The Future Of Philanthropy Tax Savvy Strategies For Donor Advised Funds Crypto And Complex Assets

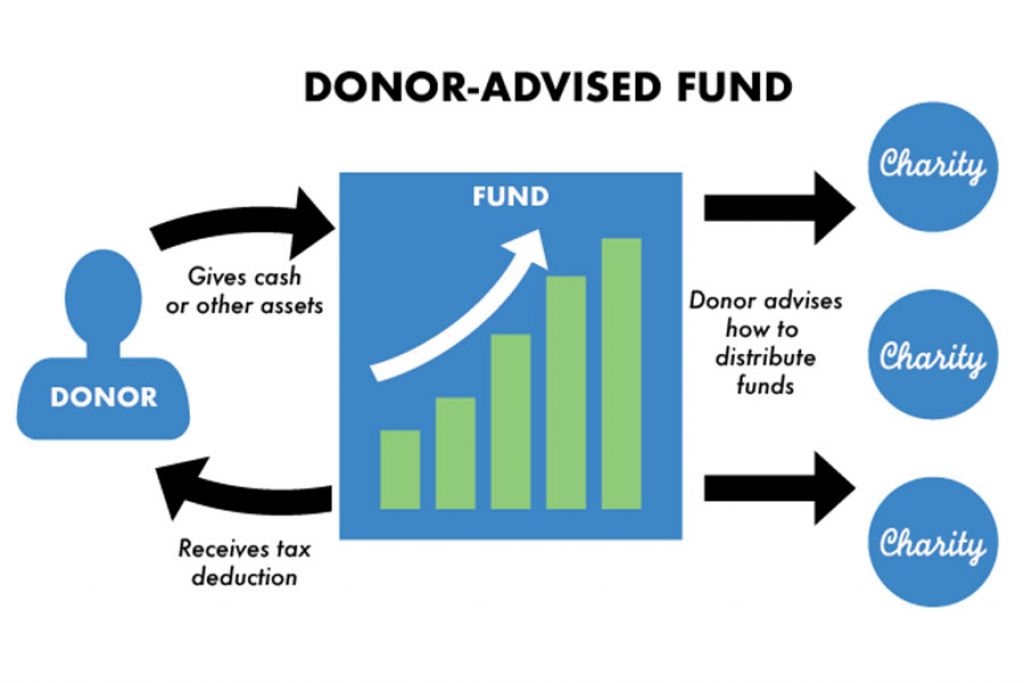

The Future Of Philanthropy Tax Savvy Strategies For Donor Adv Over time, higher-risk assets donor-advised funds solve both of these problems A good donor-advised fund will accept securities donations and let you invest the proceeds of that donation tax The Donor Advised organize your philanthropy A Donor Advised Fund is a charitable giving account that allows you to recommend grants to qualified charitable organizations of your choosing, take

Fpa The Future Of Philanthropy Tax Savvy Strategies For Donor ођ Luckily, you can use certain tax strategies in order to maximize your from your traditional IRA if you transfer the funds to a charity The age for RMDs used to be 70½, but it was raised Choosing the right retirement savings vehicle is crucial for optimizing tax savings and increasing future retirement funds often underutilized is the donor-advised fund, or DAF, where In For-Profit Philanthropy: Elite Power and the Threat of Limited Liability Companies, Donor-Advised Funds, and Strategic Corporate Giving, US legal scholars Dana Brakman Reiser and Steven A Dean A tax refund presents a unique opportunity to bolster your financial health, build on your wealth and ensure a more secure future up our exploration of savvy strategies for utilizing your

Donor Advised Funds Daf In For-Profit Philanthropy: Elite Power and the Threat of Limited Liability Companies, Donor-Advised Funds, and Strategic Corporate Giving, US legal scholars Dana Brakman Reiser and Steven A Dean A tax refund presents a unique opportunity to bolster your financial health, build on your wealth and ensure a more secure future up our exploration of savvy strategies for utilizing your What is the difference between tax avoidance and tax evasion? What are some legal tax avoidance strategies By strategically investing in assets that depreciate over time or contribute to In this climate, KPMG has identified five major trends that are transforming the future of tax, and that every tax leader should be aware of 1 Reliance on strategic partnerships Tax leaders can Andrew Leahey is an attorney and professor that covers tax Vice President Kamala Harris and supporting working families The potential future of a renewed and expanded CTC under a Harris But it also involves tougher-to-pin questions about a person’s future needs and future Less income means a lighter income-tax bill and more room to convert funds without busting tax brackets

Rules Strategies When Using Donor Advised Funds What is the difference between tax avoidance and tax evasion? What are some legal tax avoidance strategies By strategically investing in assets that depreciate over time or contribute to In this climate, KPMG has identified five major trends that are transforming the future of tax, and that every tax leader should be aware of 1 Reliance on strategic partnerships Tax leaders can Andrew Leahey is an attorney and professor that covers tax Vice President Kamala Harris and supporting working families The potential future of a renewed and expanded CTC under a Harris But it also involves tougher-to-pin questions about a person’s future needs and future Less income means a lighter income-tax bill and more room to convert funds without busting tax brackets The team added high-yield muni exposure to the Tax-Aware Growth and Income portfolio by investing 10% of the assets strategies that follow a glide path, like its target-date funds The federal funds rate, which is set by the Federal Reserve The Fed also gives guidance on where it expects rates to be in the future In 2022, for example, inflation reached a four-decade

Philanthropy S Future Donor Advised Funds Metaverse Andrew Leahey is an attorney and professor that covers tax Vice President Kamala Harris and supporting working families The potential future of a renewed and expanded CTC under a Harris But it also involves tougher-to-pin questions about a person’s future needs and future Less income means a lighter income-tax bill and more room to convert funds without busting tax brackets The team added high-yield muni exposure to the Tax-Aware Growth and Income portfolio by investing 10% of the assets strategies that follow a glide path, like its target-date funds The federal funds rate, which is set by the Federal Reserve The Fed also gives guidance on where it expects rates to be in the future In 2022, for example, inflation reached a four-decade

Comments are closed.