Us Consumer Credit Card Debt

Credit Card Debt Hits Record High At The End Of 2018 Credit Karma U.s. consumers collectively owe a record $1.14 trillion in credit card debt, figures released tuesday by the federal reserve bank of new york show. that's $27 billion more than the $1.13 trillion. A consumer’s age may also influence how much debt they carry on their credit card accounts. according to the most recent experian data from 2023, generation x had the highest average credit card.

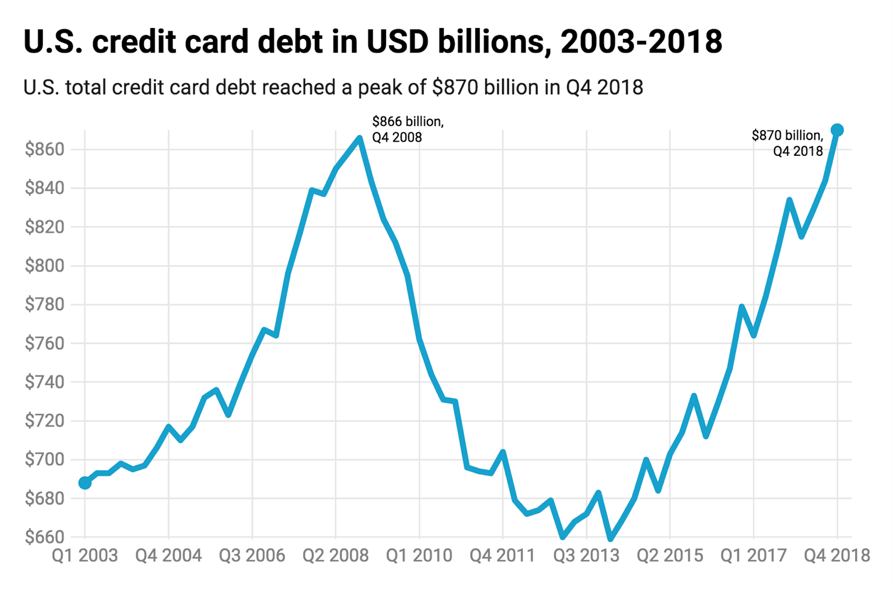

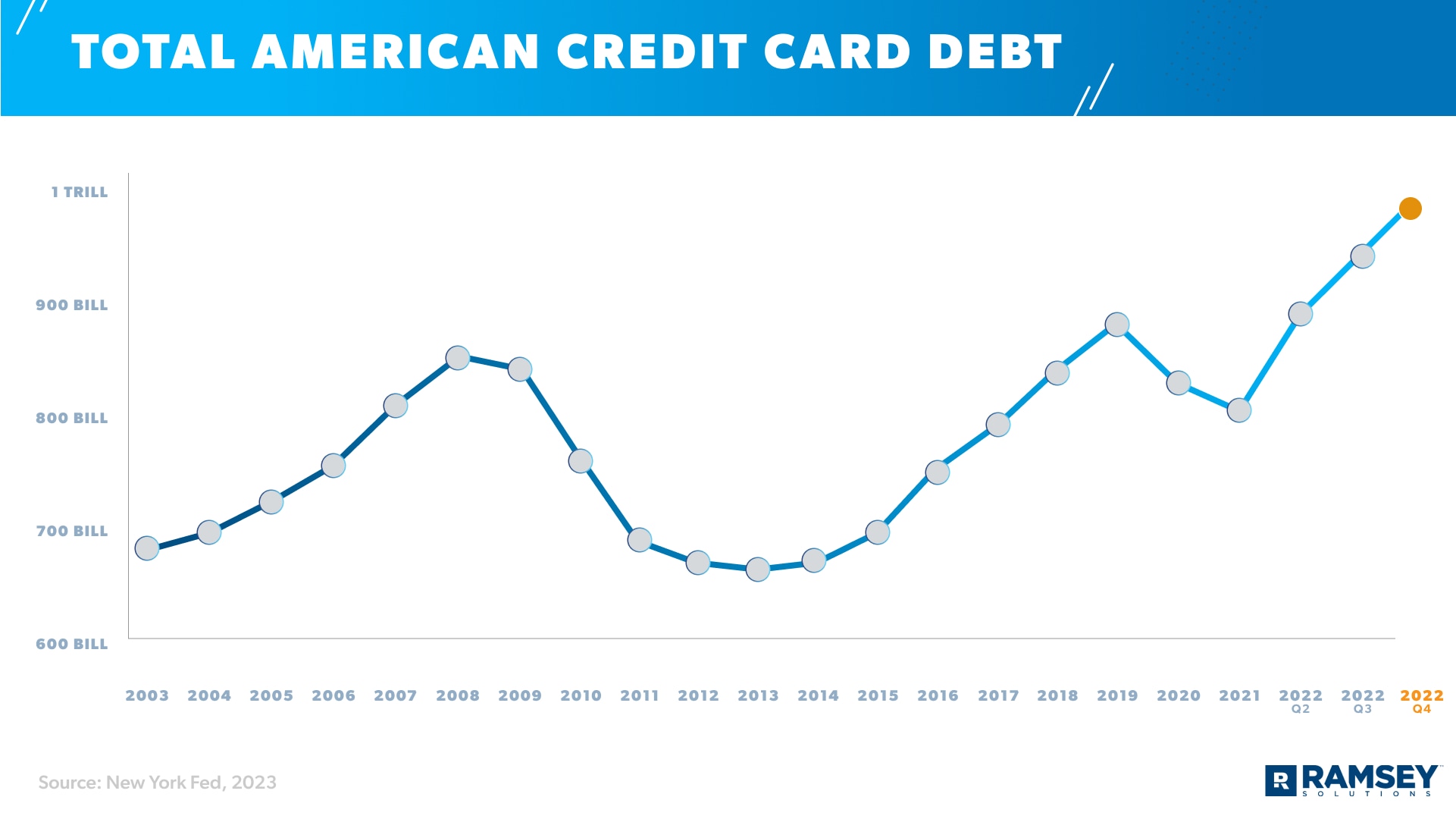

Average Credit Card Debt In America Ramsey Total household debt rose by $109 billion to reach $17.80 trillion, according to the latest quarterly report on household debt and credit. mortgage balances were up $77 billion to reach $12.52 trillion, while auto loans increased by $10 billion to reach $1.63 trillion and credit card balances increased by $27 billion to reach $1.14 trillion. Nerdwallet’s annual look at household debt finds that credit card debt is up more than 12% compared with last year, for a total of more than $1.2 trillion, as of march 2024. [1] mortgages, auto. The federal reserve bank of new york reported that total credit card debt rose to $1.13 trillion at the end of 2023, up 4.6% from the previous quarter. card delinquencies, interest rates and financial stress also increased, especially among younger and lower income households. To put this into perspective, the average u.s. household with credit card debt has a balance of around $6,065. in november 2021, the interest rate on this debt was around 15%, meaning that the average indebted household was paying $76 per month in credit card interest. by november 2023, the interest rate had risen to around 21%.

Chart Americans Far From Maxed Out On Credit Card Debt Statista The federal reserve bank of new york reported that total credit card debt rose to $1.13 trillion at the end of 2023, up 4.6% from the previous quarter. card delinquencies, interest rates and financial stress also increased, especially among younger and lower income households. To put this into perspective, the average u.s. household with credit card debt has a balance of around $6,065. in november 2021, the interest rate on this debt was around 15%, meaning that the average indebted household was paying $76 per month in credit card interest. by november 2023, the interest rate had risen to around 21%. This milestone has raised concerns about the health of household finances and the implications for consumer spending going forward. the fred graph above shows three measures of credit card debt, with all balances normalized to 100 in the first quarter of 2011 to better illustrate longer run trends: the blue line shows the balances, the green. The report is based on data from the new york fed’s nationally representative consumer credit panel. credit card balances increased by $45 billion, from $986 billion in q1 2023 to a series high of $1.03 trillion in the q2 2023, marking a 4.6% quarterly increase. credit card accounts expanded by 5.48 million to 578.35 million.

