What Is Chapter 7 Bankruptcy A Liquidation Guide Lexington Law

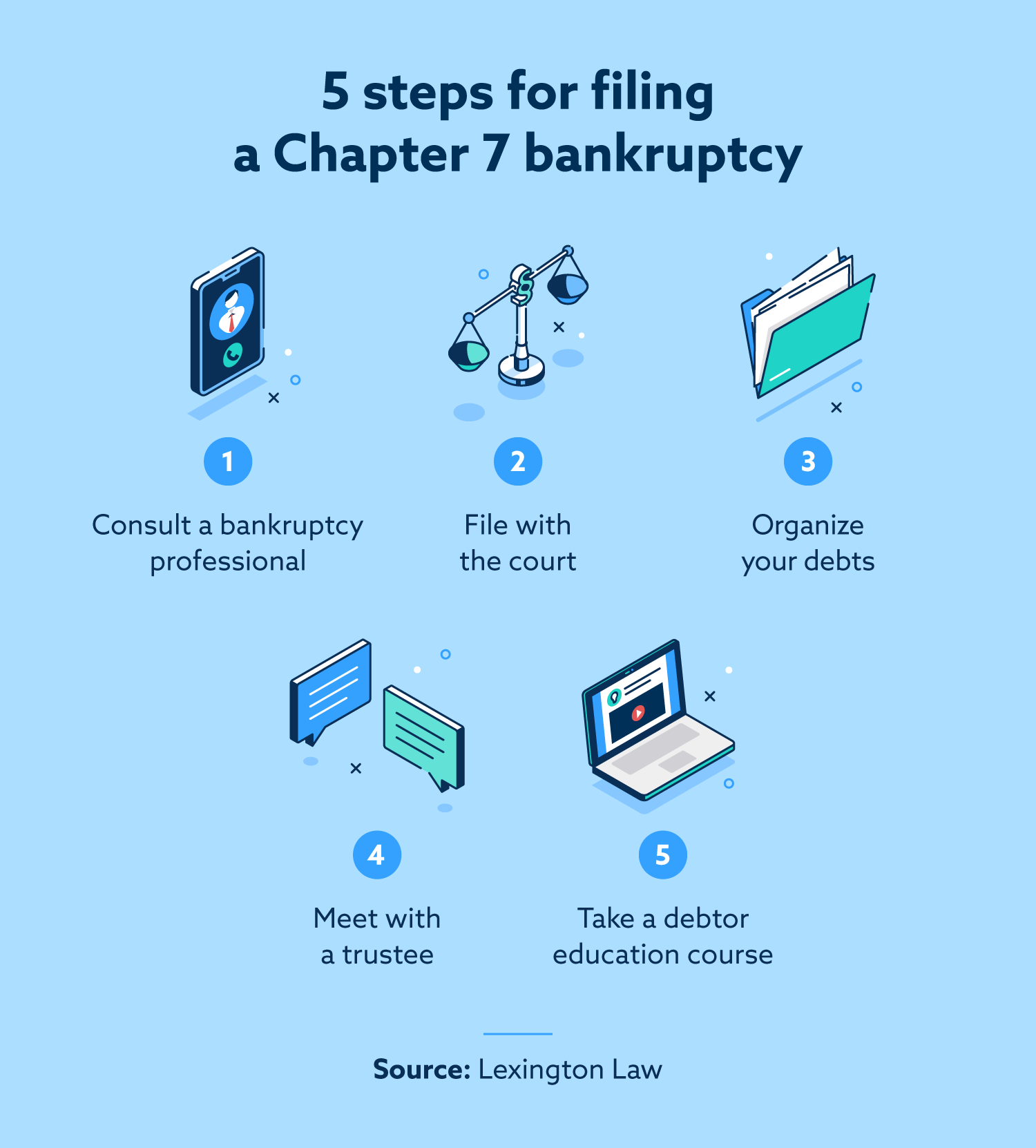

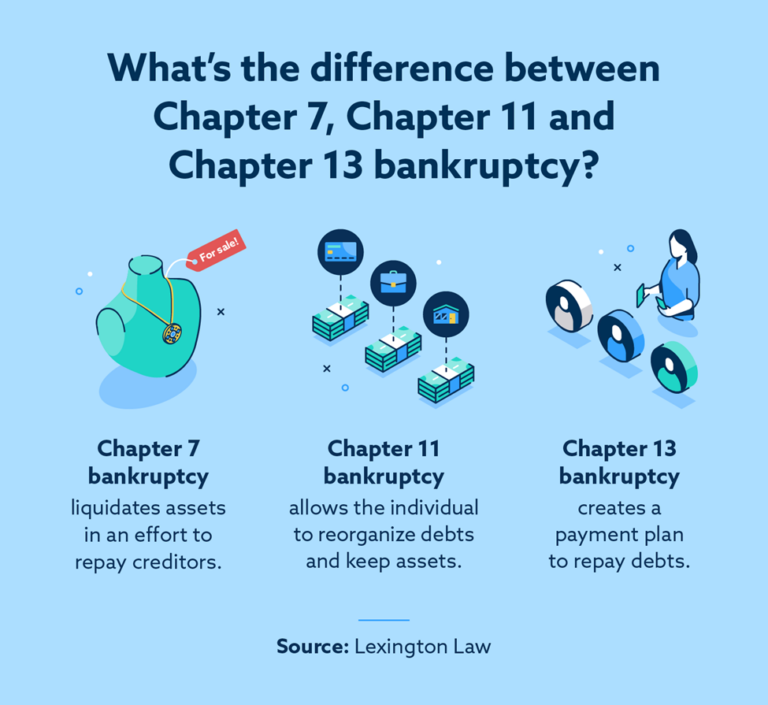

What Is Chapter 7 Bankruptcy A Liquidation Guide Lexington Law Chapter 7 bankruptcy is available to both individuals and businesses. as you’ve read, in chapter 7 bankruptcies, some items and property may be liquidated in order to pay the creditors. once complete, the filer will receive a complete discharge from the dischargeable debts based on the court’s decision. Chapter 7. chapter 7 bankruptcy is the most straightforward approach to filing for bankruptcy. chapter 7 bankruptcy, also called liquidation bankruptcy or fresh start bankruptcy, sometimes involves the sale of assets to pay off debt. in most cases a debtor’s assets are exempt and no assets need be sold.

