The Science Of Term Structure Models

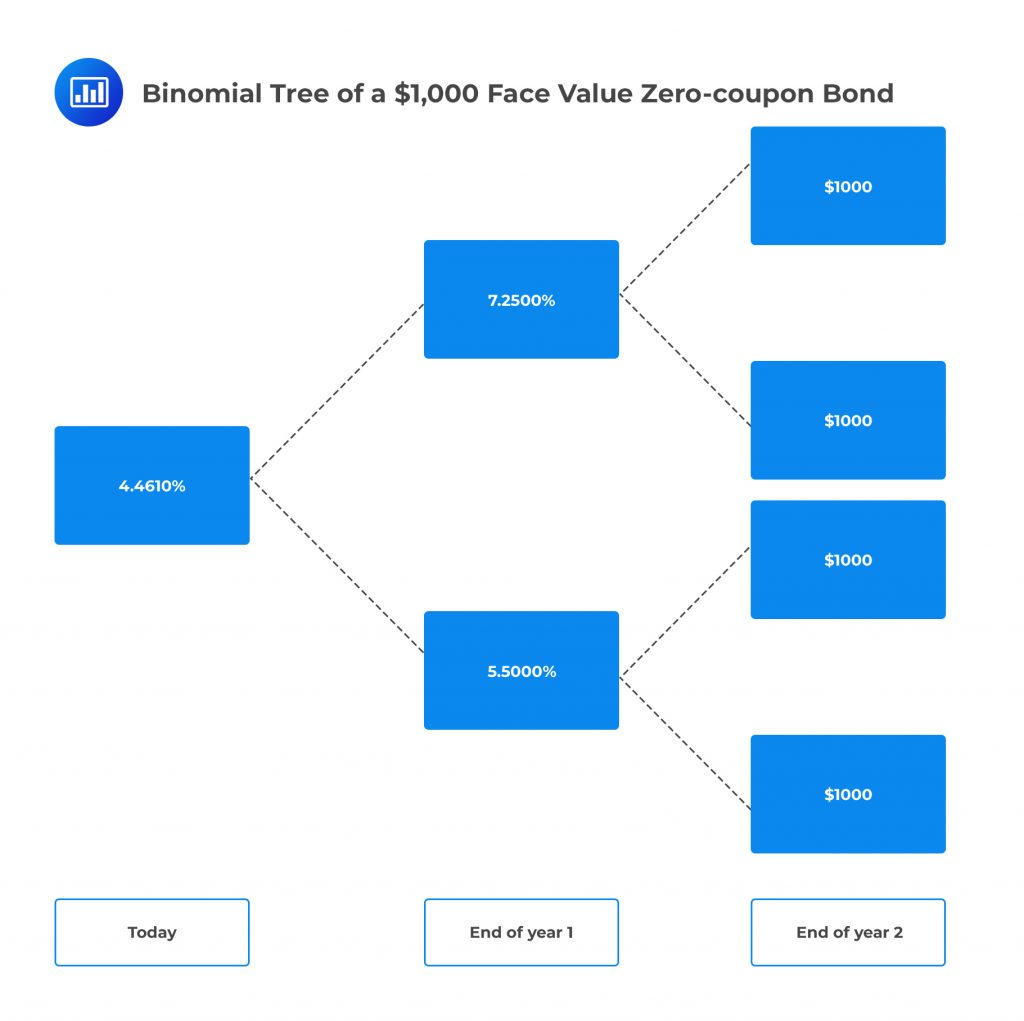

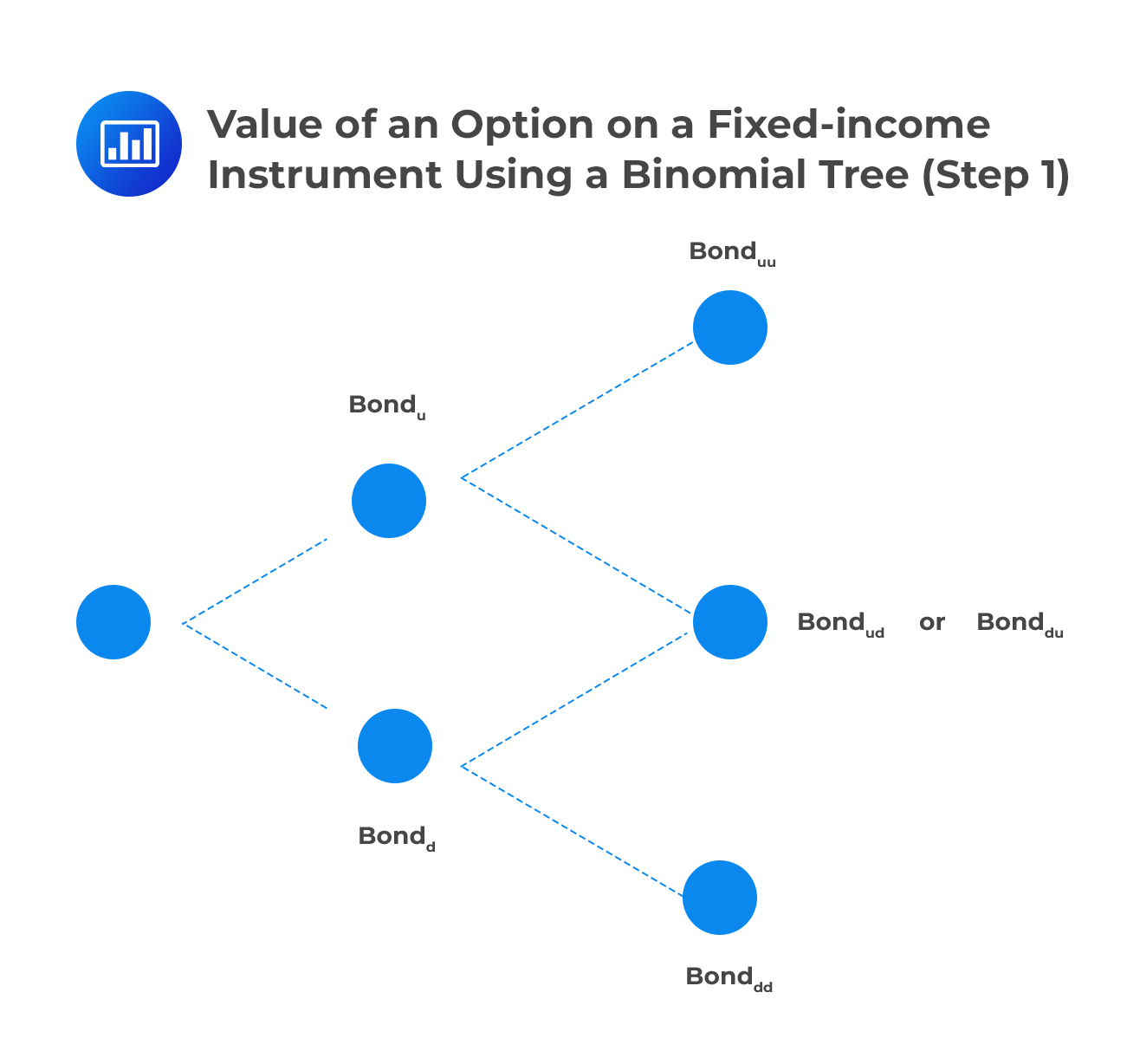

Ppt Term Structure Tests And Models Powerpoint Presentation Free Step 1:price the bond value at each node using the projected interest rates. step 2:calculate the intrinsic value of the derivative at each node at maturity. step 3:calculate the expected discounted value of the derivative at each node using the risk neutral probabilities and working backward through the tree. Short rate models. the short rate denoted by r is defined as the limit of the continuously compounded interest rate term structure (8.3). $$\begin {aligned} r (t) = \lim {t\downarrow t} \frac {\log (p (t,t))} {t t} \end {aligned}$$. (8.3) the short rate is not observable and a rather theoretic concept. however, most of the models assigning an.

The Science Of Term Structure Models Youtube Modeling the term structure movements of interest rates is a challenging task. this volume gives an introduction to the mathematics of term structure models in continuous time. it includes practical aspects for fixed income markets such as day count conventions, duration of coupon paying bonds and yield curve construction; arbitrage theory. Equilibrium term structure models estimate the stochastic process that describes the dynamics of the yield curve (term structure). the models identify mis pricing in the bond market since the estimated term structure is almost never equal to the actual market term structure. they primarily look at macroeconomic variables when estimating the. Term structure models 115 term structure models victor lapshin national research university higher school of economics, moscow, russia. email: victor.lapshin@gmail abstract the paper is an overview from scratch of the term structure modeling field. we present a brief review of the problem of modeling the term structure of interest rates. Dynamic models of the term structure are characterizations that are specifically established to consider future market scenarios where there is uncertainty. as such they are rooted in probability, stochastic process, and martingale theory. standard models include those derived from assumptions that include a short rate or a forward rate process.

