Understanding Market Limit And Stop Orders

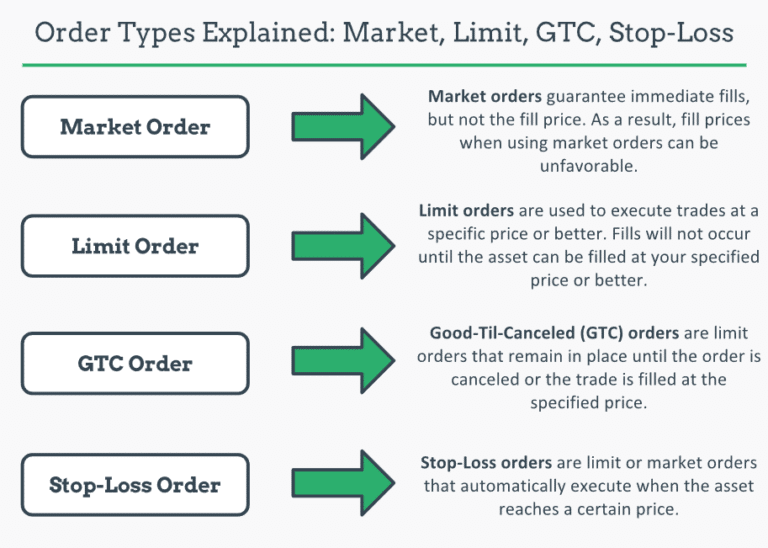

Understanding The Difference Between Market Orders And Limit Orders Understanding market, limit, and stop orders. january 16, 2023 beginner. the stock order type can have a big impact on when, how, and at what cost an order gets filled. learn about three common types: market orders, limit orders, and stop orders. Stop orders may help you obtain a predetermined entry or exit price, limit a loss, or lock in a profit. identifying so called head and shoulders patterns can be tricky. 0624 5l7w. limit orders, market orders, and stop orders are common order types used to buy or sell stocks and etfs. learn about the risks and advantages of each.

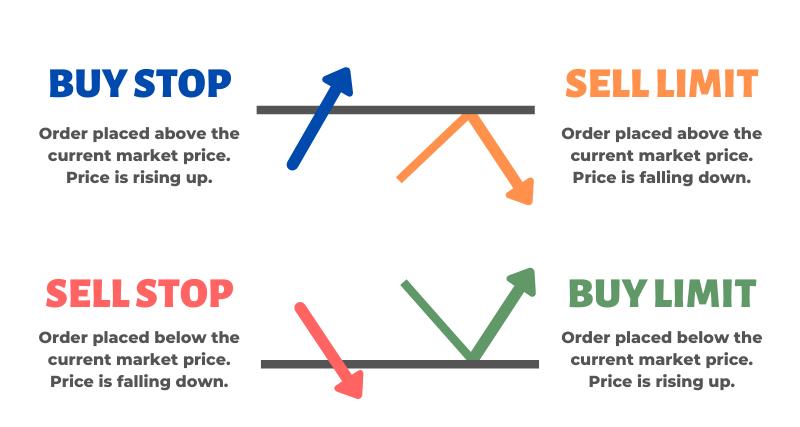

Different Forex Market Order Types Limit And Stop Orders Key takeaways. a limit order instructs your broker to fill your buy or sell order at a specific price or better. a stop order will activate a market order when a certain price has been met. When placing trades, the stock order type you choose can have a big impact on when, how, and at what price your order gets filled. watch to learn about three. The bottom line. understanding the difference between market orders and limit orders is crucial when trading stocks. market orders allow you to quickly buy or sell a security at the market price. A stop loss order (also known as simply a stop order) is an order to buy or sell a stock at the market price when a stock reaches a specified price. if the stock reaches the stop price, the order.

Option Order Types Market Limit Gtc Stop Loss Projectfinance The bottom line. understanding the difference between market orders and limit orders is crucial when trading stocks. market orders allow you to quickly buy or sell a security at the market price. A stop loss order (also known as simply a stop order) is an order to buy or sell a stock at the market price when a stock reaches a specified price. if the stock reaches the stop price, the order. Understanding these orders requires understanding the differences in a limit order vs. a stop order. a limit order sets a specified price for an order and executes the trade at that price. a buy. Stop orders alone turn into a market order trading immediately, whereas a stop limit order turns into a limit order that will only be executed at a set price or even better. understanding how.

Understanding Order Types Limit Stop Limit And Ibkr Explained Understanding these orders requires understanding the differences in a limit order vs. a stop order. a limit order sets a specified price for an order and executes the trade at that price. a buy. Stop orders alone turn into a market order trading immediately, whereas a stop limit order turns into a limit order that will only be executed at a set price or even better. understanding how.

Comments are closed.