What Is A 401 K Is It A Good Retirement Plan Youtube

Is A 401 K Really A Good Retirement Plan Youtube 💵 create your free budget! sign up for everydollar ⮕ ter.li 6h2c45 📱download the ramsey network app ⮕ ter.li ajeshj 🛒 visit the ramsey sto. I give an overview of the differences between all these retirement plans the 401k, ira, roth formats of both (roth 401k and ira), as well as the sep ira an.

401 K Retirement Plan Everything You Need To Know Sbnri Since 1980, pensions plans have been phased out in favor of 401(k) plans. they now represent nearly one fifth of the u.s. retirement market. so how did 401(k. A 401 (k) is an employer sponsored account that lets you invest for retirement. many employers match 401 (k) contributions. in 2024, you can contribute up to $23,000 to your 401 (k), or $30,500 if. Pros and cons. a 401 (k) is an employer sponsored retirement plan – so named after a part of the u.s. tax code – offered by companies to the employees who work there. similar plans for teachers, nonprofit employees and government workers include 403 (b)s and 457s. although 401 (k)s are offered through an employer, each company’s plan is. A 401 (k) is a tax advantaged retirement savings plan. named after a section of the u.s. internal revenue code, the 401 (k) is an employer provided, defined contribution plan. the employer may.

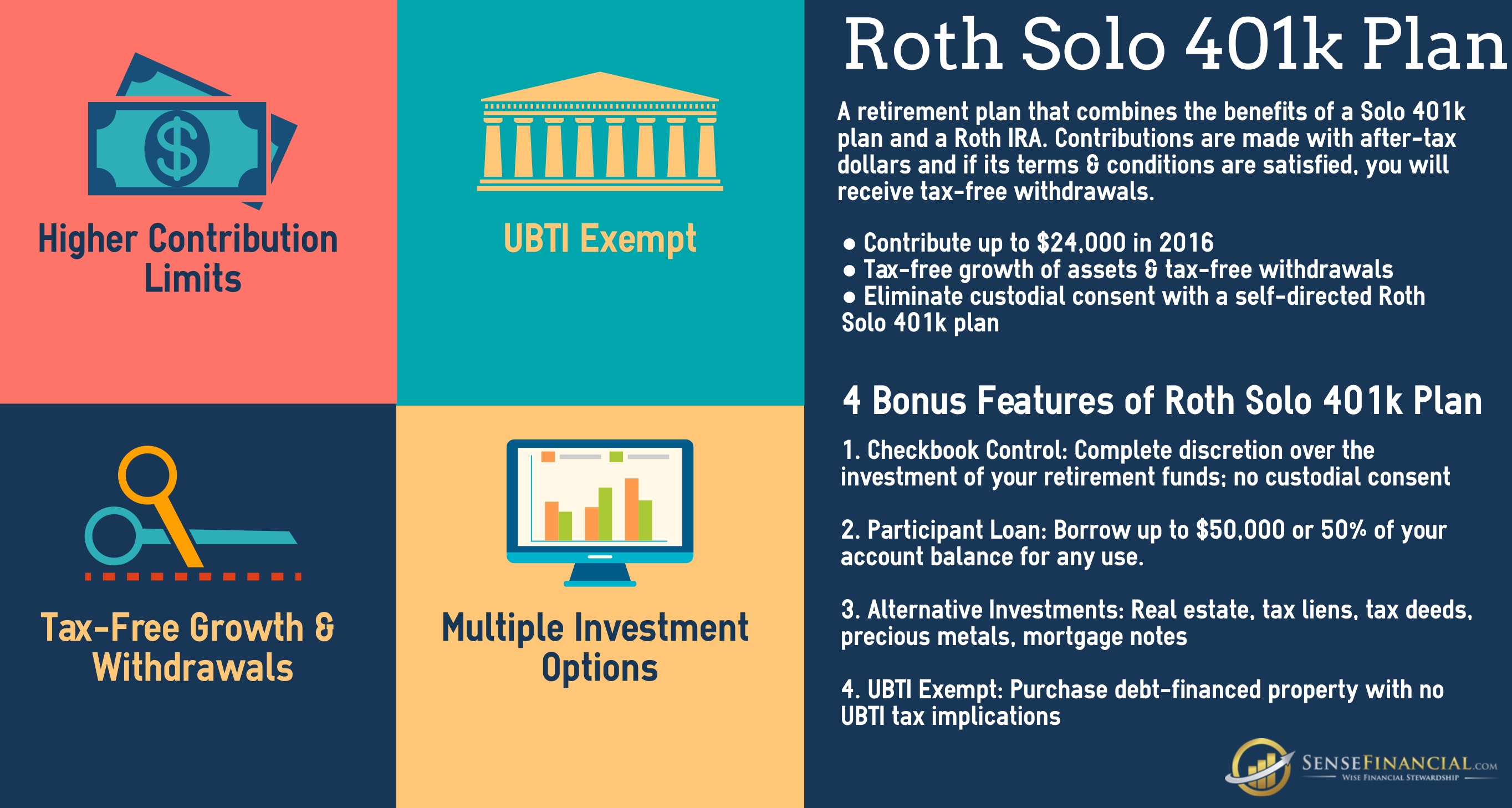

Infographics Why Choosing A Roth Solo 401 K Plan Makes Sense Pros and cons. a 401 (k) is an employer sponsored retirement plan – so named after a part of the u.s. tax code – offered by companies to the employees who work there. similar plans for teachers, nonprofit employees and government workers include 403 (b)s and 457s. although 401 (k)s are offered through an employer, each company’s plan is. A 401 (k) is a tax advantaged retirement savings plan. named after a section of the u.s. internal revenue code, the 401 (k) is an employer provided, defined contribution plan. the employer may. A 401 (k) is a retirement savings plan that lets you invest a portion of each paycheck before taxes are deducted depending on the type of contributions made. because of 401 (k) tax advantages, the federal government imposes some restrictions about when you can withdraw your 401 (k) contributions. 401 (k)s are the most popular retirement savings. A 401 (k) is an employer sponsored retirement savings plan. commonly offered as part of a job benefits package, employees may save a portion of their salary in a 401 (k) account, subject to annual.

Is A 401 K Really A Good Retirement Plan Youtube A 401 (k) is a retirement savings plan that lets you invest a portion of each paycheck before taxes are deducted depending on the type of contributions made. because of 401 (k) tax advantages, the federal government imposes some restrictions about when you can withdraw your 401 (k) contributions. 401 (k)s are the most popular retirement savings. A 401 (k) is an employer sponsored retirement savings plan. commonly offered as part of a job benefits package, employees may save a portion of their salary in a 401 (k) account, subject to annual.

Comments are closed.