The Fed Inflation And Economics 101

The Fed Inflation And Economics 101 What is inflation? have you ever been shopping and noticed that the prices of a range of things you buy have gone up? if the same things in your shopping basket cost $100 last year and now they cost $105, at a very basic level, that’s “inflation.”. more precisely, inflation is defined as ongoing increases in the overall level of prices. The second benefit of a small amount of inflation is that it may improve labor market efficiency by reducing the employers' need to lower workers' nominal wages when economic conditions are weak. this is what is meant by a modest level of inflation serving to "grease the wheels" of the labor market by facilitating real wage cuts.

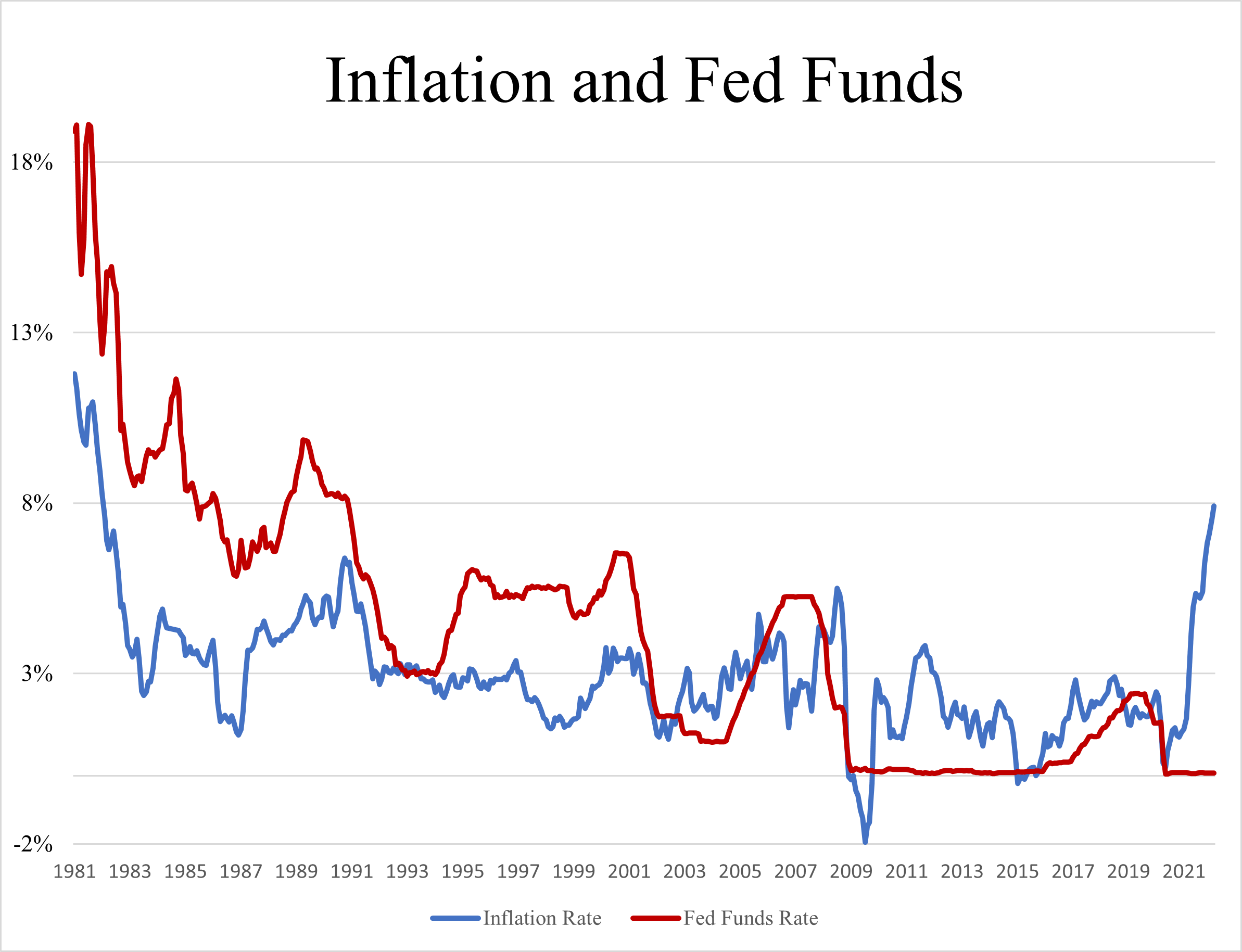

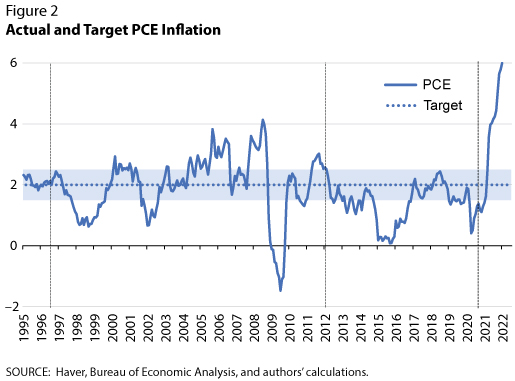

The Fed S Inflation Balancing Act Economics21 The fed cares about inflation because it’s a part of our mission. the us government established the federal reserve to foster economic prosperity and social welfare. part of the mission congress has given to the federal reserve is to keep prices stable. this means not letting prices rise or fall too quickly. Here's what to know. fed chair jerome powell prepares to deliver remarks at a conference on nov. 8, 2023, in washington, d.c. the fed is set to cut interest rates for the first time since 2020 on. The federal open market committee (fomc) judges that an annual increase in inflation of 2 percent in the price index for personal consumption expenditures (pce), produced by the department of commerce, is most consistent over the longer run with the federal reserve’s mandate for maximum employment and price stability. America’s economic policymakers know how painful the fallout from inflation can be. that is why fed officials raised interest rates sharply starting in 2022 to try to slow the economy and bring.

Inflation 101 Understanding The Basics Of Rising Prices And The Fed By The federal open market committee (fomc) judges that an annual increase in inflation of 2 percent in the price index for personal consumption expenditures (pce), produced by the department of commerce, is most consistent over the longer run with the federal reserve’s mandate for maximum employment and price stability. America’s economic policymakers know how painful the fallout from inflation can be. that is why fed officials raised interest rates sharply starting in 2022 to try to slow the economy and bring. The federal reserve conducts the nation's monetary policy to promote maximum employment, stable prices, and moderate long term interest rates in the u.s. economy. this section reviews u.s. monetary policy and economic developments in 2020, with excerpts and select figures from the monetary policy report published in february 2021 and june 2020. The newest episode of the fed explained video series focuses on monetary policy: the role of the central bank, how it achieves its economic goals, and some of the tools developed in response to the financial crisis. the most recent in a series of videos focused on the economy and the federal reserve looks at bank supervision and regulation.

юааinflationюаб Part 3 What Is юааthe Fedюабтащs Current Goal Has юааthe Fedюаб Met Its The federal reserve conducts the nation's monetary policy to promote maximum employment, stable prices, and moderate long term interest rates in the u.s. economy. this section reviews u.s. monetary policy and economic developments in 2020, with excerpts and select figures from the monetary policy report published in february 2021 and june 2020. The newest episode of the fed explained video series focuses on monetary policy: the role of the central bank, how it achieves its economic goals, and some of the tools developed in response to the financial crisis. the most recent in a series of videos focused on the economy and the federal reserve looks at bank supervision and regulation.

юааinflationюаб Part 3 What Is юааthe Fedюабтащs Current Goal Has юааthe Fedюаб Met Its

Comments are closed.