Statement Cfpb 1071 Data Collection Proposal

Cfpb Final Section 1071 Rule On Small Business Data Collection Includes Cfpb released a voluntary survey to measure the one time costs of compliance with an eventual small business lending data collection rule. sept. 15, 2020. cfpb released an outline of proposals under consideration and alternatives considered for the small business lending data collection rulemaking, along with a high level summary of outline of. Main small business lending rule provisions and official interpretations can be found in: § 1002.102, definitions. § 1002.103 .106, coverage. § 1002.107, data points collected. § 1002.108, firewall. § 1002.109, reporting requirements. supplement i to part 1002 (including official interpretations for the above provisions).

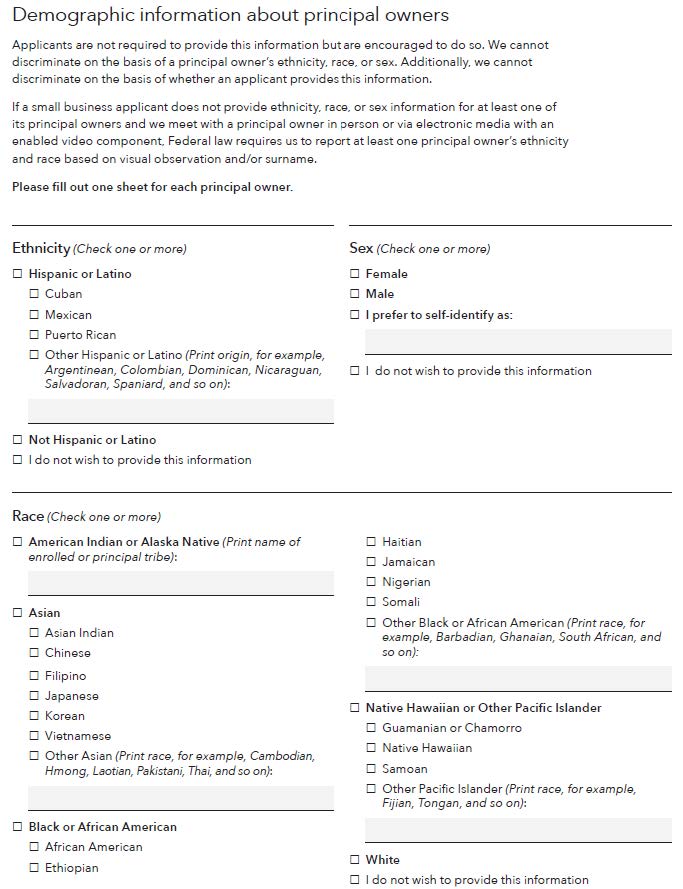

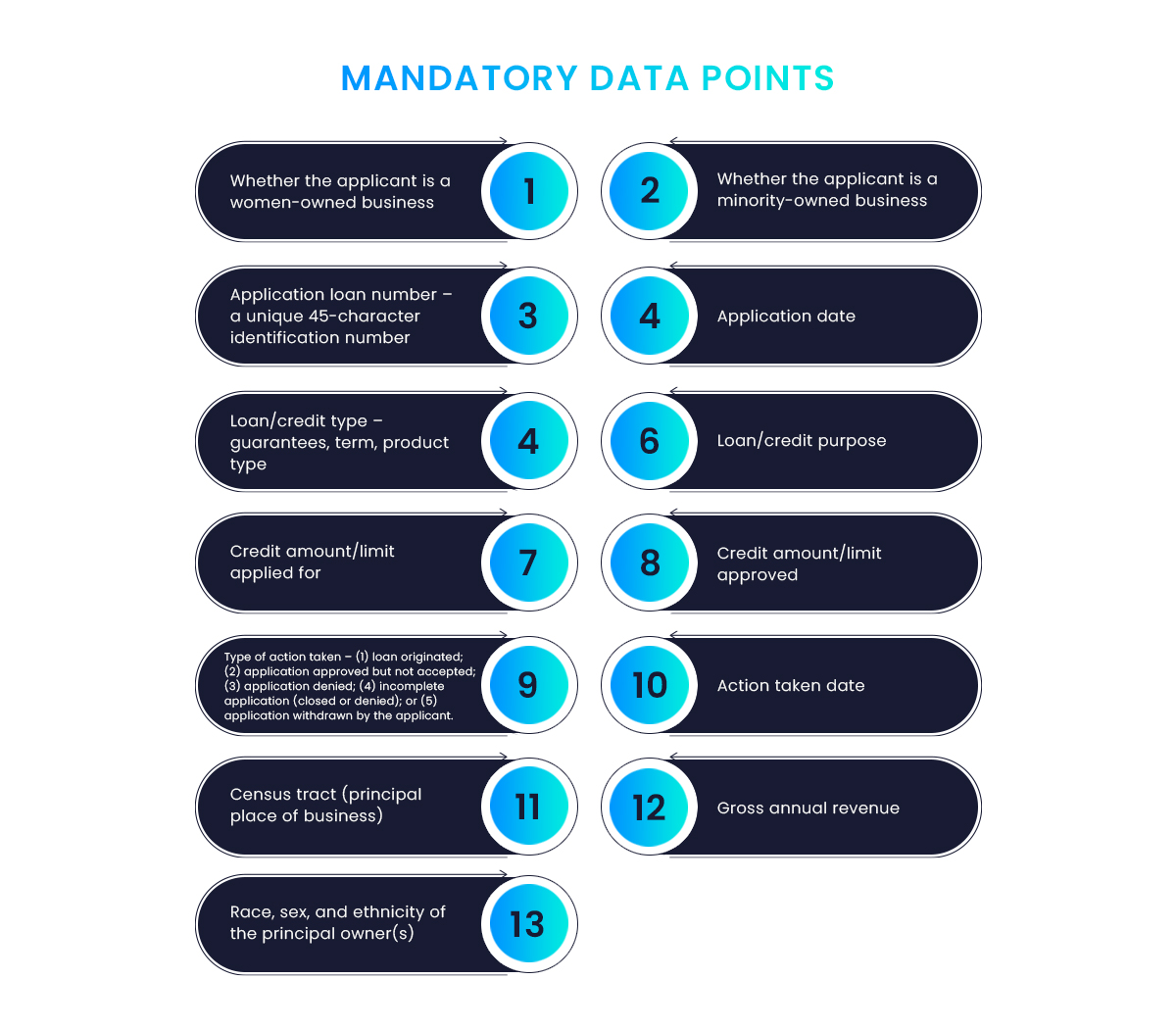

Cfpb Proposes Rule For Small Business Data Collection Nafcu Small business lending data collection requirements set forth in section 1071 of the dodd frank act (section 1071 ). the bureau is proposing to add a new subpart b to regulation b to implement section 1071’s requirements. some background information and a summary of k ey aspects of the bureau’s nprm are provided below. Section 1071 of the dodd frank act requires the cfpb to collect data about small business lending to facilitate enforcement of fair lending laws and to help identify business and community development needs and opportunities. today’s proposal is the result of years of research, engagement, supervisory work, and policy development. Sept. 1, 2021. consumer financial protection bureau | september 2021. table of contents for proposal regarding small business lending data collection proposal to implement the small business. lending data collection requirements set forth in section 1071 of the dodd frank act. (docket no. cfpb 2021 0015, rin 3170 aa 09). On september 1, 2021, the consumer financial protection bureau (bureau) issued a notice of proposed rulemaking (nprm) to implement the small business lending data collection requirements set forth in section 1071 of the dodd frank act. this chart summarizes the data points that covered financial institutions (fis) would be required to collect.

