The Best Order To Save For Retirement Infographic The Retirement

The Best Order To Save For Retirement Infographic The Retirement National benefit services, inc. is a chicago based retirement plan consulting, actuarial, and administration firm that helps employers get their retirement plans from where they are now to where they need to be. the firm's clients include u.s. employers and multi national employers with u.s. operations. learn more. Let's examine the proportions: about 27% of your savings is in a taxable investment account, 53% in a tax deferred retirement account and 20% in a a roth account. if you need $30,000 for living.

Pin By Senioradvisor On Infographics Retirement Planning A prudent retirement income and tax strategy maximizes tax advantaged growth while maintaining the flexibility of funding some portion of your retirement expenses with non taxable income. it’s. This is evidenced by the fact that only 54% of baby boomers have a retirement strategy in place. for younger generations such as millennials, this falls to as low as 31%. thankfully, it’s never too late to start thinking about retirement. in this infographic from new york life investments, we’ve put together a straightforward overview that. Downsize today and you can invest your gain from the sale into retirement accounts. • avoid touching social security until you’re 70. as i explain in "70 is the new 65," if you’re in good health, the best financial move you can make is to delay taking your retirement benefit until age 70. if you were born in 1960 or later, your monthly. The order of operations for saving. step 1 save in your 401k (up to the match) step 2 save the max in your ira. step 3 continue to max your 401k contributions. step 4 max your hsa. step 5 side hustle and do a sep ira. step 6 save in a standard brokerage account. step 7 be smart about social security.

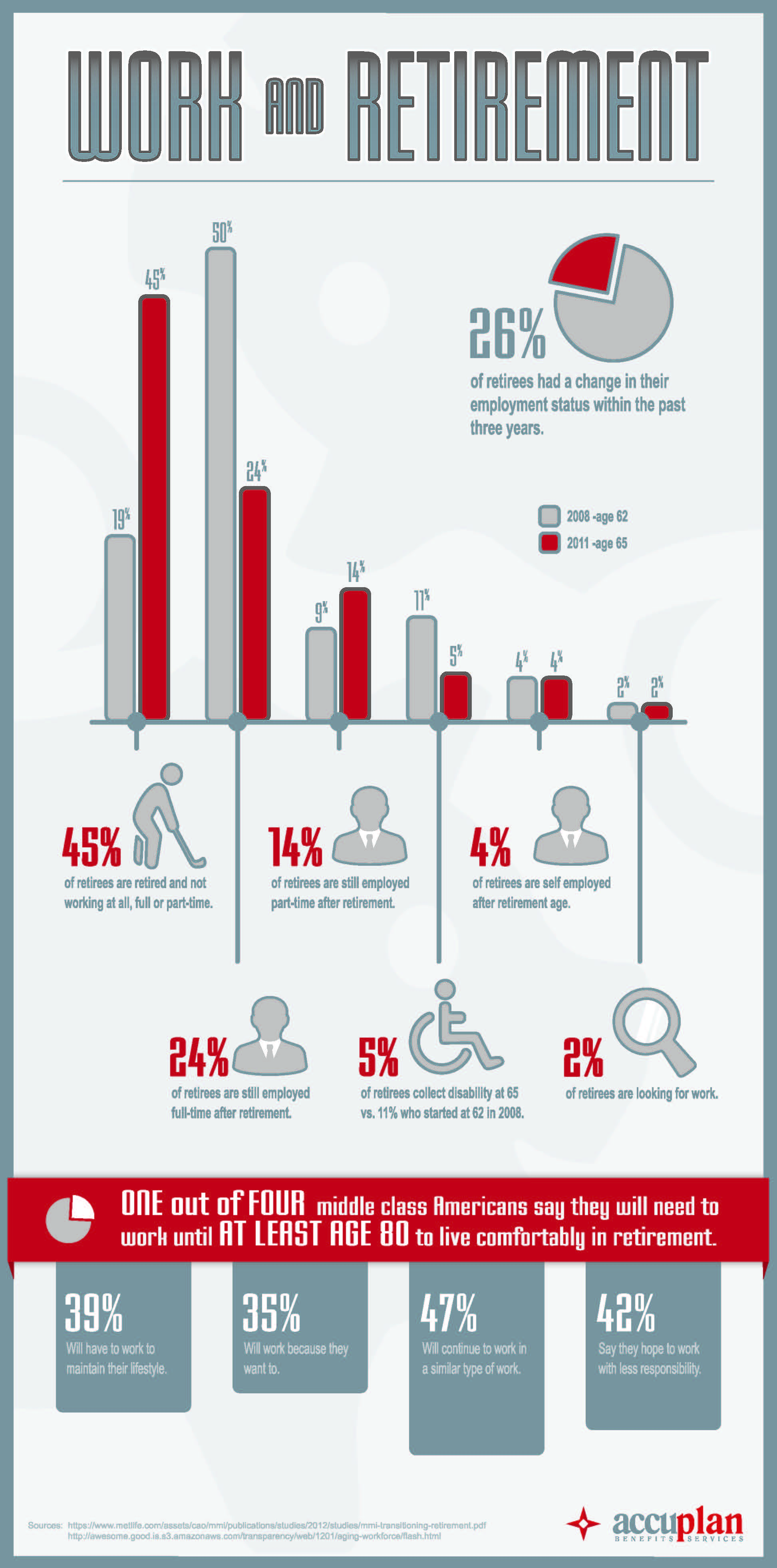

Retirement Infographic Downsize today and you can invest your gain from the sale into retirement accounts. • avoid touching social security until you’re 70. as i explain in "70 is the new 65," if you’re in good health, the best financial move you can make is to delay taking your retirement benefit until age 70. if you were born in 1960 or later, your monthly. The order of operations for saving. step 1 save in your 401k (up to the match) step 2 save the max in your ira. step 3 continue to max your 401k contributions. step 4 max your hsa. step 5 side hustle and do a sep ira. step 6 save in a standard brokerage account. step 7 be smart about social security. Retirement accounts ranked by order of contribution priority. step 1: contribute to the 401k up to the employer match. step 2: contribute to the hsa up to the employer match. step 3: max out your hsa. step 4: make maximum contributions to your traditional ira or roth ira. step 5: finish maxing out your 401k. Are you currently on track with your retirement planning? here are some statistics that may surprise you: 39% of households nearing retirement do not have a formal retirement plan. only 35% of americans are confident they can rely on social security. for a couple both 62 years old, there is a 47% chance that one of them will live to be 90.

Comments are closed.