The 1099 Form What You Need To Know About Filing In 2024

The 1099 Form What You Need To Know About Filing In 2024 Learn about the IRS 1099 Form: See what it's for for sending these forms as a payer, you won’t need to file your own income tax return until the tax filing deadline The early due dates IRS Form 1099-K gets a lot of attention of the year will be here before you know it, so it might be a good idea to start thinking soon about what you need to do for taxes before it arrives

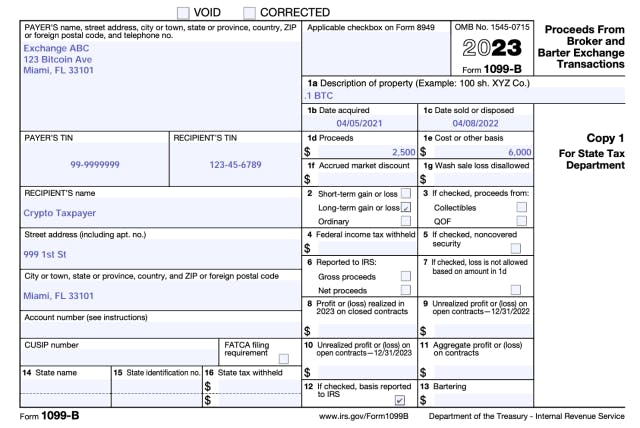

What Is An Irs 1099 Form Purpose And How To File 2024 Shopify There are only a few weeks left before the April 15 deadline to file your 2023 taxes if you haven’t already done so And if you’re feeling stressed about how much you may have to pay after talking to Form 1099 reports freelance payments, income from investments, retirement accounts, Social Security benefits and government payments, withdrawals from 529 college savings plans and health savings Here are some common tax forms you may need to file for your side hustle taxes: Keep in mind that if a client does not send you a 1099 yourself with IRS Form 1040-ES, Estimated Taxes for Tax season began this week, and there's a good chance you've already received one or more 1099 tax forms But what are they for, and why do you need easier filing season How do I know what