Cfpb 1071 Purpose Implications Credacc Sept. 1, 2021. consumer financial protection bureau | september 2021. table of contents for proposal regarding small business lending data collection proposal to implement the small business. lending data collection requirements set forth in section 1071 of the dodd frank act. (docket no. cfpb 2021 0015, rin 3170 aa 09). On september 1, 2021, the consumer financial protection bureau (bureau) issued a notice of proposed rulemaking (nprm) to implement the small business lending data collection requirements set forth in section 1071 of the dodd frank act. this chart summarizes the data points that covered financial institutions (fis) would be required to collect. The consumer financial protection bureau (cfpb) has issued its final small business lending rule, which amends regulation b to implement changes to the equal credit opportunity act (ecoa) made by section 1071 of the dodd frank act. consistent with section 1071, the rule requires covered financial institutions to collect and report to cfpb data. San jose, calif., jan 5, 2022 — i am encouraged by the guidelines the consumer financial protection bureau (cfpb) has issued to fulfill its congressional mandate (section 1071 of the dodd frank act) to collect small business lending data on how much is being lent to small businesses and who is receiving the funding. this action is long overdue.

Understanding The Cfpb Section 1071 Final Rule Implications For The consumer financial protection bureau (cfpb) has issued its final small business lending rule, which amends regulation b to implement changes to the equal credit opportunity act (ecoa) made by section 1071 of the dodd frank act. consistent with section 1071, the rule requires covered financial institutions to collect and report to cfpb data. San jose, calif., jan 5, 2022 — i am encouraged by the guidelines the consumer financial protection bureau (cfpb) has issued to fulfill its congressional mandate (section 1071 of the dodd frank act) to collect small business lending data on how much is being lent to small businesses and who is receiving the funding. this action is long overdue.

Cfpb 1071 Purpose Implications Credacc

Comments are closed.