The Complete Guide To Risk Reward Ratio Pro Trading School

The Complete Guide To Risk Reward Ratio Pro Trading School From this, your percentage win ratio is 6 10 or 60%. if from the 6 winners you made $3600, then your average win is $3600 6 = $600. if your 4 losers were $1600, it means your average loss is $1600 4 = $400. we can then apply the above figures to the expectancy formula…. e= [1 (600 400)] x 0.6 – 1 = 0.5 or 50%. The rr ratio is the difference between the potential loss and the potential profit of your trade, according to your trade setup. you never want to take a trade if your risk reward ratio is below 1. a rr of 2 and more is one of the key factors in order to become successful in trading.

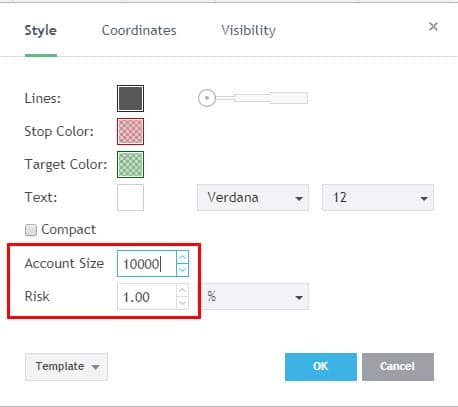

The Complete Guide To Risk Reward Ratio Pro Trading School If you have a risk reward ratio of 1:3, it means you’re risking $1 to potentially make $3. if you have a risk reward ratio of 1:5, it means you’re risking $1 to potentially make $5. you get my point. now, here’s the biggest lie you’ve been told about the risk reward ratio. “you need a minimum of 1:2 risk reward ratio.”. The reward is the distance between the entry price and the take profit: reward: entry price – take profit = 15387.8 – 14854.6 = 533.2. to get the reward to risk ratio, you divide the reward by the risk we just calculated in the previous steps: reward to risk ratio = reward risk = 533.2 178.0 = 2.99 = 3. The risk to reward ratio formula is a mathematical way of determining the amount of risk versus reward in a given situation. to calculate it, divide the potential loss by the potential gain. the higher the risk to reward ratio, the riskier the situation. the risk to reward ratio is a way for investors to decide if a potential investment is. Case studies: risk reward ratio applications in forex, crypto, and stock trading. forex: a trader sets a risk reward ratio of 3:1, entering a trade at 1.1200, with a stop loss at 1.1150 and a take profit at 1.1350. despite forex market fluctuations, the defined ratio ensures that the potential gain outweighs the risk.

The Complete Guide To Risk Reward Ratio Pro Trading School The risk to reward ratio formula is a mathematical way of determining the amount of risk versus reward in a given situation. to calculate it, divide the potential loss by the potential gain. the higher the risk to reward ratio, the riskier the situation. the risk to reward ratio is a way for investors to decide if a potential investment is. Case studies: risk reward ratio applications in forex, crypto, and stock trading. forex: a trader sets a risk reward ratio of 3:1, entering a trade at 1.1200, with a stop loss at 1.1150 and a take profit at 1.1350. despite forex market fluctuations, the defined ratio ensures that the potential gain outweighs the risk. If you are trading, understanding the risk reward ratio is important. it quantifies the potential profit against possible losses, improving rational decision making. a figure like 1:3 suggests a threefold return for every unit risked, serving as a benchmark for investment and trading suitability. If you have a risk reward ratio of 1:3, it means you’re risking $1 to potentially make $3. if you have a risk reward ratio of 1:5, it means you’re risking $1 to potentially make $5. you get my point. now, here’s the biggest lie you’ve been told about the risk reward ratio. “you need a minimum of 1:2 risk reward ratio.”.

Risk Reward In Trading The Complete Guide For Traders If you are trading, understanding the risk reward ratio is important. it quantifies the potential profit against possible losses, improving rational decision making. a figure like 1:3 suggests a threefold return for every unit risked, serving as a benchmark for investment and trading suitability. If you have a risk reward ratio of 1:3, it means you’re risking $1 to potentially make $3. if you have a risk reward ratio of 1:5, it means you’re risking $1 to potentially make $5. you get my point. now, here’s the biggest lie you’ve been told about the risk reward ratio. “you need a minimum of 1:2 risk reward ratio.”.

The Complete Guide To Risk Reward Ratio Pro Trading School Bank2home

Comments are closed.