What Are 1099s And Do I Need To File Them Singletrack Accounting

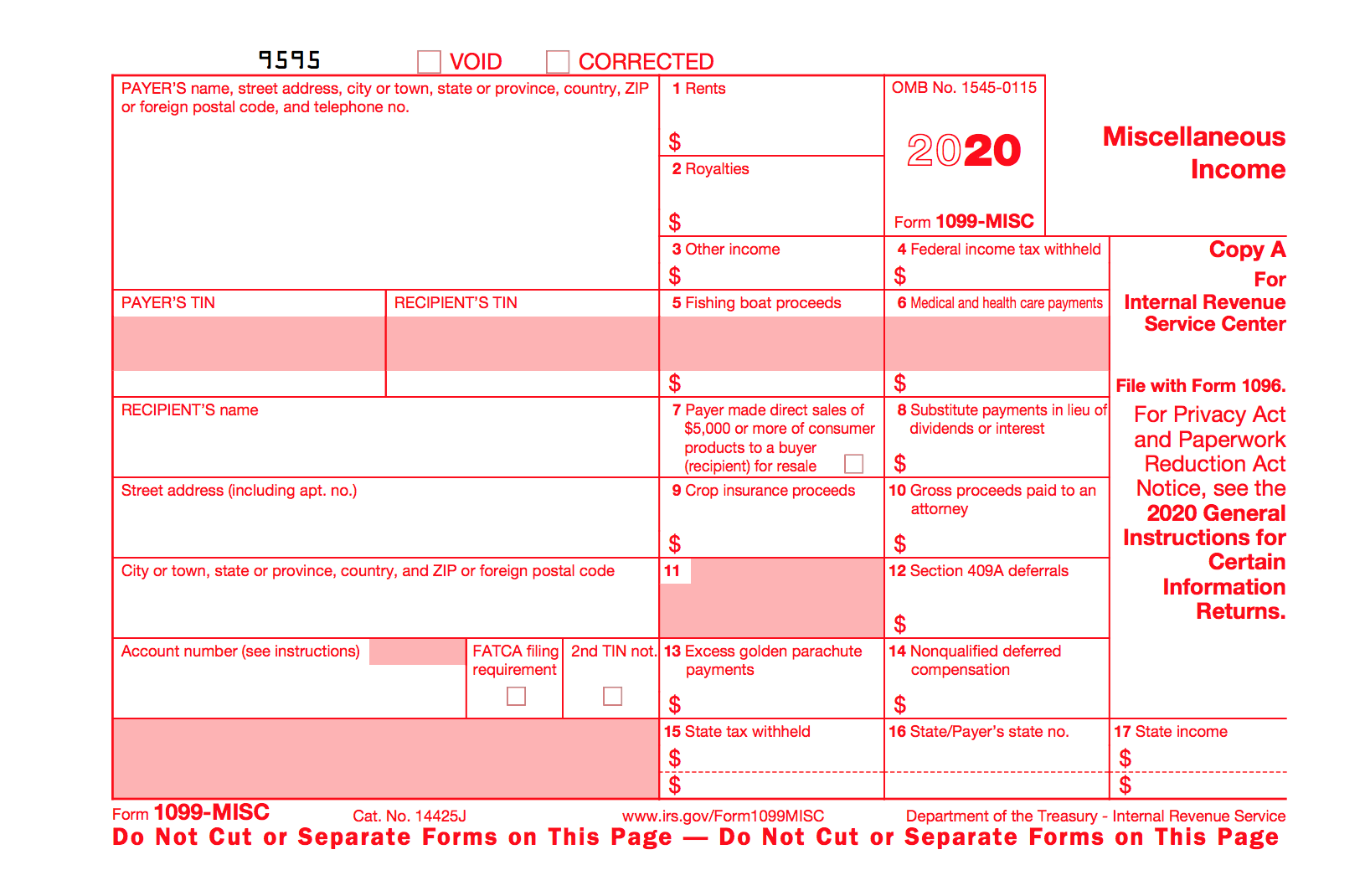

What Are 1099s And Do I Need To File Them Singletrack Accounting Rules on sending 1099s: generally, you are required to send 1099 misc forms to people and vendors you have paid for business services by cash or check. there is a threshold of $600. you must have paid a vendor for services, $600 or more over the course of the year, in order to fall under this requirement. you do not need to send a 1099 to a. Here are nine basics that you need to know about 1099s. 1099s need to be issued to anyone that provided a good or service to you that exceeds $600. a good or service is: parts, material, prizes, awards, rents, or other income payments. these need to be paid to any individual, partnership, llc, limited partnership, or estate.

