South Africa Inflation Expectations 2022 Data 2023 Forecast 2000

South Africa Inflation Expectations 2022 Data 2023 Forecast 2000 South africa's one year ahead inflation expectations for households continued to trend downward in the second quarter of 2024, reaching 5%. it was the lowest reading since q1 2022. inflation expectations in south africa averaged 5.87 percent from 2000 until 2024, reaching an all time high of 8.72 percent in the third quarter of 2008 and a. Inflation rate in south africa 2029. south africa’s inflation has been quite stable for the past years, levelling off between 3.2 and 6.9 percent, and is in fact expected to stabilize at around.

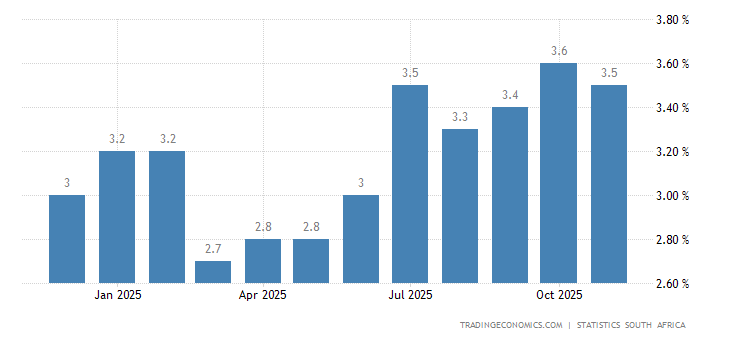

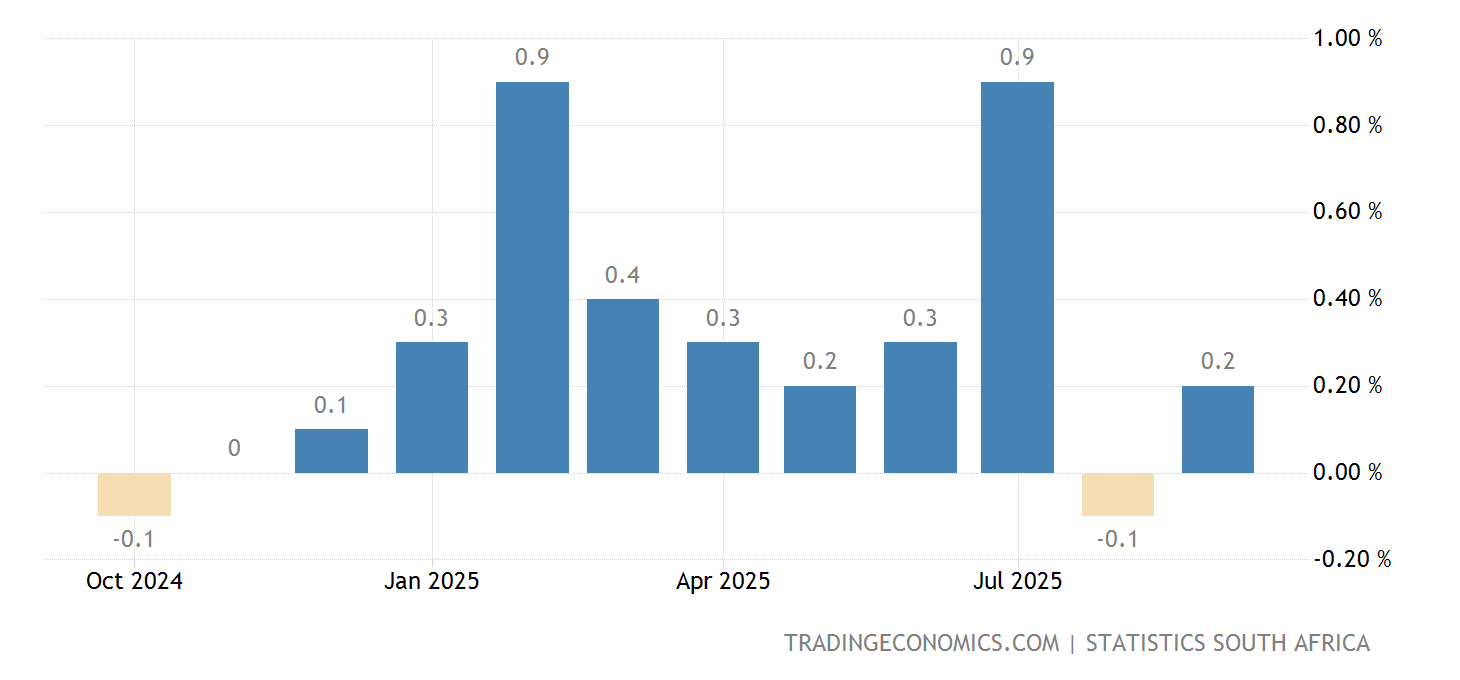

South Africa Inflation Rate 1968 2021 Data 2022 2023 Forecast South africa inflation rate eases to 6 month low. south africa’s annual inflation rate eased to 5.1% in june 2024, edging lower from 5.2% in the previous two months, but remained above the central bank's target of 4.5%. still, it was the lowest reading since december 2023, as prices softened across several cpi categories, including food and. The decade was marked by economic challenges, including currency volatility, wage pressures and energy shortages, which contributed to the inflationary pressures. consumer price inflation in south africa averaged 5.2% in the ten years to 2022, below the sub saharan africa regional average of 9.4%. the 2022 average figure was 6.9%. Consumer inflation cooled in march. following a two month upswing, headline inflation softened to 5,3% in march from 5,6% in february. the rate has held its ground between 5% and 6% since september 2023. the monthly change in the consumer price index (cpi) was 0,8% in march. this is lower than the 1,0% increase in february. All countries and economies. country. most recent year. most recent value. inflation, consumer prices (annual %) south africa from the world bank: data.

South Africa Inflation Rate Mom 1960 2021 Data 2022 2023 Fore Consumer inflation cooled in march. following a two month upswing, headline inflation softened to 5,3% in march from 5,6% in february. the rate has held its ground between 5% and 6% since september 2023. the monthly change in the consumer price index (cpi) was 0,8% in march. this is lower than the 1,0% increase in february. All countries and economies. country. most recent year. most recent value. inflation, consumer prices (annual %) south africa from the world bank: data. However, for countries like south africa, the real exchange rate gap is driven mostly by domestic idiosyncrasies; hence, the influence of fed rate hikes on domestic policy is difficult to quantify, but likely to be small. 4 2 0 2 4 6 8 percentage change global growth* 2017 2019 2021 2023 2025 source: sarb sep 2022 mar 2023 forecast. Copy the linklink copied! south africa. gdp is projected to grow by 1.7% in 2022, 1.1% in 2023, and 1.6% in 2024. private consumption and investment will remain the main drivers of growth. household spending remains supported by social transfers and an improving labour market. private investment will rise as companies replace an increasingly.

South Africa Economic Outlook Deloitte Insights However, for countries like south africa, the real exchange rate gap is driven mostly by domestic idiosyncrasies; hence, the influence of fed rate hikes on domestic policy is difficult to quantify, but likely to be small. 4 2 0 2 4 6 8 percentage change global growth* 2017 2019 2021 2023 2025 source: sarb sep 2022 mar 2023 forecast. Copy the linklink copied! south africa. gdp is projected to grow by 1.7% in 2022, 1.1% in 2023, and 1.6% in 2024. private consumption and investment will remain the main drivers of growth. household spending remains supported by social transfers and an improving labour market. private investment will rise as companies replace an increasingly.

Comments are closed.