Unexpected Wage Garnishment What You Can Do

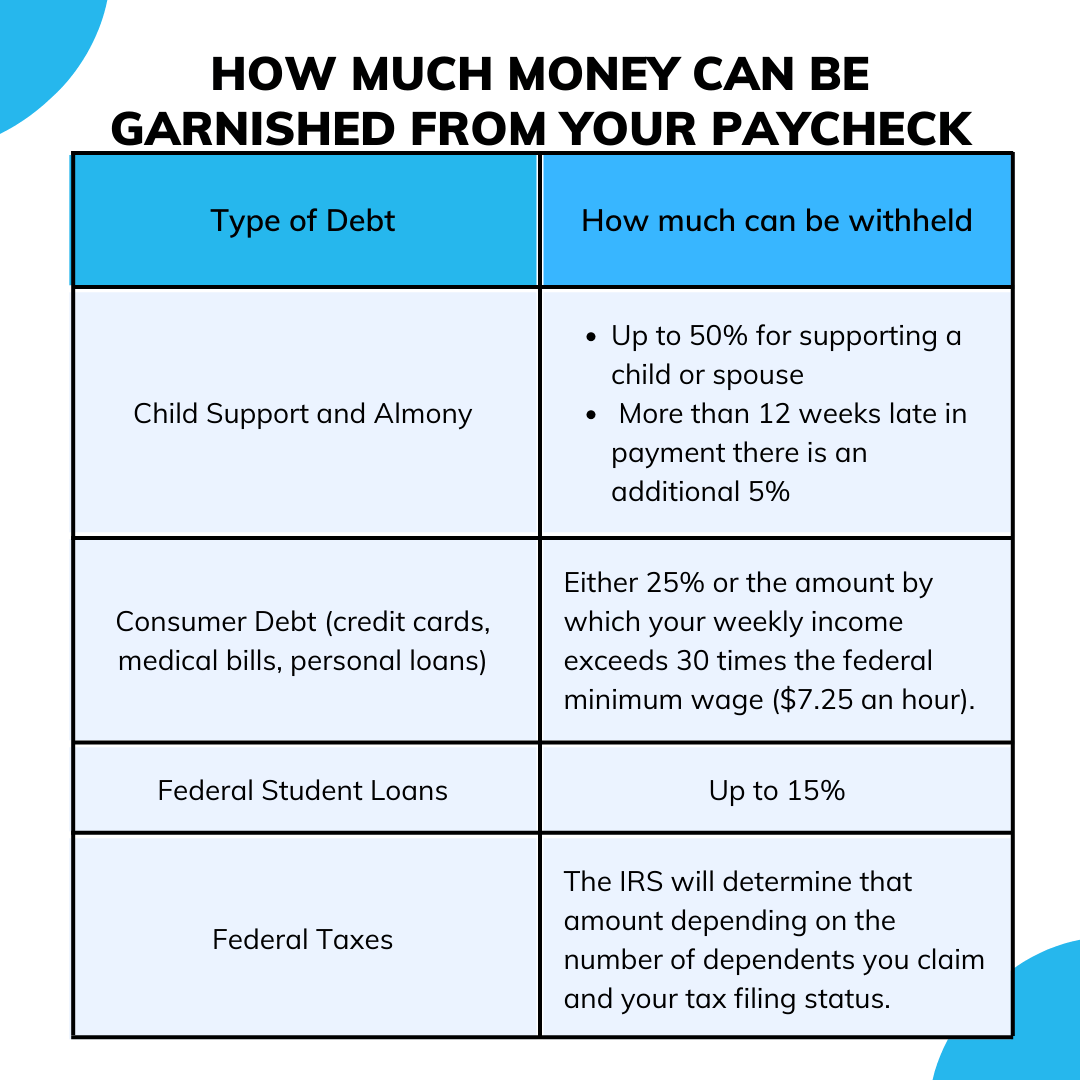

Unexpected Wage Garnishment During The Holidays вђ What You Can Doо Here’s how that breaks down: • if your weekly disposable income is $290 or more, a maximum of 25% is taken. • if it's between $289.99 and $217.51, the amount above $217.51 can be taken. How frustrating would it be to open your pay stub and discover that 25% of your disposable pay has been seized by a creditor for a #wagegarnishment ?it happe.

9 Things To Do In Wage Garnishment Cases Tax Relief Center There are four direct ways you can take action to stop a wage garnishment: 1. try to negotiate a payment plan with your creditor (s) or settle your debt. 2. challenge the wage garnishment in court. 3. file for bankruptcy to stop the garnishment fast. 4. reach out to a nonprofit to ask for financial assistance. The garnishment amount is limited to 25% of your disposable earnings for that week (what's left after mandatory deductions) or the amount by which your disposable earnings for that week exceed 30 times the federal minimum hourly wage, whichever is less. (15 u.s.c. § 1673). state limitations on garnishments for money judgments. Some of the ways to lower—or even eliminate—the amount of a wage garnishment include: filing a claim of exemption. filing for bankruptcy, or. vacating the underlying money judgment. read on to learn more about these options. get debt relief now. we've helped 205 clients find attorneys today. first name. 2. file a claim of exemption. you might be able to file a claim of exemption and stop or decrease the wage garnishment based on your personal and financial situation. for instance, many states offer a head of household exemption for debtors who have a dependent, such as a child or elderly parent, that they financially support. 3.

Wage Garnishment How It Works And What You Can Do Stps Some of the ways to lower—or even eliminate—the amount of a wage garnishment include: filing a claim of exemption. filing for bankruptcy, or. vacating the underlying money judgment. read on to learn more about these options. get debt relief now. we've helped 205 clients find attorneys today. first name. 2. file a claim of exemption. you might be able to file a claim of exemption and stop or decrease the wage garnishment based on your personal and financial situation. for instance, many states offer a head of household exemption for debtors who have a dependent, such as a child or elderly parent, that they financially support. 3. In most cases, including those involving unpaid credit card and loan balances, debt collectors may garnish up to 25% of your disposable wages or the amount by which your income exceeds 30 times the federal minimum wage – whichever is less. garnishable wages = (disposable income * 0.25) or (disposable income – (30 * federal minimum wage)). If your weekly pay period is $1,256.66 or more; 25% maximum of disposable earnings. however, some states may have different limits. for example, if you can argue your case in front of a court, they may reduce your wage garnishment percentage to 10% of your disposable earnings instead of 25%. wage garnishments can also apply to other sources of.

How Wage Garnishment Works And What You Can Do About It In most cases, including those involving unpaid credit card and loan balances, debt collectors may garnish up to 25% of your disposable wages or the amount by which your income exceeds 30 times the federal minimum wage – whichever is less. garnishable wages = (disposable income * 0.25) or (disposable income – (30 * federal minimum wage)). If your weekly pay period is $1,256.66 or more; 25% maximum of disposable earnings. however, some states may have different limits. for example, if you can argue your case in front of a court, they may reduce your wage garnishment percentage to 10% of your disposable earnings instead of 25%. wage garnishments can also apply to other sources of.

Comments are closed.