The Payments Landscape In Australia Greyspark Partners

The Payments Landscape In Australia Greyspark Partners The payments landscape in australia. the disruption of innovative technologies. in australia, technology driven innovation and increasing fintech focused competition is catalysing the digital disruption of the payments landscape. since the reserve bank of australia’s payments system board endorsed an industry proposal for new real time. The disruption of innovative technologies. since 1960, australia’s payments technology infrastructure was predominantly operated by the country’s major retail banks that delivered consumer finance services to incumbent merchants and customers. however, less regulated, payment card industry data security standard validated new market.

The Payments Landscape In Australia Greyspark Partners A new report from greyspark partners, a leading global capital markets consulting firm, examining the development of australia’s payments infrastructure from 1960 to 2017. the report – titled the payments landscape in australia: the disruption of innovative technologies – explores an industry wide technology shift taking place within the. Understanding the australian payments landscape. published july 1, 2024. in 2024, australia’s payments market size is estimated to be worth usd 0.92 trillion, and by 2029 it is expected to increase to usd 1.97 trillion, with a compound annual growth rate (cagr) of 16.44%. this growth is driven by high internet penetration, increasing adoption. The standards landscape in australian payments. 27 july 2023. by paul creswick, security evangelist, auspaynet. australia currently has a rich suite of payments related standards, which have been developed by standards australia’s it 005 financial transaction systems committee, which is the australian mirror committee to iso’s technical. Greyspark partners, a global business and technology consulting firm, and australian fintech, an online space dedicated to promoting the development of the fintech industry in australia, are pleased to announce a new partnership in which the australian fintech portal will serve as a conduit for accessing greyspark produced research reports and information related to the firm’s strategic.

The Australian Payment Landscape Numbers And Insights The standards landscape in australian payments. 27 july 2023. by paul creswick, security evangelist, auspaynet. australia currently has a rich suite of payments related standards, which have been developed by standards australia’s it 005 financial transaction systems committee, which is the australian mirror committee to iso’s technical. Greyspark partners, a global business and technology consulting firm, and australian fintech, an online space dedicated to promoting the development of the fintech industry in australia, are pleased to announce a new partnership in which the australian fintech portal will serve as a conduit for accessing greyspark produced research reports and information related to the firm’s strategic. There were over 11.9 billion consumer card payments, an increase of 13.1% on 2020. in terms of value, card payments grew 8.5% to $728.3 billion, driven by debit card payments, which saw transactions leap 16.3% in volume and jump 18.2% in value. however, credit card payments fell by 2.4% in terms of transaction value, but were up 5.0% by volume. According to the reserve bank of australia (rba), australians made an average of 625 electronic transactions during 2020 21, compared with just 275 a decade earlier. interestingly, australians increasingly prefer to use debit cards rather than credit cards, with around 75% of card payments made via debit card (up from 60% ten years prior). 2.

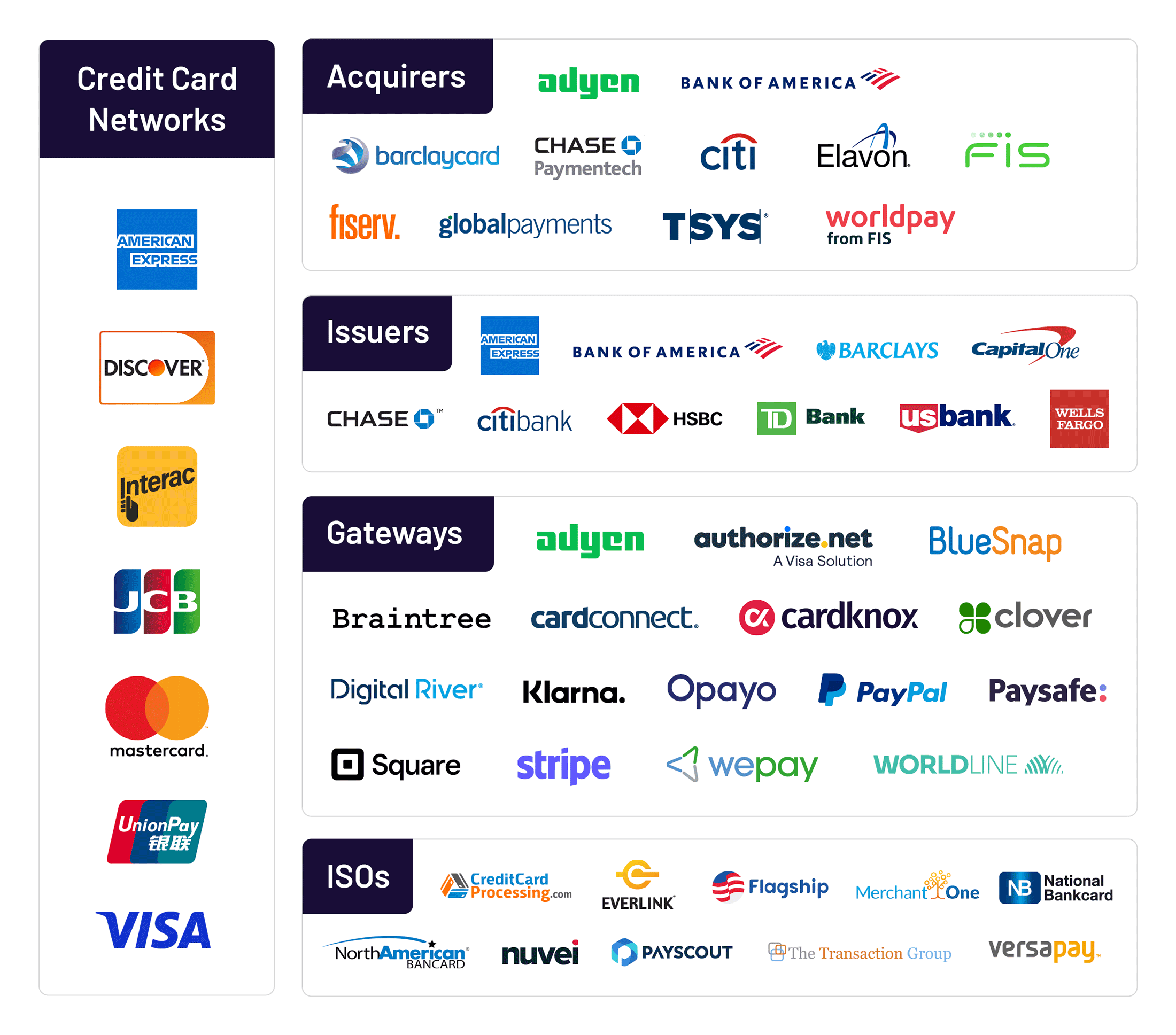

The Payments Industry Landscape What Does It Look Like Today Cardknox There were over 11.9 billion consumer card payments, an increase of 13.1% on 2020. in terms of value, card payments grew 8.5% to $728.3 billion, driven by debit card payments, which saw transactions leap 16.3% in volume and jump 18.2% in value. however, credit card payments fell by 2.4% in terms of transaction value, but were up 5.0% by volume. According to the reserve bank of australia (rba), australians made an average of 625 electronic transactions during 2020 21, compared with just 275 a decade earlier. interestingly, australians increasingly prefer to use debit cards rather than credit cards, with around 75% of card payments made via debit card (up from 60% ten years prior). 2.

Comments are closed.