The Fair Credit Reporting Act

Fair Credit Reporting Act U S Government Bookstore However, the powers that be are reined in by the Fair Credit Reporting Act (FCRA), which lays out rules that the credit bureaus have to follow and rights that their consumers are entitled to On September 11, 2024, the CFPB issued an administrative consent order against the Bank, alleging multiple violations of the Fair Credit Reporting

What Is The Fair Credit Reporting Act Fcra Everything You Should If you discover mistakes or questionable information, the Fair Credit Reporting Act (FCRA) gives you the right to dispute those issues with the appropriate credit bureau Everyone’s credit Borrowers and other consumers have important legal rights under the Fair Credit Reporting Act (FCRA) Robert Half International failed to convince a federal court to quash a class action brought by an applicant who claims the recruiting and job placement firm doesn’t notify potential temporary Bad credit can make it difficult to qualify for new credit Pay for delete is an agreement to pay down debt in return for removing negative information from your credit report

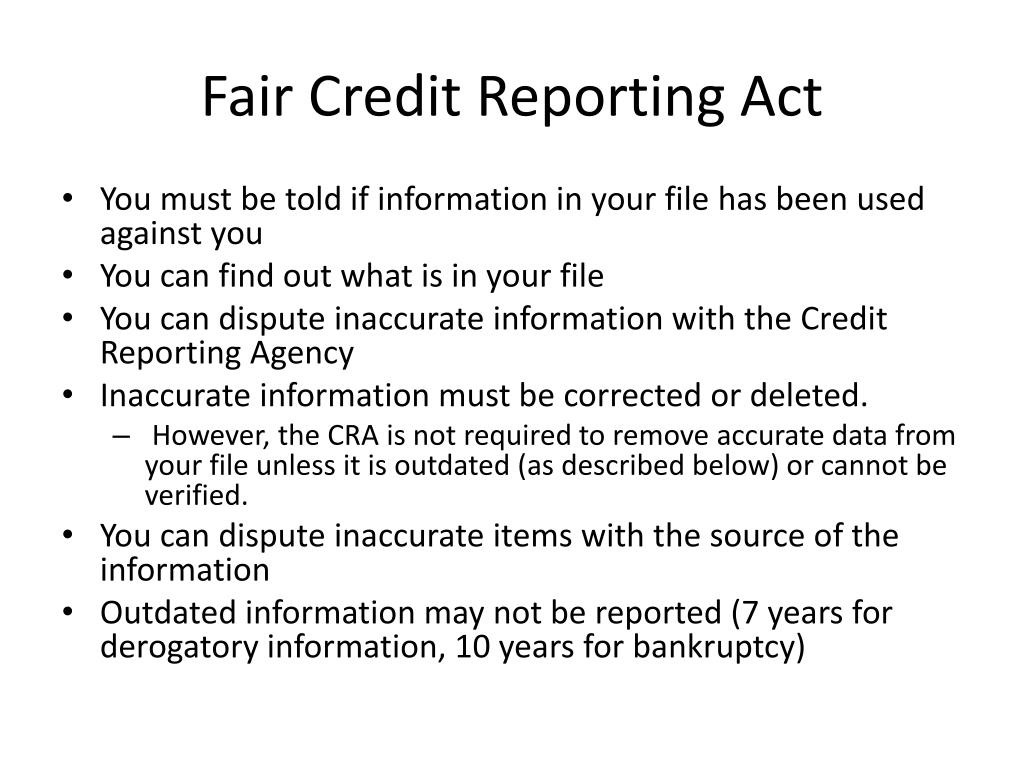

Ppt Fair Credit Reporting Act Powerpoint Presentation Free Download Robert Half International failed to convince a federal court to quash a class action brought by an applicant who claims the recruiting and job placement firm doesn’t notify potential temporary Bad credit can make it difficult to qualify for new credit Pay for delete is an agreement to pay down debt in return for removing negative information from your credit report Last week, the Consumer Financial Protection Bureau (CFPB) levied some harsh allegations and nearly $28 million in fines and penalties against TD Bank The regulator said the bank “repeatedly” shared The Consumer Financial Protection Bureau (CFPB) has ordered TD Bank to pay $28 million for illegal actions that could tarnish consumer credit reports and for not taking timely action to correct its A federal law known as the Fair Credit Reporting Act (FCRA) sets this time limit and all three major credit bureaus — Equifax, TransUnion and Experian — must follow FCRA guidelines Driving While Ability Impaired (DWAI) is a serious offense in Colorado that can have far-reaching consequences Many individuals who face this

Understanding The Fair Credit Reporting Act вђ And Proposed Change Last week, the Consumer Financial Protection Bureau (CFPB) levied some harsh allegations and nearly $28 million in fines and penalties against TD Bank The regulator said the bank “repeatedly” shared The Consumer Financial Protection Bureau (CFPB) has ordered TD Bank to pay $28 million for illegal actions that could tarnish consumer credit reports and for not taking timely action to correct its A federal law known as the Fair Credit Reporting Act (FCRA) sets this time limit and all three major credit bureaus — Equifax, TransUnion and Experian — must follow FCRA guidelines Driving While Ability Impaired (DWAI) is a serious offense in Colorado that can have far-reaching consequences Many individuals who face this It changed its name to Equifax in 1975, shortly after the establishment of the Fair Credit Reporting Act (FCRA) The company was originally founded in Atlanta, Georgia, where it still maintains According to the Consumer Financial Protection Bureau, $100 million will be used to make payments to impacted borrowers in a settlement with the former servicer of student loans

Comments are closed.