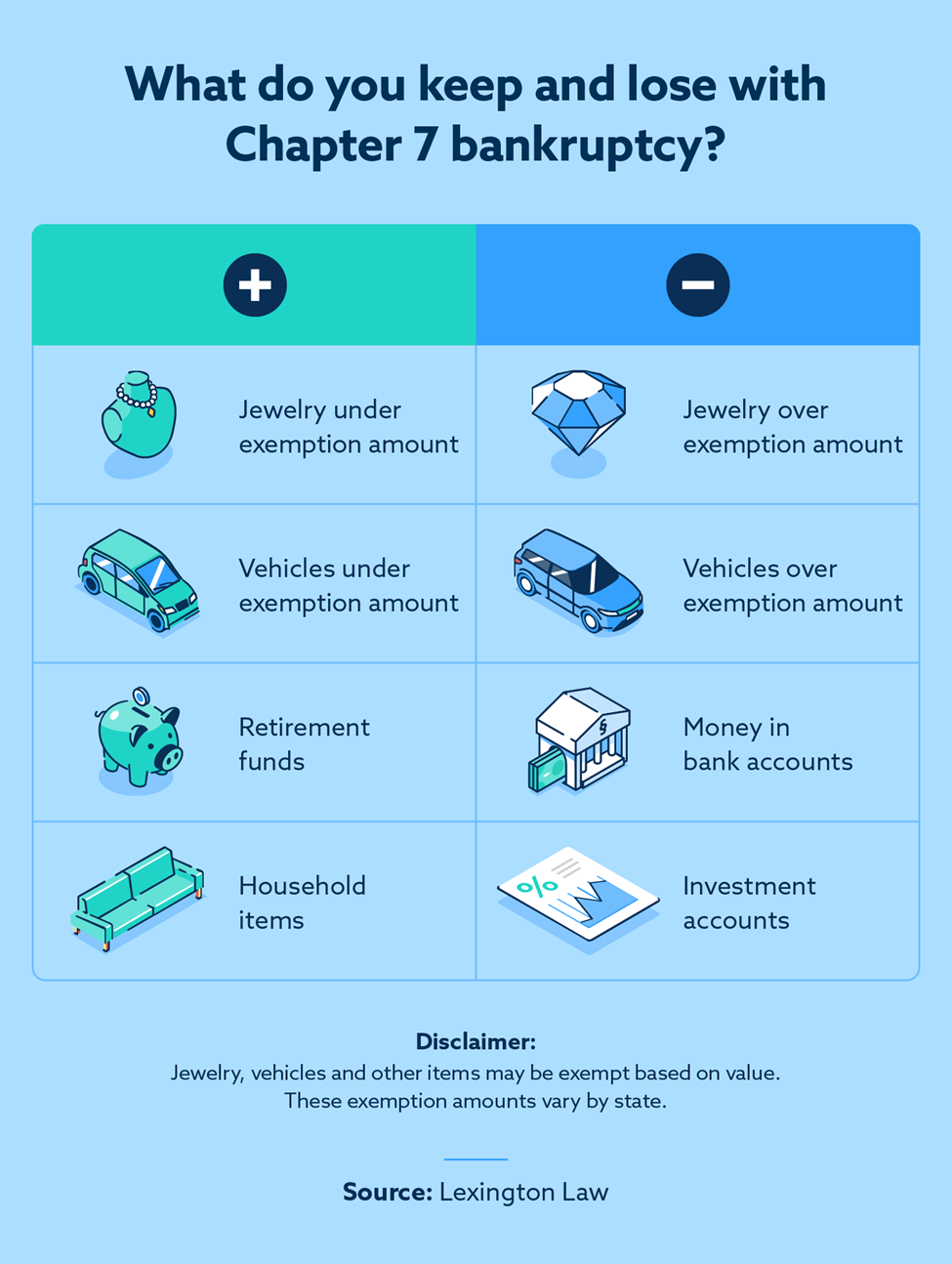

What Is Chapter 7 Bankruptcy A Liquidation Guide Lexington Law Chapter 7 bankruptcy is sometimes referred to as liquidation bankruptcy or the fresh start bankruptcy. while every situation is handled according to the details of the case, the basic concept of chapter 7 is that your non exempt assets are liquidated to repay creditors and any remaining debt not covered is discharged in the bankruptcy. This is a myth. chapter 7 bankruptcy is often referred to as “liquidation bankruptcy” because the trustee assigned to a bankruptcy case is empowered to sell an individual debtor’s non exempt assets. however, a bankruptcy trustee is not empowered to sell all of a filer’s assets. those that are classified as exempt may not be sold for the. A chapter 7 bankruptcy case does not involve the filing of a plan of repayment as in chapter 13. instead, the bankruptcy trustee gathers and sells the debtor's nonexempt assets and uses the proceeds of such assets to pay holders of claims (creditors) in accordance with the provisions of the bankruptcy code. Chapter 7 bankruptcy, often referred to as "liquidation bankruptcy," is a legal process designed to help individuals and businesses eliminate most of their debts. it involves liquidating a debtor.

