The State Of The American Debt Slaves Q2 2018 Seeking Alpha

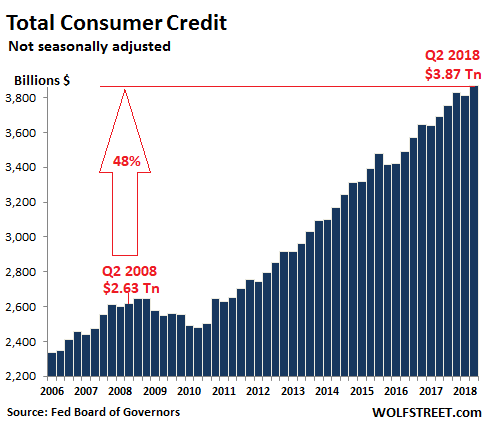

The State Of The American Debt Slaves Q2 2018 Seeking Alpha Let the good times roll total consumer credit or less soothingly, consumer debt rose 4.8% in the second quarter from a year earlier, or by $176 billion,. A special note about the records in credit card balances: the $1.03 trillion in q4 2017 had been an all time record, finally beating the records of the fourth quarters in 2007 and 2008. and q2 2018 set a record for any second quarter.

The State Of The American Debt Slaves Q2 2018 Wolf Street Credit card debt and other revolving credit in q4 rose 6% year over year to $1.027 trillion, a blistering pace, but it was down from the 9.2% surge in q3, the nearly 10% surge in q2, and the dizzying 12% surge in q1. so the growth of credit card debt in q4 was somewhat of a disappointment for those wanting to see consumers drown in expensive debt. The bifurcation among consumers. consumer credit – auto loans, student loans, and revolving credit such as credit card balances and personal loans, but not housing related debt such as mortgages and helocs – grew 5.4%, or by $208 billion, in the second quarter compared to a year ago, to a new record of $4.06 trillion (not seasonally adjusted), according to the federal reserve this afternoon. These charge offs among the largest 100 banks in q2 rose a fraction year over year to 3.6% (seasonally adjusted). the state of the american debt slaves, q2 2018. this article was written by. Wolf richter at wolf street. consumer credit – auto loans, student loans, and revolving credit such as credit card balances and personal loans, but not housing related debt such as mortgages and helocs – grew 5.4%, or by $208 billion, in the second quarter compared to a year ago, to a….

The State Of The American Debt Slaves Q2 2018 Wolf Street These charge offs among the largest 100 banks in q2 rose a fraction year over year to 3.6% (seasonally adjusted). the state of the american debt slaves, q2 2018. this article was written by. Wolf richter at wolf street. consumer credit – auto loans, student loans, and revolving credit such as credit card balances and personal loans, but not housing related debt such as mortgages and helocs – grew 5.4%, or by $208 billion, in the second quarter compared to a year ago, to a…. The chart below shows the progression of consumer debt since 2006. after the seasonal hangover in q1, following the spend and borrow party in q4, consumer debt set a new record in q2: to put this 4.8% increase in perspective: in q2, the economy as measured by real gdp grew 2.8% year over year, and inflation as measured by cpi increased 2.7%. Debt slavery, a state of indebtedness to landowners that limits the autonomy of producers (e.g., tenant farmers) and provides the owners of capital with cheap labor. a prime example of debt slavery is the system that existed among sharecroppers and landowners in the u.s. south from the 1860s until world war ii.

Comments are closed.