The Data Driven Investor Msci

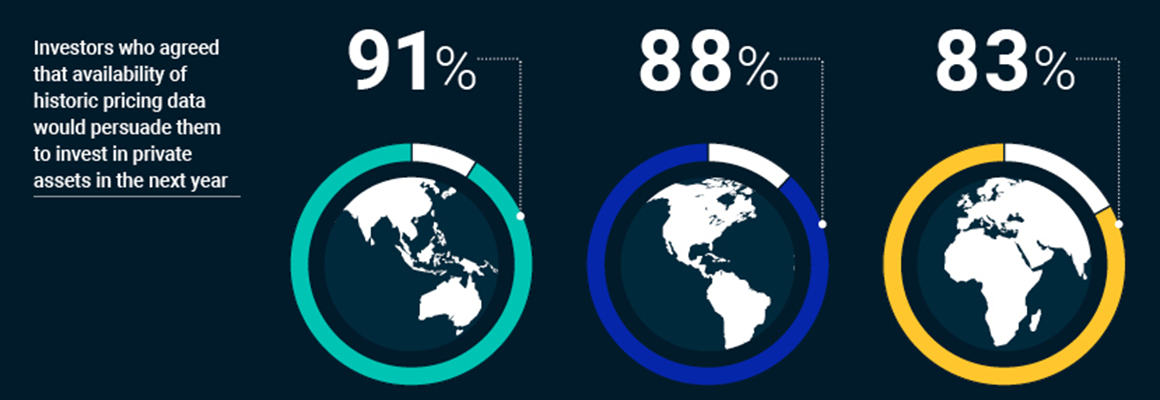

The Data Driven Investor Msci The data driven investor. published earlier this year, our global survey revealed that institutional investors recognize the increasing importance of data. this infographic shows the pressures acting on investors to improve their data quality, the firms leading the charge on data usage, and how better availability of data will affect asset. 28%. 25%. 23%. where data on climate is available, investors are using it to make crucial decisions. investors’ current use of data and indexes around climate change. 98%. of global respondents use climate data to manage risk. 94%. of global respondents use climate indexes to manage risk.

Navigating Market Uncertainty Through Data Driven Analytics Msci technology and data help investors solve some of their most important investment problems. we calculate more than 290,000 indexes daily, including over 15,000 in real time. each day investors draw on our nearly 50 years of historical data for equities, factors and fixed income, together with more than 30 years of historical esg data. 1. Mark segal july 1, 2024. global integrated risk assessment firm moody’s and investment data and research provider msci announced today the launch of a new strategic partnership, with each company gaining access to each others’ sustainability and business databases to enable the launch of new data driven esg investing and sustainable finance. Msci is a leading provider of critical decision support tools and services for the global investment community. with over 50 years of expertise in research, data and technology, we enable clients to understand and analyze key drivers of risk and return and confidently build more effective portfolios. clients use our industry leading, research enhanced solutions to gain insight into and improve. About msci. msci is a leading provider of critical decision support tools and services for the global investment community. with over 50 years of expertise in research, data, and technology, we power better investment decisions by enabling clients to understand and analyze key drivers of risk and return and confidently build more effective.

Moodyтащs And юааmsciюаб Announce A Strategic Partnership To Enhance Msci is a leading provider of critical decision support tools and services for the global investment community. with over 50 years of expertise in research, data and technology, we enable clients to understand and analyze key drivers of risk and return and confidently build more effective portfolios. clients use our industry leading, research enhanced solutions to gain insight into and improve. About msci. msci is a leading provider of critical decision support tools and services for the global investment community. with over 50 years of expertise in research, data, and technology, we power better investment decisions by enabling clients to understand and analyze key drivers of risk and return and confidently build more effective. Credit ratings4 as of 08 15 2023: msci typically seeks to maintain minimum cash balances globally of approximately $225.0 million to $275.0 million for general operating purposes reflects gross debt, net of deferred financing fees and premium. aggregate revolver commitments of $500.0 million until february 2027. A new study by investor's business daily and indexing leader msci pushes esg investing a step further. investors get the tools to find top performing socially aware companies on their own.

Quick Guide To Data Driven Investing Coresignal Credit ratings4 as of 08 15 2023: msci typically seeks to maintain minimum cash balances globally of approximately $225.0 million to $275.0 million for general operating purposes reflects gross debt, net of deferred financing fees and premium. aggregate revolver commitments of $500.0 million until february 2027. A new study by investor's business daily and indexing leader msci pushes esg investing a step further. investors get the tools to find top performing socially aware companies on their own.

Comments are closed.