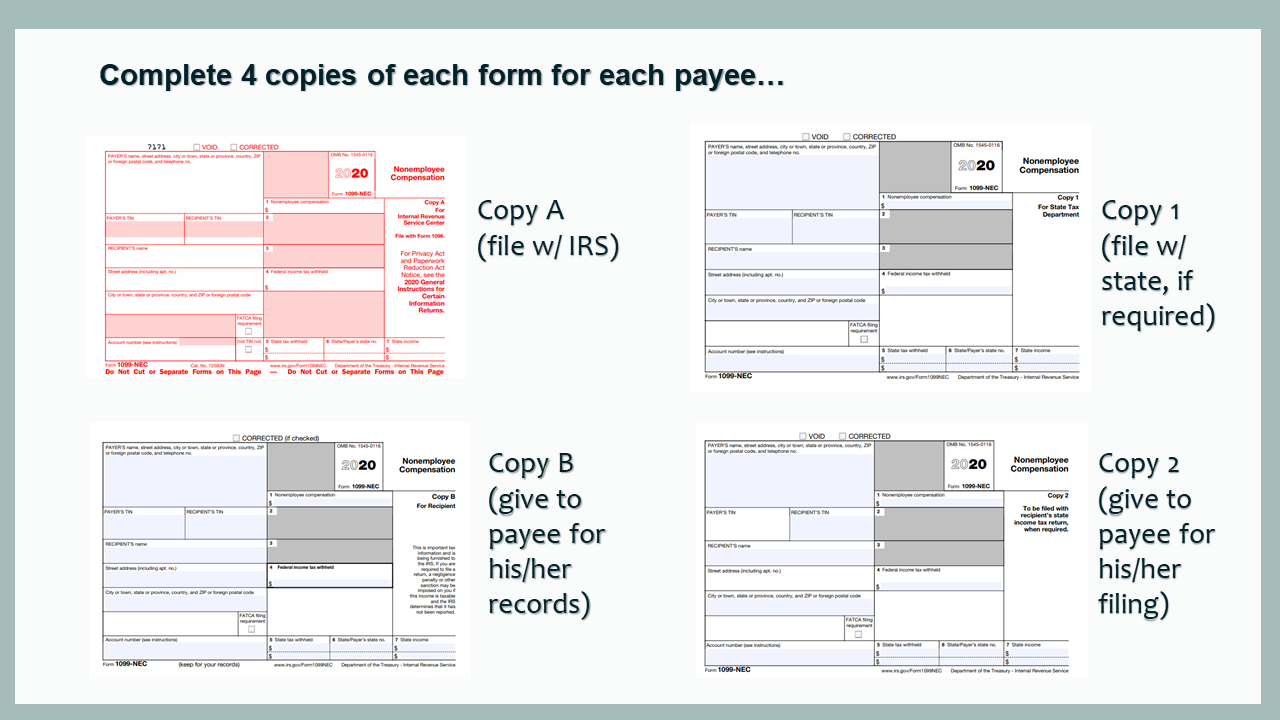

Do I Need To File 1099s 3 Steps To Figuring It Out вђ Small Biz Numbers 1099 k. 1) you are likely to receive one. 2) it’s the reason you don’t have to issue 1099 nec to anyone you pay via credit card debit card, zelle, quickpay, a business paypal account, or a business venmo account. 3) you may need to reconcile this form against the amount of sales income you report on your tax return. Form 1099 is used to report certain types of non employment income to the irs such as dividends from a stock or pay you received as an independent contractor. businesses must issue 1099s to any. 10 or more returns: e filing now required. starting tax year 2023, if you have 10 or more information returns, you must file them electronically. this includes forms w 2, e filed with the social security administration. find details on the final e file regulations and requirements for forms w 2. to e file, apply now for a transmitter control. Send them a w 9 to collect their taxpayer id number, address, and business name. create an account with 1099online . create a payer which will be your business information. create the payees. this is everyone who needs to receive a 1099 nec (use w 9 info). enter the amount of “nonemployee compensation” each person received.

What Are 1099s The Basics Every Business Owner Needs To Know Anne 10 or more returns: e filing now required. starting tax year 2023, if you have 10 or more information returns, you must file them electronically. this includes forms w 2, e filed with the social security administration. find details on the final e file regulations and requirements for forms w 2. to e file, apply now for a transmitter control. Send them a w 9 to collect their taxpayer id number, address, and business name. create an account with 1099online . create a payer which will be your business information. create the payees. this is everyone who needs to receive a 1099 nec (use w 9 info). enter the amount of “nonemployee compensation” each person received. A 1099 is an “information filing form,” used to report non salary income to the irs for federal tax purposes. there are several variants of 1099s, but the most popular is the 1099 nec. if you paid an independent contractor more than $600 in a financial year, you’ll need to complete a 1099 nec. When in doubt, remember that filing unnecessary 1099s has no penalty, while not filing required forms can cost you time and money. in general, you should be sending 1099 necs to any non employee you’ve paid more than $600 to throughout the year through your small business. this includes contractors, freelancers, and sole proprietors, among.

When To File 1099s And How To Do It A 1099 is an “information filing form,” used to report non salary income to the irs for federal tax purposes. there are several variants of 1099s, but the most popular is the 1099 nec. if you paid an independent contractor more than $600 in a financial year, you’ll need to complete a 1099 nec. When in doubt, remember that filing unnecessary 1099s has no penalty, while not filing required forms can cost you time and money. in general, you should be sending 1099 necs to any non employee you’ve paid more than $600 to throughout the year through your small business. this includes contractors, freelancers, and sole proprietors, among.

Comments are closed.