The Science Of Term Structure Models Frm Part Ii Analystprep Term structure models 115 term structure models victor lapshin national research university higher school of economics, moscow, russia. email: victor.lapshin@gmail abstract the paper is an overview from scratch of the term structure modeling field. we present a brief review of the problem of modeling the term structure of interest rates. Dynamic models of the term structure are characterizations that are specifically established to consider future market scenarios where there is uncertainty. as such they are rooted in probability, stochastic process, and martingale theory. standard models include those derived from assumptions that include a short rate or a forward rate process. Term structure models: a graduate course. damir filipovic. springer science & business media, jul 28, 2009 mathematics 256 pages. changing interest rates constitute one of the major risk sources for banks, insurance companies, and other financial institutions. modeling the term structure movements of interest rates is a challenging task. The science of term structure models this chapter uses a very simple setting to show how to price interest rate contingent claims relative to a set of underlying securities by arbitrage arguments. unlike the arbitrage pricing of securities with fixed cash flows in part one, the techniques of this chapter require strong assumptions about how.

Frm Part 2 Market Risk The Science Of Term Structure Models Part 1 Term structure models: a graduate course. damir filipovic. springer science & business media, jul 28, 2009 mathematics 256 pages. changing interest rates constitute one of the major risk sources for banks, insurance companies, and other financial institutions. modeling the term structure movements of interest rates is a challenging task. The science of term structure models this chapter uses a very simple setting to show how to price interest rate contingent claims relative to a set of underlying securities by arbitrage arguments. unlike the arbitrage pricing of securities with fixed cash flows in part one, the techniques of this chapter require strong assumptions about how.

The Science Of Term Structure Models Frm Part Ii Analystprep

Comments are closed.