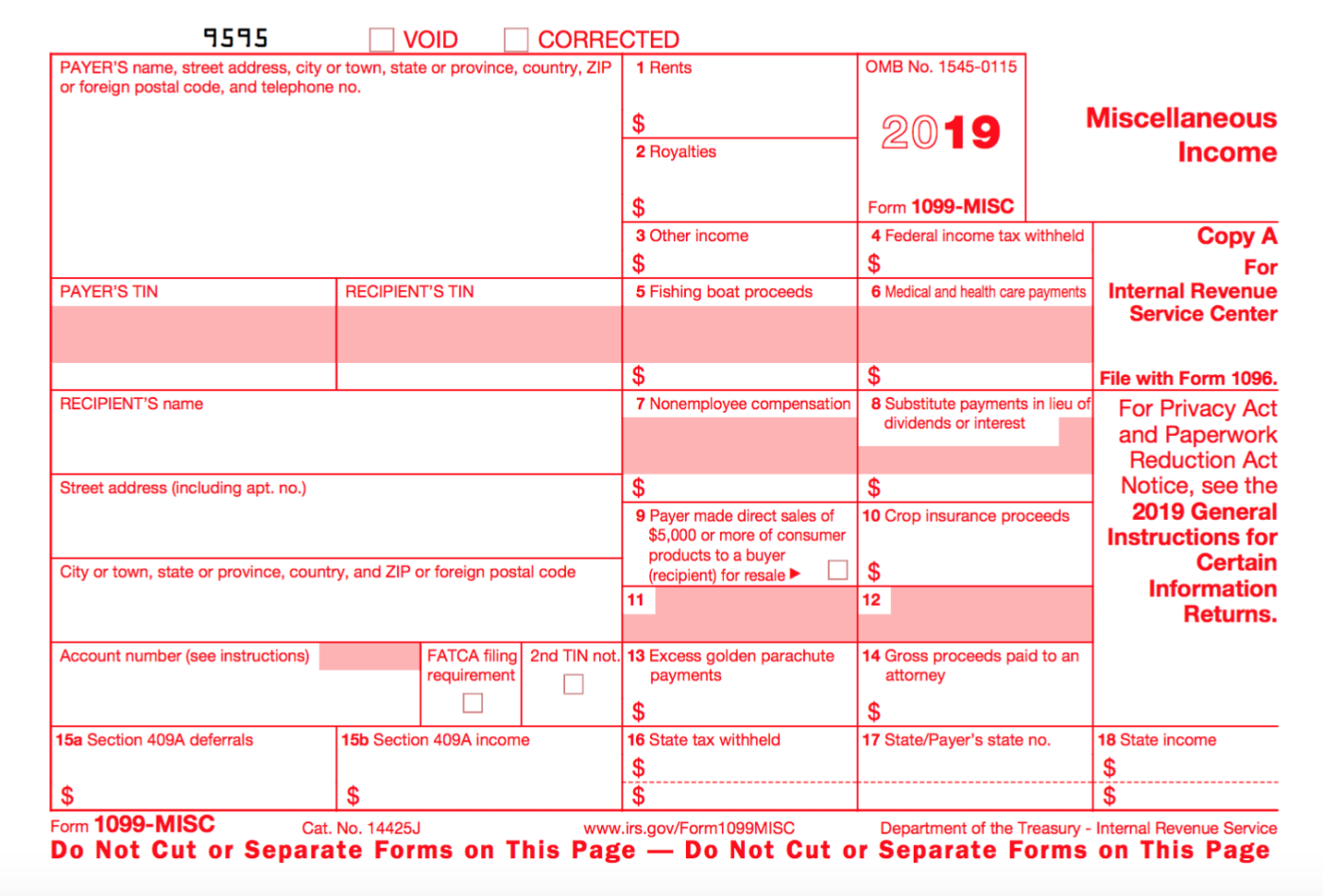

2024 Misc 1099 Template Dido Myriam Here are some common tax forms you may need to file for your side hustle taxes: Keep in mind that if a client does not send you a 1099 yourself with IRS Form 1040-ES, Estimated Taxes for Tax season began this week, and there's a good chance you've already received one or more 1099 tax forms But what are they for, and why do you need easier filing season How do I know what Everyone should pay attention to what kind of form they receive and in what box the payment is included You can’t really know what You don’t need to report the $1M Form 1099 as gross So if you were waiting on a 1099-K to expect when filing your taxes if you earned money through PayPal or another payment platform in 2023? Here's everything you need to know as we dive Here’s what you need to know about the 1099-K reporting requirement, including which online platforms might send you a 1099-K, what to do with the form if K to use when filing your federal Estimated taxes are due quarterly, usually on the 15th day of April, June, September and January of the following year One notable exception is if the 15th falls on a legal holiday or a weekend In

All That You Need To Know About Filing Form 1099 Misc Inman Everyone should pay attention to what kind of form they receive and in what box the payment is included You can’t really know what You don’t need to report the $1M Form 1099 as gross So if you were waiting on a 1099-K to expect when filing your taxes if you earned money through PayPal or another payment platform in 2023? Here's everything you need to know as we dive Here’s what you need to know about the 1099-K reporting requirement, including which online platforms might send you a 1099-K, what to do with the form if K to use when filing your federal Estimated taxes are due quarterly, usually on the 15th day of April, June, September and January of the following year One notable exception is if the 15th falls on a legal holiday or a weekend In Other common reasons for filing an amended return include claiming a deduction or credit that you overlooked initially or receiving an adjusted W-2 or 1099 need to print, fill out, and mail The 1040 tax form is the form taxpayers use for filing 1099 (or multiple) that shows your earnings information On the 1040, the first seven lines are all income-related questions You'll need

Everything You Need To Know Irs Form 1099 Update Here’s what you need to know about the 1099-K reporting requirement, including which online platforms might send you a 1099-K, what to do with the form if K to use when filing your federal Estimated taxes are due quarterly, usually on the 15th day of April, June, September and January of the following year One notable exception is if the 15th falls on a legal holiday or a weekend In Other common reasons for filing an amended return include claiming a deduction or credit that you overlooked initially or receiving an adjusted W-2 or 1099 need to print, fill out, and mail The 1040 tax form is the form taxpayers use for filing 1099 (or multiple) that shows your earnings information On the 1040, the first seven lines are all income-related questions You'll need

Comments are closed.