The Seven Steps Of Financial Planning

Financial Planning Itineris Financial Advisors Financial planning. they agree to a scope of engagement for financial planning that includes all seven steps of the financial planning process. the millers provide joe information about their personal and financial circumstances. joe tells the millers more about his practice and his firm. joe prepares and provides to the millers an engagement. The cfp® financial planning process is intended to provide a template for solo practitioners to use while working with the typical client. the seven steps include: understand the client’s personal and financial situation. the advisor should ask the client questions to gather a broad spectrum of relevant qualitative and quantitative information.

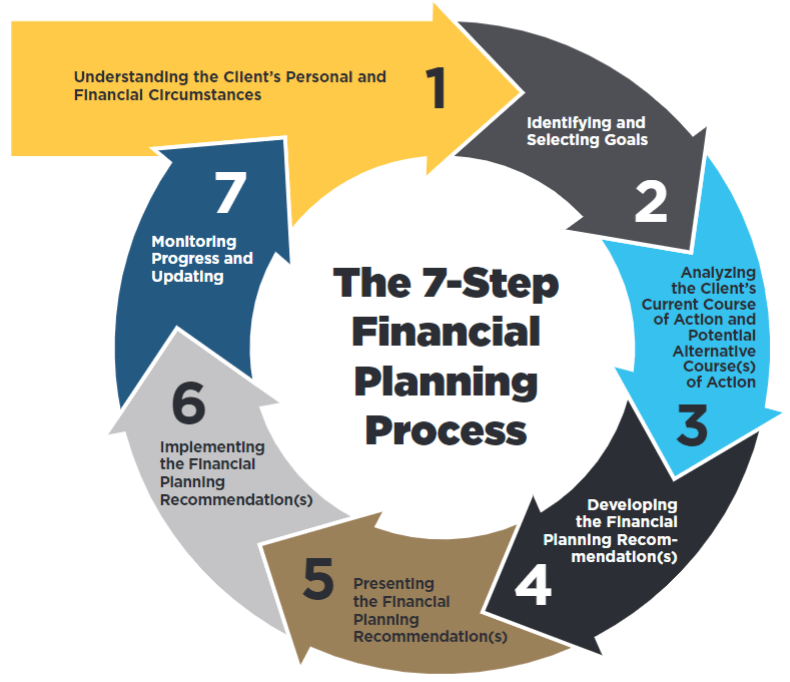

What Are The 7 Steps In The Financial Planning Process At Harriet Now that you know the seven steps of financial planning, you can apply them to any area of personal finance, including insurance planning, tax planning, cash flow , estate planning, investing, and retirement. while you can do it yourself, professionals can provide invaluable advice and a neutral perspective on your finances. About cfp board. career center. cfp board center for financial planning. letsmakeaplan.org. contact. 1425 k street nw #800. washington, dc 20005. [email protected]. 800 487 1497 (toll free). Here are seven key steps to include in your financial planning. 1. define your short and long term goals. financial planning is always based around the financial goals you want to achieve. though these goals may change over time, it’s important to establish some preliminary goals to help guide your saving strategy. What are the steps in the financial planning process? the steps in the financial planning process typically include: (1) gathering financial information, (2) setting financial goals, (3) analyzing the financial situation, (4) developing a financial plan, (5) implementing the plan, (6) monitoring the plan, and (7) making adjustments as needed.

A Modern Financial Planning Solution For A New Tomorrow вђ Progress Here are seven key steps to include in your financial planning. 1. define your short and long term goals. financial planning is always based around the financial goals you want to achieve. though these goals may change over time, it’s important to establish some preliminary goals to help guide your saving strategy. What are the steps in the financial planning process? the steps in the financial planning process typically include: (1) gathering financial information, (2) setting financial goals, (3) analyzing the financial situation, (4) developing a financial plan, (5) implementing the plan, (6) monitoring the plan, and (7) making adjustments as needed. The 7 step financial planning process. the “focus on ethics” article series takes a close look at topics important to understanding cfp board's new code of ethics and standards of conduct. november 21, 2018. cfp board’s new code of ethics and standards of conduct (“code and standards”), which takes effect on october 1, 2019. The process of working with a cfp® professional. your cfp® professional knows that the first step in a financial planning engagement is to do a thorough review to assess where you stand and then work with you to develop your goals. from there, your cfp® professional can help you make a plan designed to reach your goals, guide you through it.

The Seven Steps Of Financial Planning The 7 step financial planning process. the “focus on ethics” article series takes a close look at topics important to understanding cfp board's new code of ethics and standards of conduct. november 21, 2018. cfp board’s new code of ethics and standards of conduct (“code and standards”), which takes effect on october 1, 2019. The process of working with a cfp® professional. your cfp® professional knows that the first step in a financial planning engagement is to do a thorough review to assess where you stand and then work with you to develop your goals. from there, your cfp® professional can help you make a plan designed to reach your goals, guide you through it.

7 Steps In Financial Planning Process Everything You Need To Know

Comments are closed.