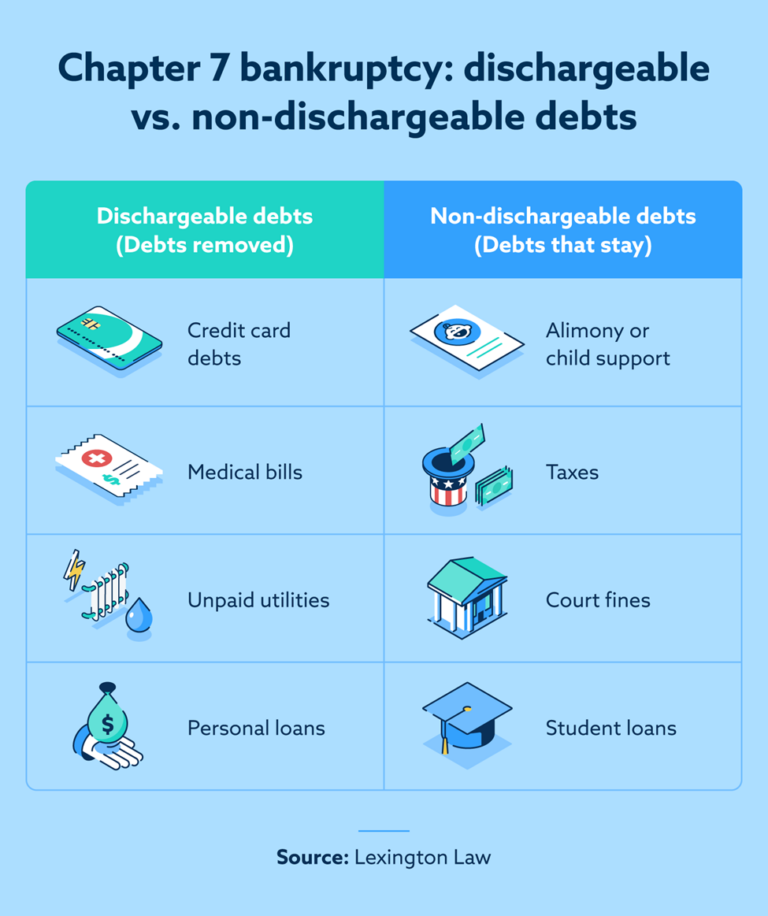

What Is Chapter 7 Bankruptcy A Liquidation Guide Lexington Law A chapter 7 bankruptcy case does not involve the filing of a plan of repayment as in chapter 13. instead, the bankruptcy trustee gathers and sells the debtor's nonexempt assets and uses the proceeds of such assets to pay holders of claims (creditors) in accordance with the provisions of the bankruptcy code. Chapter 7 bankruptcy, often referred to as "liquidation bankruptcy," is a legal process designed to help individuals and businesses eliminate most of their debts. it involves liquidating a debtor. Chapter 7 bankruptcy is a “second chance” to regain control of your finances by having most of your unsecured debt, including credit card debt, medical bills, and personal loans, legally discharged by a bankruptcy court. in virtually all cases, however, it does not discharge student loans, tax debt, alimony, or child support. Liquidation bankruptcy—also referred to as "ordinary," "straight," or "chapter 7" bankruptcy—is the most commonly filed bankruptcy type for individuals. the term liquidation bankruptcy comes from the fact that the bankruptcy trustee assigned to the case sells or "liquidates" property for the benefit of creditors.

What Is Chapter 7 Bankruptcy A Liquidation Guide Lexington Law Chapter 7 bankruptcy is a “second chance” to regain control of your finances by having most of your unsecured debt, including credit card debt, medical bills, and personal loans, legally discharged by a bankruptcy court. in virtually all cases, however, it does not discharge student loans, tax debt, alimony, or child support. Liquidation bankruptcy—also referred to as "ordinary," "straight," or "chapter 7" bankruptcy—is the most commonly filed bankruptcy type for individuals. the term liquidation bankruptcy comes from the fact that the bankruptcy trustee assigned to the case sells or "liquidates" property for the benefit of creditors.

What Is Chapter 7 Bankruptcy A Liquidation Guide Lexington Law

Comments are closed.