T4 C Overview David

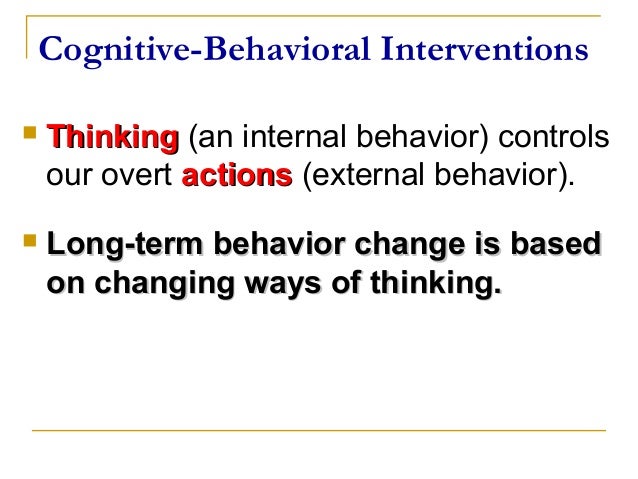

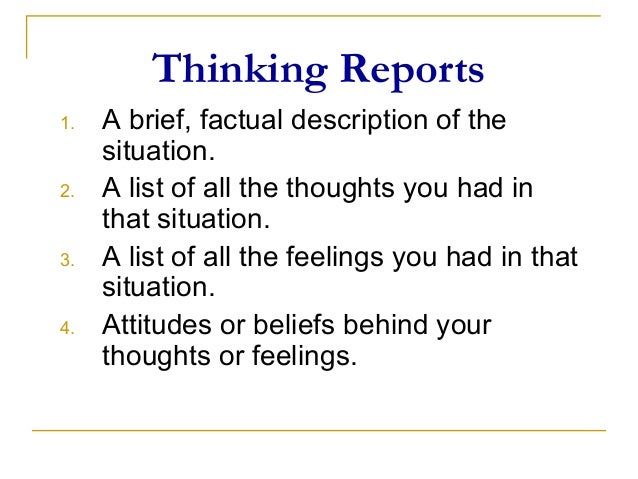

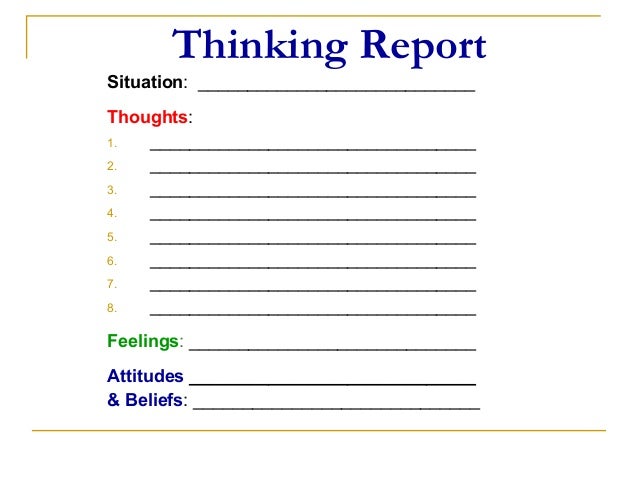

T4 C Overview David T4 c overview david. jul 2, 2013 • download as ppt, pdf •. 1 like • 1,220 views. ai enhanced description. this document provides an overview of the thinking for a change cognitive behavioral program. it discusses cognitive behavioral interventions and their focus on changing thinking to alter behavior. the program teaches cognitive self. Ontario t4 slip – box 14 = $35,000 and box 26 = $35,000. quebec t4 slip – box 14 = $35,000 and box 26 = $31,600 (calculated as the maximum pensionable earnings for 2023 of $66,600 – $35,000 already reported on t4 slip with ontario as province of employment = $31,600) on the quebec t4 slip.

T4 C Overview David Central (secondary or tertiary) hypothyroidism is characterized by a low serum t4 concentration and a serum tsh concentration that is not appropriately elevated. this topic will review diagnosis of and screening for hypothyroidism in nonpregnant adults. the major clinical manifestations, causes, and treatment of hypothyroidism and the diagnosis. What is a t4 summary. the t4 summary (t4sum) represents the total of the information reported on all of the t4 slips you prepared for each employee for the calendar year. information reported on the t4 summary includes the totals for all employment income, cpp contributions, ei premiums, and income tax deducted, for all employees. Effortless t4 filing: a step by step guide for employers | cra t4 slip summary submission made easy!🚀 ready to streamline your t4 filing process? in this tu. Must be given to employees by the last day of february following the calendar year to which the t4 applies. ways to distribute: can be made available electronically on secure site with secure printer. can be distributed via email (with written consent) can provide 2 paper copies, in person or by mail.

T4 C Overview David Ppt Effortless t4 filing: a step by step guide for employers | cra t4 slip summary submission made easy!🚀 ready to streamline your t4 filing process? in this tu. Must be given to employees by the last day of february following the calendar year to which the t4 applies. ways to distribute: can be made available electronically on secure site with secure printer. can be distributed via email (with written consent) can provide 2 paper copies, in person or by mail. A paper copy of the slips or summary. for information about filing electronically, see “electronic filing methods,” starting on page 19, or go to cra.gc.ca iref. if you are filing on paper, use the t4 summary, summary of remuneration paid, to report the totals of the amounts reported on the related t4 slips. Box 22 shows the total income tax your employer deducted from your earnings. this amount gets reported on line 43700. so in summary, the t4 slip helps you report your income, deductions, and taxes for the year on your tax return. refer to the cra website for detailed instructions on what each box on your t4 means.

T4 C Overview David A paper copy of the slips or summary. for information about filing electronically, see “electronic filing methods,” starting on page 19, or go to cra.gc.ca iref. if you are filing on paper, use the t4 summary, summary of remuneration paid, to report the totals of the amounts reported on the related t4 slips. Box 22 shows the total income tax your employer deducted from your earnings. this amount gets reported on line 43700. so in summary, the t4 slip helps you report your income, deductions, and taxes for the year on your tax return. refer to the cra website for detailed instructions on what each box on your t4 means.

Comments are closed.