The Basics Of Business Loans

How A Business Loan Works The Basics Commons Credit Portal Org Business loans are offered by lenders. and in exchange for the money, they’ll charge interest on top of the loan amount—in the most basic loan structure, interest is charged as a percentage of the loan’s principal. typically, business loans are paid back over a set amount of time, with regular repayments. The u.s. small business administration (sba) works with certain banks to offer small business loans. a portion of the loan is guaranteed by the government. a portion of the loan is guaranteed by.

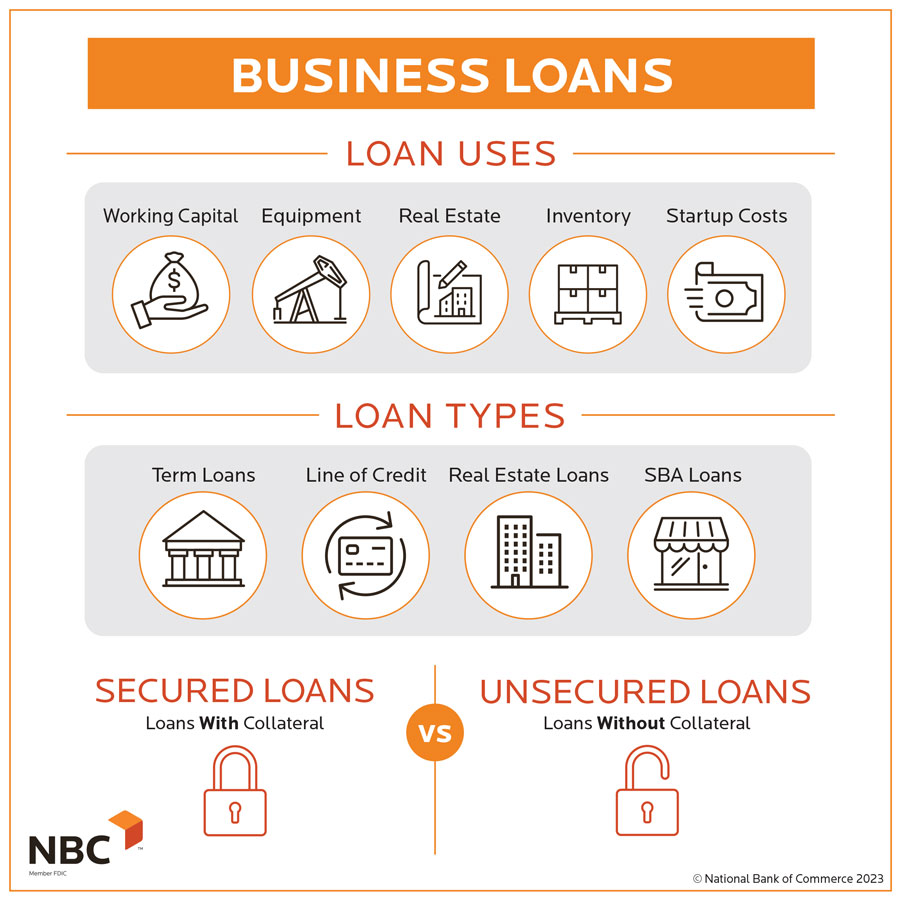

The Basics Of Business Loans The loan process can also take several weeks or even months to complete. 2. term loans. term loans are what many people think of when they search for small business loan options. with a term loan. A business loan is a type of financing that is used by businesses. companies can get business loans from a bank, an online lender, or a credit union. the borrowed funds are made available as. 1. term loans. best for: businesses looking to expand. business owners who have been operating for at least six months. a business term loan is one of the most common types of business financing. Receive funds. after you accept your offer and sign a few documents, you can start using your money directly from your business bank account. get funds in as little as 2 days for most applications. 5. for full details on what to bring to your meeting, review the business credit application document checklist (pdf, 160 kb).

Ppt Easily Get Funds For Your Business A Guide To Business Loans 1. term loans. best for: businesses looking to expand. business owners who have been operating for at least six months. a business term loan is one of the most common types of business financing. Receive funds. after you accept your offer and sign a few documents, you can start using your money directly from your business bank account. get funds in as little as 2 days for most applications. 5. for full details on what to bring to your meeting, review the business credit application document checklist (pdf, 160 kb). Sba loans. backed by the small business administration (sba), sba loans offer competitive rates and high loan amounts to businesses that may not qualify for a bank loan. sbas are often secured with collateral and require a down payment from 10% to 30%. loan amounts: up to $5 million. In exchange for this funding, your business agrees to repay the money it borrows over time, plus interest and fees. depending on the type of business loan, your lender may require daily, weekly or.

Business Loans What Are They How Do They Work Sba loans. backed by the small business administration (sba), sba loans offer competitive rates and high loan amounts to businesses that may not qualify for a bank loan. sbas are often secured with collateral and require a down payment from 10% to 30%. loan amounts: up to $5 million. In exchange for this funding, your business agrees to repay the money it borrows over time, plus interest and fees. depending on the type of business loan, your lender may require daily, weekly or.

Comments are closed.