Vm Fed Expects Rate Hikes For 2022 And Beyond

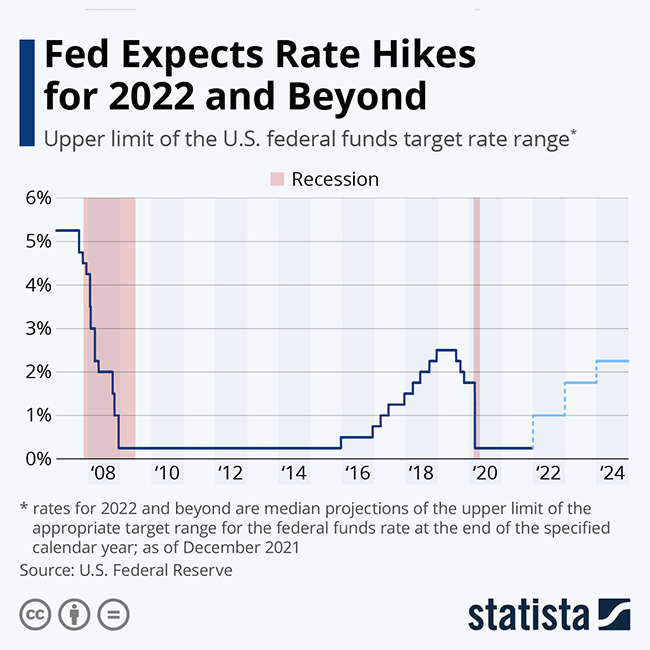

Vm Fed Expects Rate Hikes For 2022 And Beyond Despite surging consumer prices, the federal open market committee (fomc) unanimously decided to keep interest rates near zero for the time being. as the u.s. economic recovery progresses and inflation is picking up, it did move up its timeline for possible rate hikes, however, with all 18 committee members now expecting a rate hike in 2022. with inflation having exceeded the fomc’s long. Through its rate hikes in 2022 & 2023, the fed aimed to contain inflationary forces and maintain “maximum” levels of employment — all while steering the economy clear of recession.

Fed Rate Hike Expectations Chart Putting the rate to 5.25% to 5.5% would make it the highest range since 2006 and the 11th hike since the fed started raising rates from near zero in march 2022. beyond july, however, rate hikes. Fed expected to hold rates at 22 year high but leave hikes on the table. when the federal reserve announces its latest policy decision on wednesday, wall street expects the central bank will hold. The fed’s open market committee unanimously decided at its meeting this week to bump the federal funds rate by 25 basis points to 5.25% to 5.5%, sending rates to their highest level since 2001. Is the fed raising rates further in 2022 and beyond? the fed now expects its benchmark rate to rise to 1.9% by year end – above its pre pandemic level – and 2.8% by the end of 2023, higher.

The Fed Expects To Hike Rates Faster In 2022 Better Mortgage The fed’s open market committee unanimously decided at its meeting this week to bump the federal funds rate by 25 basis points to 5.25% to 5.5%, sending rates to their highest level since 2001. Is the fed raising rates further in 2022 and beyond? the fed now expects its benchmark rate to rise to 1.9% by year end – above its pre pandemic level – and 2.8% by the end of 2023, higher. The fed approved a 0.25 percentage point rate hike, the first increase since december 2018. officials indicated an aggressive path ahead, with rate rises coming at each of the remaining six. The board of governors of the federal reserve system voted unanimously to raise the interest rate paid on reserve balances to 4.4 percent, effective december 15, 2022. undertake open market operations as necessary to maintain the federal funds rate in a target range of 4 1 4 to 4 1 2 percent. conduct overnight repurchase agreement operations.

Comments are closed.