What Is An Overdraft Fee And How To Avoid It

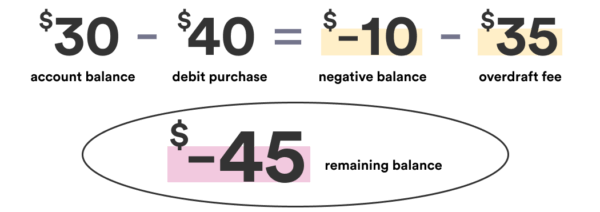

What Is An Overdraft Fee And How Do I Avoid Them An overdraft fee is what a bank charges you when you withdraw more money from your account than the amount you have in it. when someone’s account is overdrawn, the bank may lend money to cover. Overdraft fees are one of the most expensive bank fees. learn more about what they are, overdraft protection options and how to avoid overdraft fees.

What Is An Overdraft Fee And How To Avoid It How to avoid overdraft fees. there are many ways to avoid or limit overdraft fees. you may be able to link a savings account to your checking account so your bank or credit union draws funds from. 6. get a prepaid debit card. prepaid debit cards can be a helpful solution to overdrafting because they have built in, self imposed spending limits. these cards work like debit cards, so you can. Paying an overdraft fee is a costly and often unnecessary expense. some of the best ways to avoid overdraft fees include understanding your financial institution’s overdraft policy, tracking your expenses and staying within a budget. being proactive will not only help you prevent overdraft fees, but it will help you successfully manage your. Extended overdraft fees can range from $6 to $38.50, with some recurring on a daily basis, depending on how long the account stays negative. if an account is not brought up to a positive balance.

Comments are closed.