Types Of Term Loans Short Medium Long Term Efinancemanagement

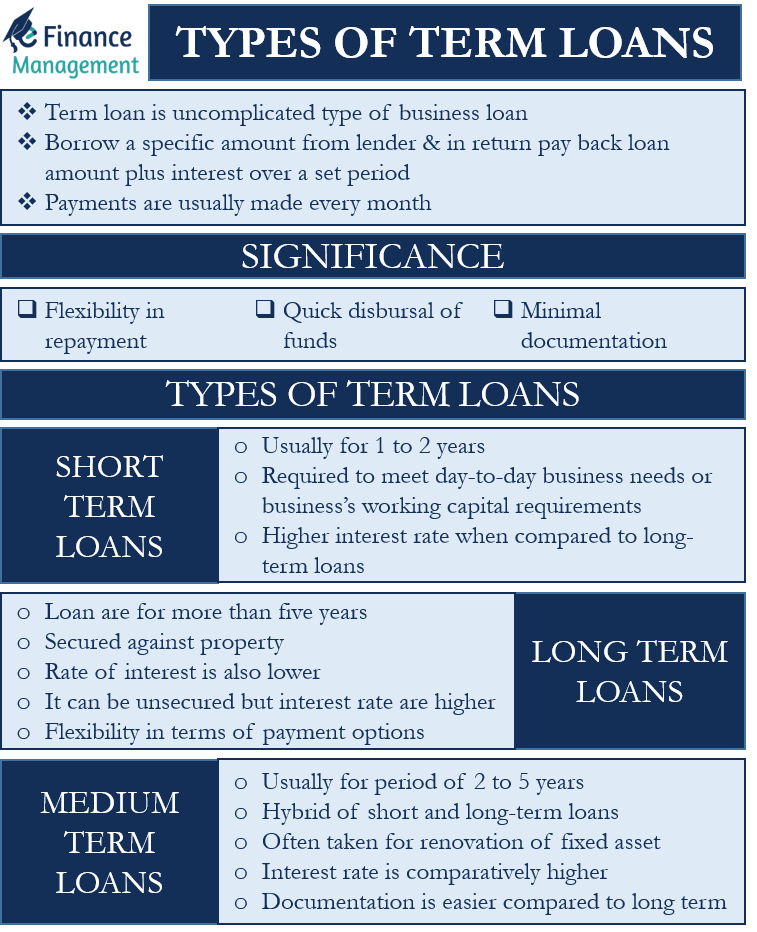

Types Of Term Loans Short Medium Long Term Efinancemanagement Medium term loans. a medium term loan is usually for a period of 2 to 5 years and can be said to be a hybrid of short and long term loans. such a loan is often taken for carrying out repair or renovation of the fixed asset. for example, modernizing a showroom. a medium term loan is usually skipped when talking about the types of terms loans as. Short term financing is normally for less than a year, and long term financing could even be for 10, 15, or even 20 years. the purposes are totally different for both types of financing. short term financing is normally used to support the working capital gap of a business, whereas the long term is required to finance big projects, ppe, etc.

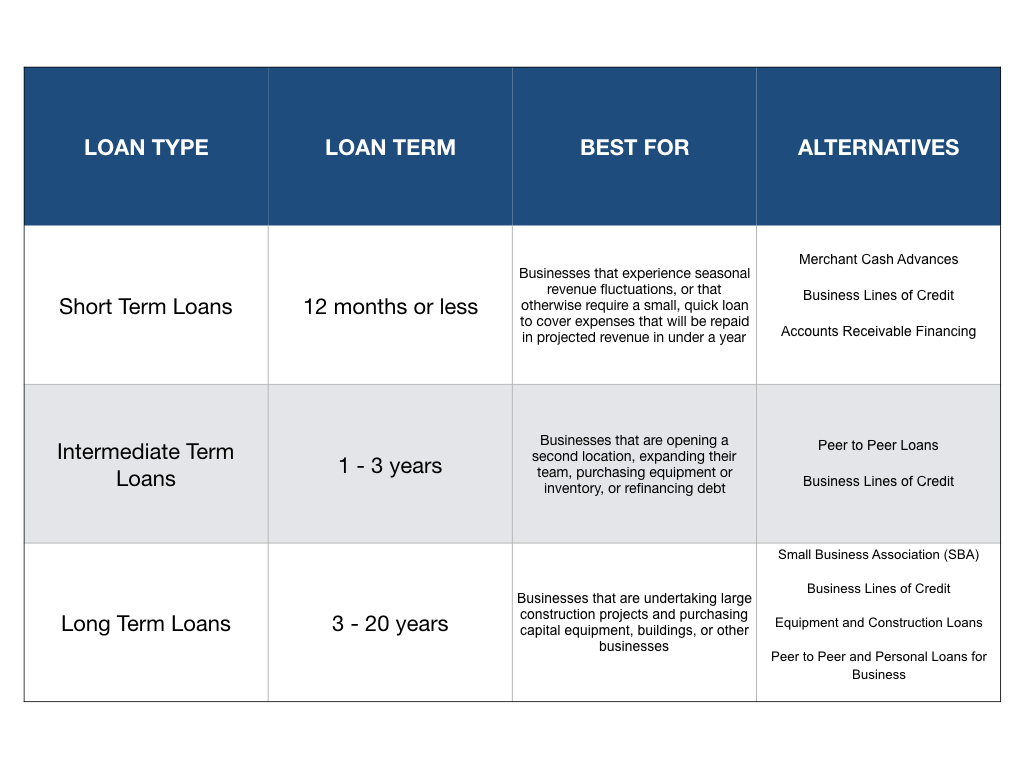

Short Term Loans Definition Types Rates How It Works Term loans are borrowings made from banks and financial institutions. such term loans maybe for the medium to long term, with a repayment period ranging from 1 to 30 years. such long term finance is generally procured to fund specific projects (expansion, diversification, capital expenditure, etc.) and is, therefore, also known as project finance. Con: higher monthly payments. pro: lower monthly payments. con: more interest paid over time. before making a decision between short term and long term loans, consider the total costs and how they align with your financial strategy. interest rates, as mentioned previously, are just one piece of the puzzle. A. long term sources of finance. the long term sources of finance are shown below: 1. equity share capital: equity shares, also known as ordinary shares or common shares represent the owners’ capital in a company. the holders of these shares are the real owners of the company. A term loan is a type of loan where you borrow a set amount of money. term loans have a predetermined repayment schedule, such as weekly or monthly repayment, and a fixed interest rate. from expanding product and service lines to dealing with short term cash shortages, business owners may need a small business loan for many reasons.

What Is A Term Loan And How It Can Unlock Growth For Your Business A. long term sources of finance. the long term sources of finance are shown below: 1. equity share capital: equity shares, also known as ordinary shares or common shares represent the owners’ capital in a company. the holders of these shares are the real owners of the company. A term loan is a type of loan where you borrow a set amount of money. term loans have a predetermined repayment schedule, such as weekly or monthly repayment, and a fixed interest rate. from expanding product and service lines to dealing with short term cash shortages, business owners may need a small business loan for many reasons. A small business administration (sba) loan, officially known as a 7(a) guaranteed loan, encourages long term financing. short term loans and revolving credit lines are also available to help with. Any longer loan term than that is considered a medium term or long term loan. long term loans can last from just over a year to 25 years. some short term loans don’t specify a payment schedule or a specific due date. they simply allow the borrower to pay back the loan at their own pace. types of short term loans. short term loans come in.

Comments are closed.