Term Life Vs Whole Life Insurance Difference And Compariso

Term Life Vs Whole Life Insurance Learn About The Differences Life insurance policy types can be put into two main buckets: term life and cash value life insurance. one of the choices for cash value life insurance is whole life insurance. knowing the main. Term life insurance has relatively low premiums for coverage that lasts a set amount of time, usually 10, 20 or 30 years. whole life insurance tends to cost more, but policies typically last your.

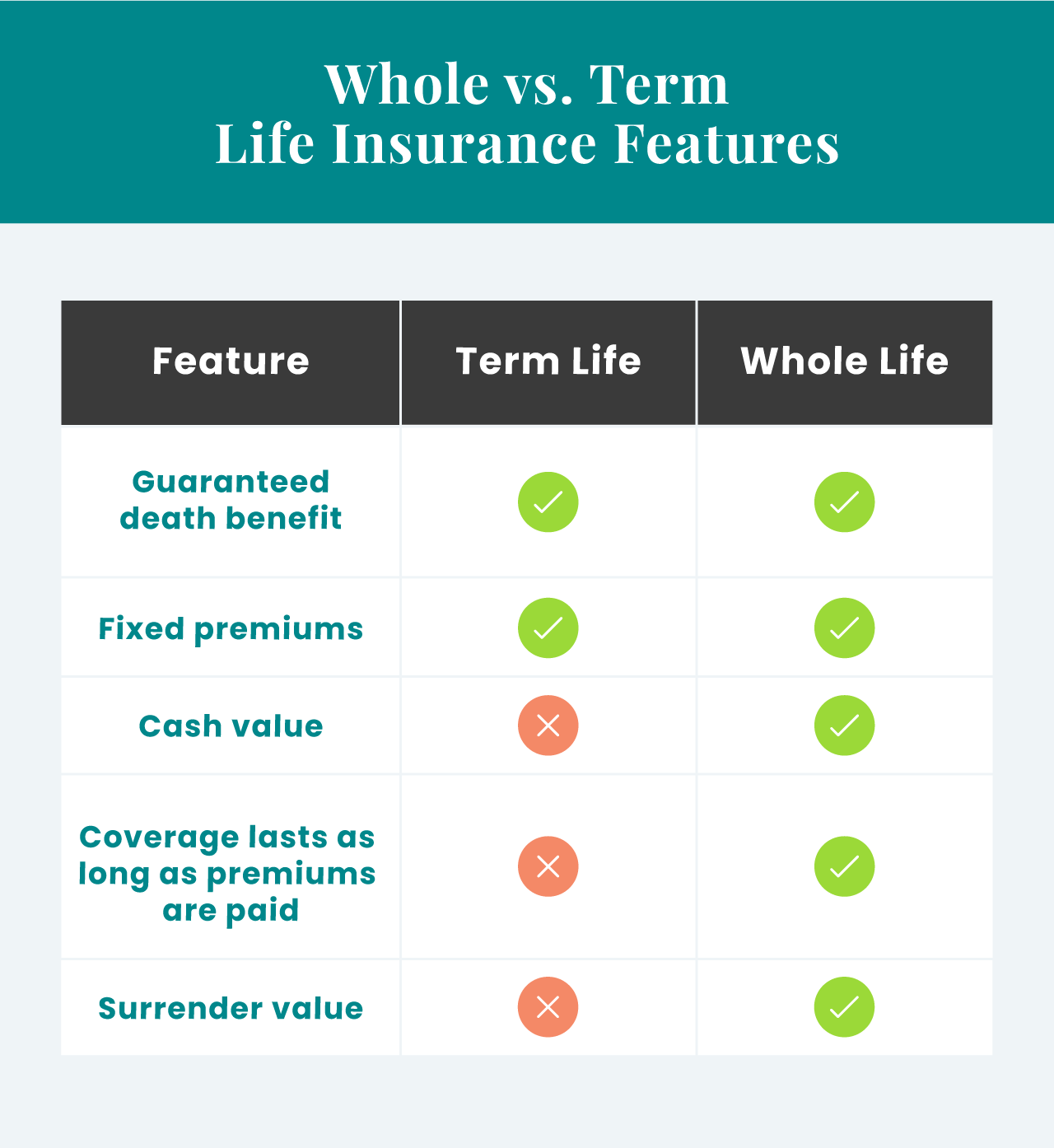

Term Vs Whole Life Insurance 2023 Guide Definition Pros Cons Key takeaways. term coverage only protects you for a limited number of years, while whole life provides lifelong protection—as long as you keep up with the premium payments. term life is just. Term life insurance. a type of life insurance that covers you for a set amount of time (e.g. 10, 15, 20, 30 years). you can choose the time length and your policy will automatically renew when the initial term length comes to an end. Cash value: it earns interest at a set rate over time, and you can access that money while you’re alive. cost: whole life insurance is significantly more expensive than term life. investment returns: whole life insurance offers lower returns than other investment options. common types of whole life insurance. Term life insurance is in force for a specific time period, usually from 10 30 years. whole life insurance lasts for as long as you pay the premium and is intended to last your entire life. term life is usually less expensive, making a large death benefit more affordable during the time that you need it most, such as when you have young children.

Comments are closed.