Taxable Social Security Calculator

How To Calculate Taxable Social Security Form 1040 Line 6b вђ Marotta Collecting Social Security benefits is an important component of any retirement income withdrawal strategy, but the federal program can also be complicated to understand When it comes to how the As more people age and begin to explore their retirement living options, one question keeps coming up: Can you afford to live in a continuing care retirement community (CCRC)? It'

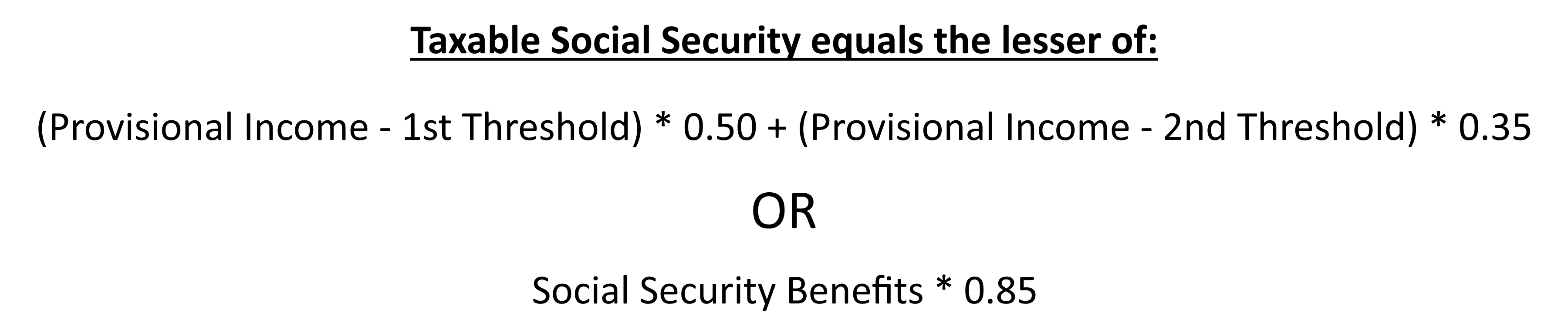

Irs Taxable Social Security Calculator Internal Revenue Code Simplified When it comes to Social Security, the age you choose to start collecting benefits can significantly affect your financial future You can begin receiving benefits as early as age 6 Social Security is an important piece of the retirement puzzle, particularly for middle-class retirees who count on the safety net to supplement their post-career income But if you see Social Reverse mortgage companies consider income and financial resources for approval Learn what income is required to get a reverse mortgage Millions of Americans rely on Social Security benefits for all, or a portion, of their retirement income Up to 85% of Social Security benefits are subject to federal income tax, depending on your

Comments are closed.