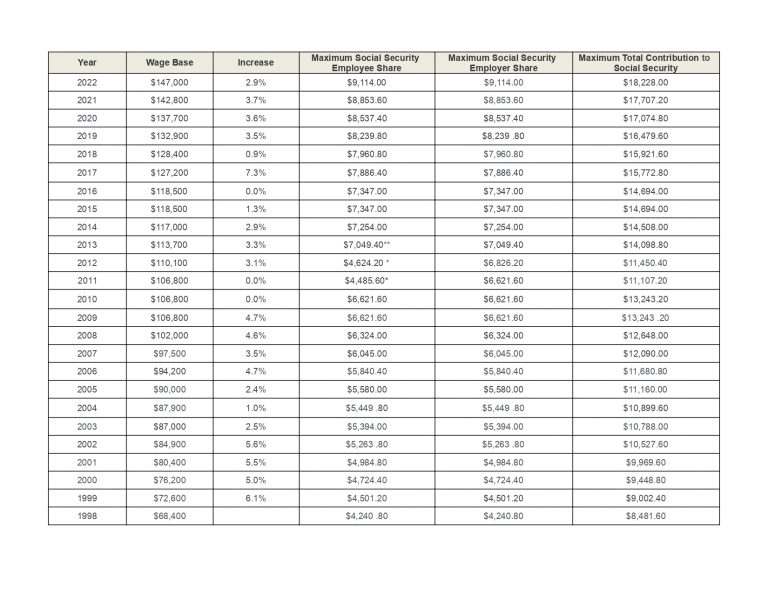

Social Security Wage Base 2021 Updated For 2024 Complete Hr The contribution and benefit base for social security in 2024 is $168,600, which is the annual limit of earnings subject to taxation. this amount is also used in benefit computation and changes each year with the national average wage index. The maximum social security employer contribution will increase by $520.80 in 2024. the $168,600 wage base for 2024 is slightly greater than the wage base forecasted by the ssa’s office of the chief actuary back in april (see payroll update, 04 03 2023) [ssa press release, cost of living adjustment (cola) information for 2024, 10 12 2023].

Social Security Wage Base 2024 Chart Calculator Coral Lianna Only the social security tax has a wage base limit. the wage base limit is the maximum wage that's subject to the tax for that year. for earnings in 2024, this base is $168,600. refer to "what's new" in publication 15 for the current wage limit for social security wages. there's no wage base limit for medicare tax. all covered wages are subject. Base for 2024. under the above formula, the base for 2024 shall be the 1994 base of $60,600 multiplied by the ratio of the national average wage index for 2022 to that for 1992, or, if larger, the 2023 base of $160,200. if the amount so determined is not a multiple of $300, it is rounded to the nearest multiple of $300. The wage base or earnings limit for the 6.2% social security tax rises every year. the 2024 limit is $168,600, up from $160,200 in 2023. Learn how the social security taxable wage base and limit affect your payroll taxes in 2024. find out the latest rates, changes and tips for employers and employees.

Social Security Wage Base Limit 2024 Ruthi Clarisse The wage base or earnings limit for the 6.2% social security tax rises every year. the 2024 limit is $168,600, up from $160,200 in 2023. Learn how the social security taxable wage base and limit affect your payroll taxes in 2024. find out the latest rates, changes and tips for employers and employees. The social security wage base will rise from $160,200 to $168,600 in 2024, according to the social security administration. the maximum employee share of the social security tax will also increase from $9,932.40 to $10,453.20 in 2024. It is also the maximum amount of covered wages that are taken into account when average earnings are calculated in order to determine a worker's social security benefit. in 2020, the social security wage base was $137,700 and in 2021 was $142,800; the social security tax rate was 6.20% paid by the employee and 6.20% paid by the employer. [1][2.

The Social Security Wage Base Is Increasing In 2024 Sva The social security wage base will rise from $160,200 to $168,600 in 2024, according to the social security administration. the maximum employee share of the social security tax will also increase from $9,932.40 to $10,453.20 in 2024. It is also the maximum amount of covered wages that are taken into account when average earnings are calculated in order to determine a worker's social security benefit. in 2020, the social security wage base was $137,700 and in 2021 was $142,800; the social security tax rate was 6.20% paid by the employee and 6.20% paid by the employer. [1][2.

Comments are closed.