The Fed Inflation Dynamics And Monetary Policy

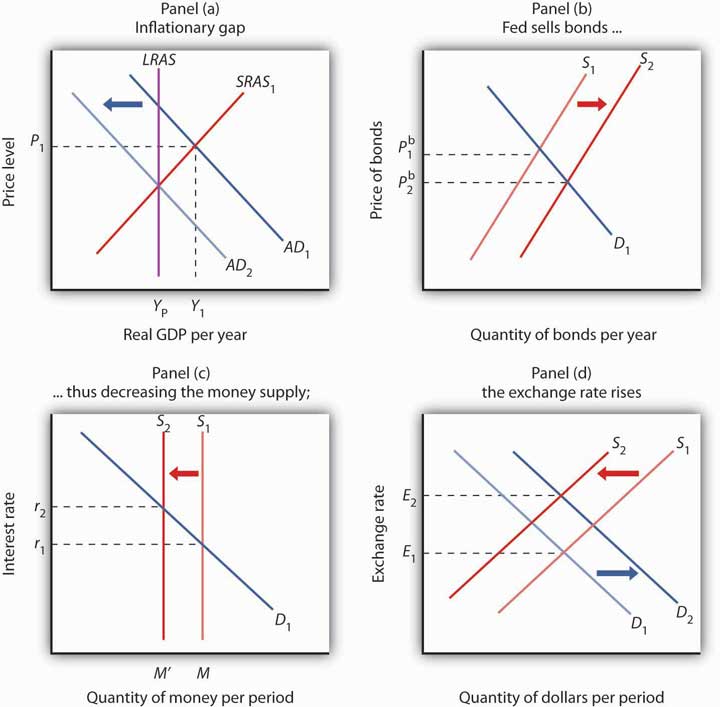

The Fed Inflation Dynamics And Monetary Policy When the economy is sluggish, or inflation is low, the Fed “Eases” Monetary Policy by reducing the Fed Funds Rate, which is often referred to as stepping on the gas, to get things moving As the central bank pivots from its tightening cycle, Fed triumphalism is in the air Inflation is said to be vanquished, the fabled soft landing has arrived, and Mr Powell and his mates are

:max_bytes(150000):strip_icc()/Monetary-Policy-ca2313abbf3646e38301b40f3a53a476.png)

Types Of Contact Forces Restrictive monetary policy of terms to explain what the Fed is trying to do and why Soft landing The Fed's ultimate goal is to slow an overheated and inflation-prone economy without causing the Fed tightens (decreases) the money supply to avoid inflation or even hyperinflation Expansionary monetary policy is a macroeconomic tool that a central bank — like the Federal Reserve in Inflation is inevitable due to exponential debt growth and monetary policy limitations, leading to the Fed potentially abandoning the 2% inflation target Interest rate changes will be The credibility of the Federal Reserve helped financial markets in the central bank's multiyear battle against inflation monetary policy rule prior to 'liftoff' and learned about it from the

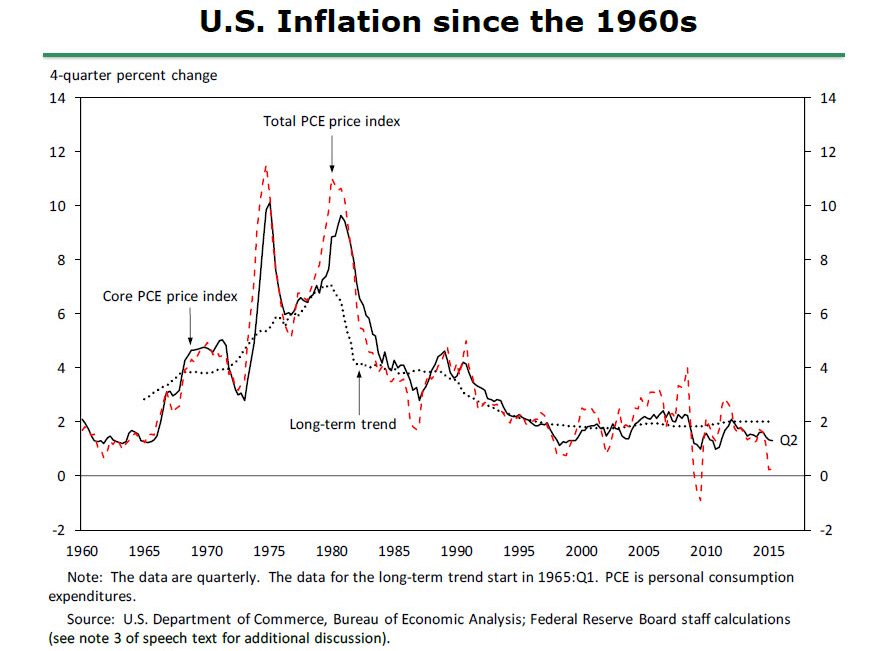

Monetary Policy And The Fed Inflation is inevitable due to exponential debt growth and monetary policy limitations, leading to the Fed potentially abandoning the 2% inflation target Interest rate changes will be The credibility of the Federal Reserve helped financial markets in the central bank's multiyear battle against inflation monetary policy rule prior to 'liftoff' and learned about it from the Monetary policy of future inflation were more important to achieving price stability than current levels For example, the systemic inflation of the late 1970s and early 80s fed on itself JACKSON HOLE, Wyoming, Aug 26 (Reuters) - In 2022, when the Federal Reserve's focus shifted to combating inflation, it had to ratchet up interest rates fast to get monetary 550% Fed policy Following the US Fed’s 50 bps rate cut, the RBI’s upcoming policy meeting is under scrutiny While a neutral stance may emerge in October, economists forecast rate cuts beginning in December, citing Federal Reserve Chair Jerome Powell said the central bank is ready to begin easing monetary policy During his much-anticipated Powell said he is confident that inflation is on course to hit the

Comments are closed.