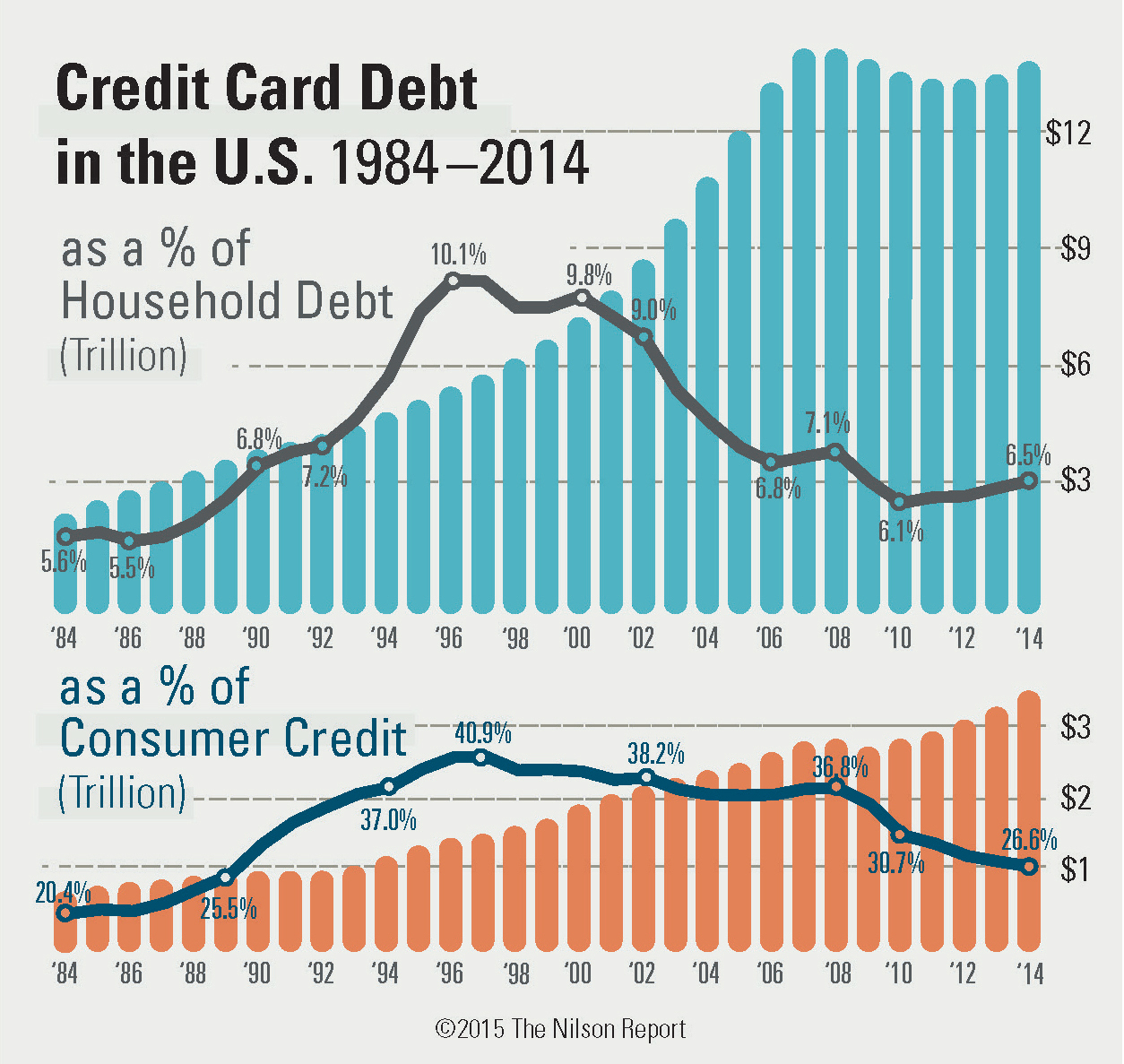

The Nilson Report U S Household And Credit Card Debt 2014 Business Wire This milestone has raised concerns about the health of household finances and the implications for consumer spending going forward. the fred graph above shows three measures of credit card debt, with all balances normalized to 100 in the first quarter of 2011 to better illustrate longer run trends: the blue line shows the balances, the green. The report is based on data from the new york fed’s nationally representative consumer credit panel. credit card balances increased by $45 billion, from $986 billion in q1 2023 to a series high of $1.03 trillion in the q2 2023, marking a 4.6% quarterly increase. credit card accounts expanded by 5.48 million to 578.35 million.

Comments are closed.